- Italy

- /

- Auto Components

- /

- BIT:SGF

Top European Dividend Stocks For October 2025

Reviewed by Simply Wall St

As European markets reach record highs, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are increasingly focused on the potential of dividend stocks to provide steady income amidst economic fluctuations. In this environment, identifying strong dividend stocks involves looking for companies with a history of stable earnings and a commitment to returning value to shareholders through consistent payouts.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.72% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.82% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.95% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.92% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

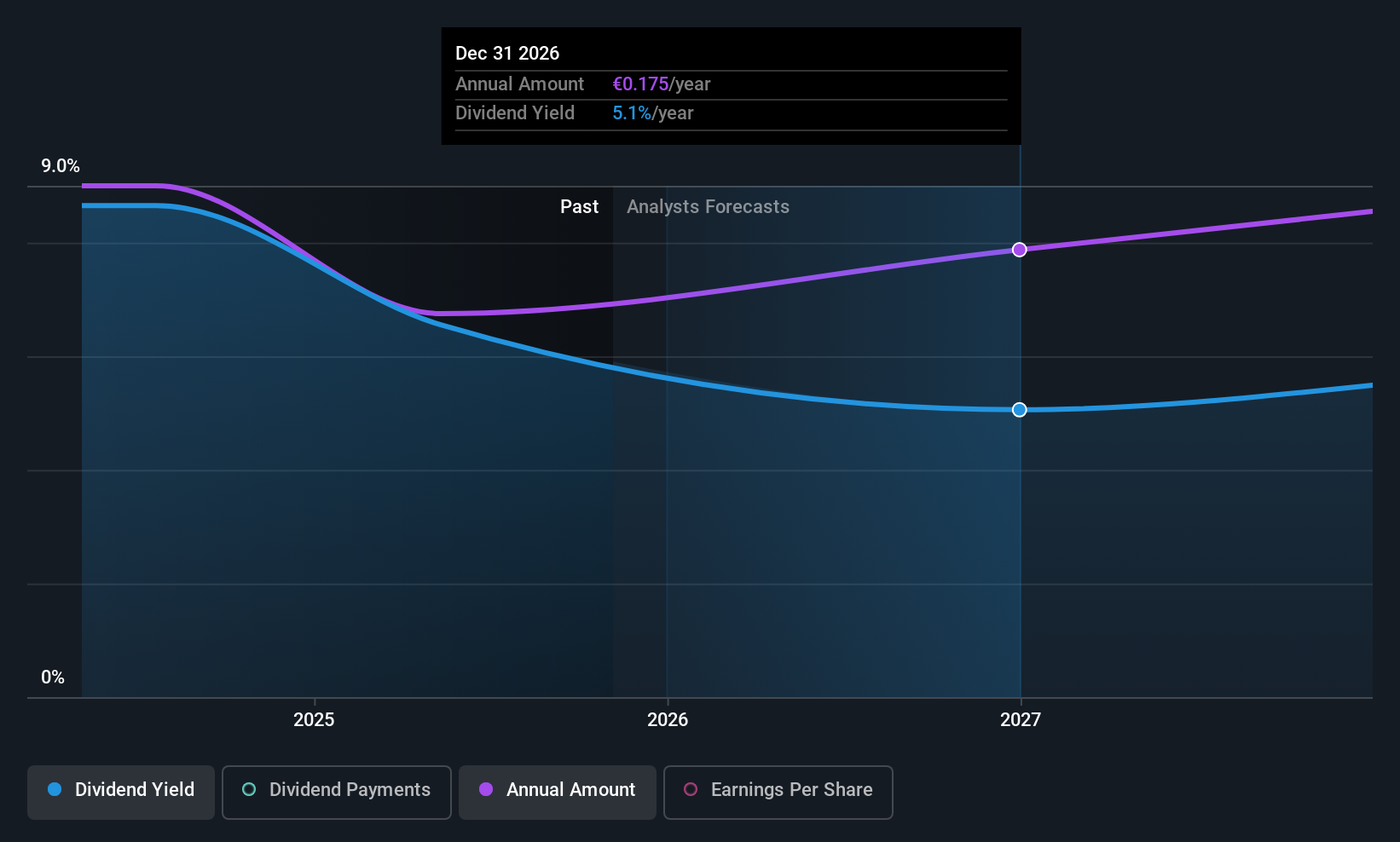

Sogefi (BIT:SGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sogefi S.p.A. is a company that designs, develops, and produces filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry globally, with a market cap of €325.77 million.

Operations: Sogefi S.p.A.'s revenue is primarily derived from its Suspensions segment, generating €549.75 million, and its Air and Cooling segment, contributing €455.80 million.

Dividend Yield: 5.5%

Sogefi's dividend yield of 5.48% is among the top quartile in Italy, yet its short two-year payment history has been marked by volatility and declines. Despite a payout ratio of 73.6% from earnings and 83.9% from cash flows, suggesting coverage, the company's net income fell sharply to €18.7 million for H1 2025 compared to €145.8 million previously, raising concerns about future dividend stability amidst forecasted revenue declines for the year.

- Click here to discover the nuances of Sogefi with our detailed analytical dividend report.

- According our valuation report, there's an indication that Sogefi's share price might be on the expensive side.

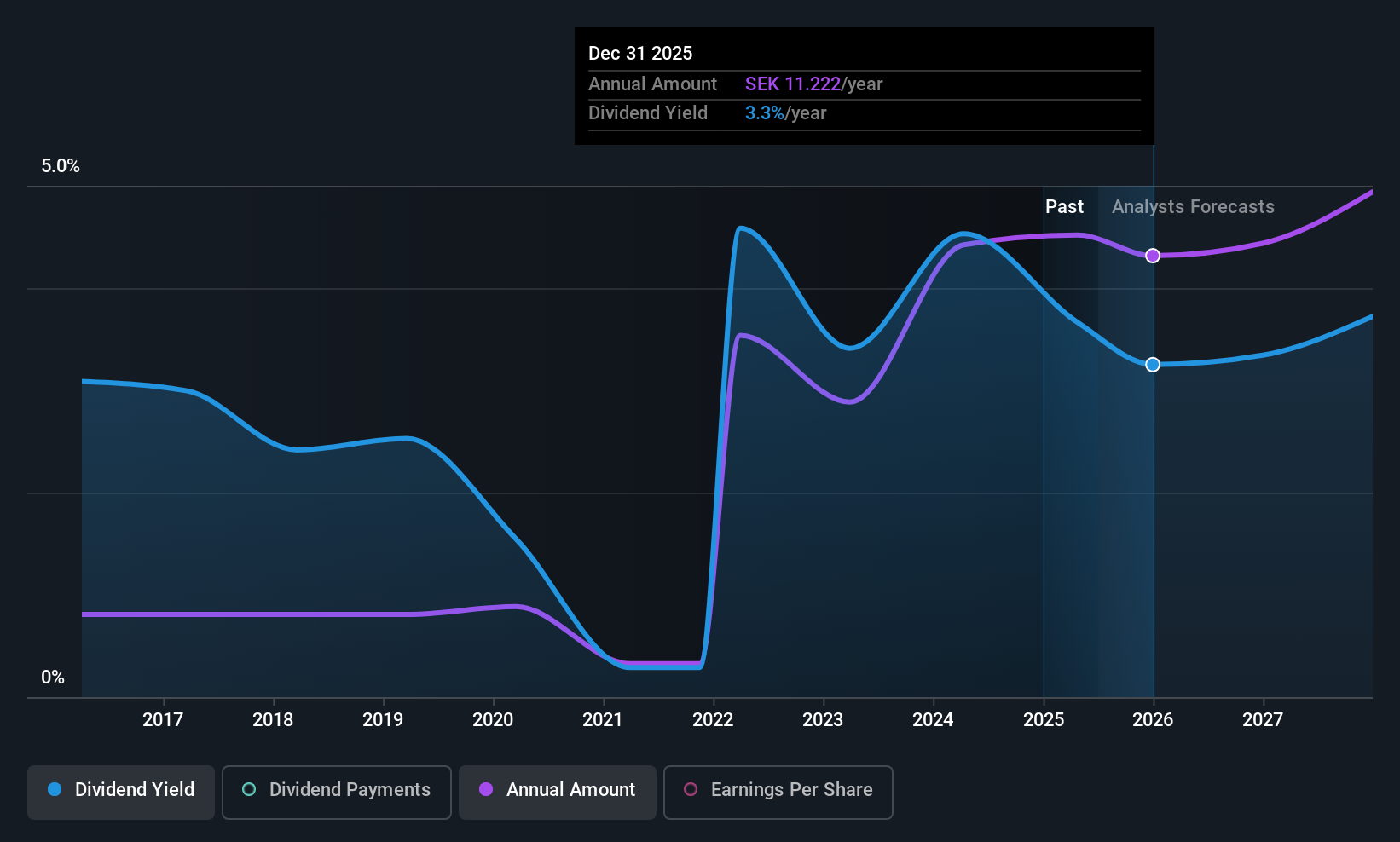

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avanza Bank Holding AB (publ), along with its subsidiaries, provides savings, pension, and mortgage products in Sweden and has a market capitalization of approximately SEK57.41 billion.

Operations: Avanza Bank Holding AB (publ) generates revenue of SEK4.65 billion from its commercial operations segment.

Dividend Yield: 3.2%

Avanza Bank Holding's dividend yield of 3.22% falls short of the top tier in Sweden, and its 10-year dividend history is marked by volatility despite growth. The payout ratio of 73.9% indicates dividends are well-covered by earnings, complemented by a robust cash payout ratio of 6.8%, ensuring coverage through cash flows. Recent earnings growth to SEK 1,307 million for H1 2025 underscores financial strength but doesn't fully mitigate concerns over historical dividend instability.

- Unlock comprehensive insights into our analysis of Avanza Bank Holding stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Avanza Bank Holding shares in the market.

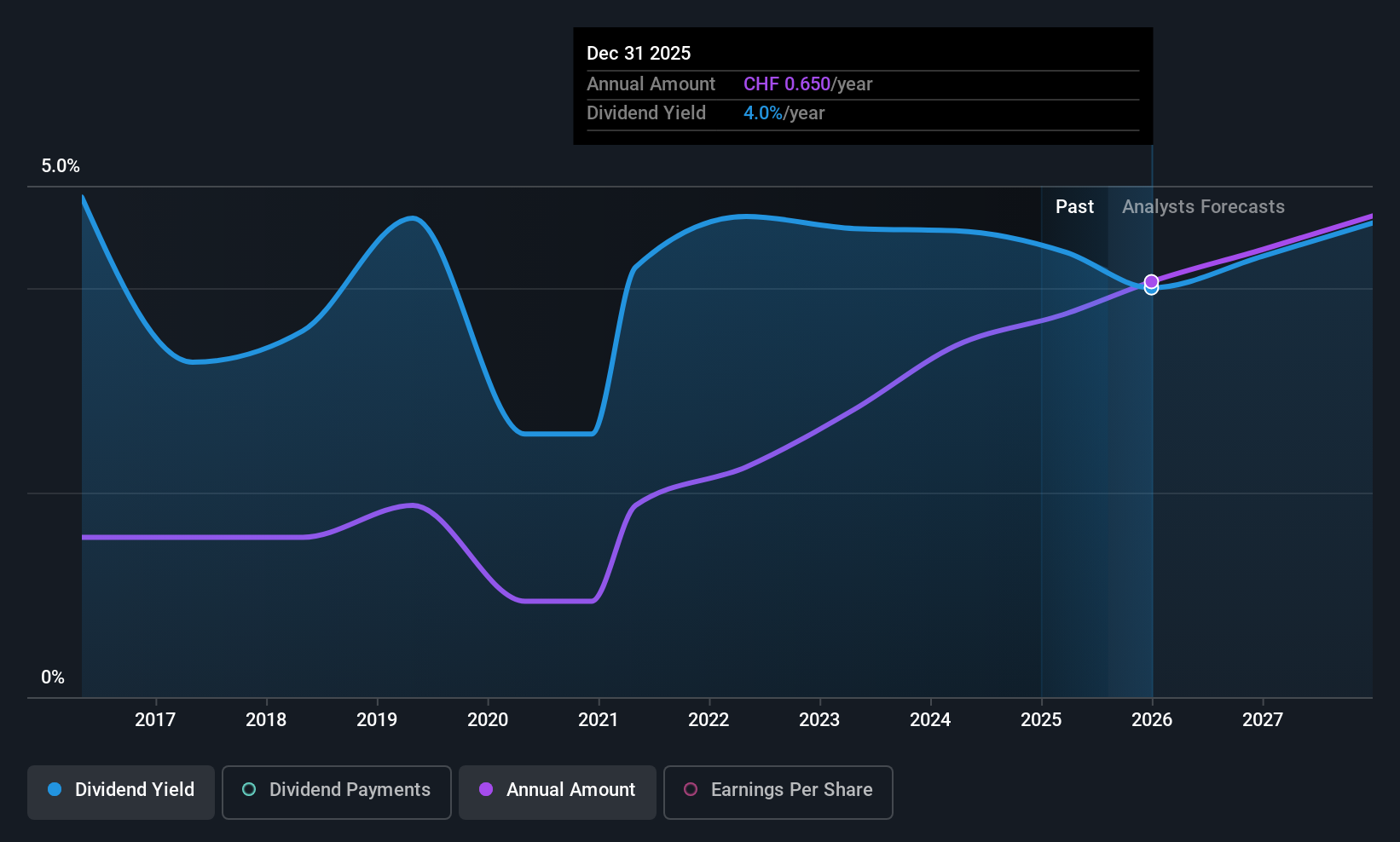

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG, with a market cap of CHF5.06 billion, operates through its subsidiaries to offer private banking, wealth management, and asset management services.

Operations: EFG International's revenue is primarily derived from its segments in Private Banking and Wealth Management across various regions, including Switzerland & Italy (CHF448.80 million), Continental Europe & Middle East (CHF236.10 million), Asia Pacific (CHF204.90 million), United Kingdom (CHF175.30 million), and Americas (CHF126.80 million), along with contributions from Global Markets & Treasury (CHF173.40 million), Investment and Wealth Solutions (CHF124.20 million), and Corporate services (CHF112.20 million).

Dividend Yield: 3.6%

EFG International's dividend yield of 3.58% is below the top tier in Switzerland, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings, with a current payout ratio of 49.9%, forecasted to rise to 57.5% in three years. Recent net income growth to CHF 221.2 million for H1 2025 highlights strong financial performance, though dividend reliability remains a concern amidst executive changes and strategic adjustments.

- Dive into the specifics of EFG International here with our thorough dividend report.

- Our expertly prepared valuation report EFG International implies its share price may be lower than expected.

Turning Ideas Into Actions

- Explore the 223 names from our Top European Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SGF

Sogefi

Designs, develops, and produces filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry in Europe, South America, North America, China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives