Stock Analysis

- Switzerland

- /

- Capital Markets

- /

- SWX:EFGN

Top 3 Dividend Stocks On SIX Swiss Exchange In July 2024

Reviewed by Simply Wall St

The Switzerland market exhibited resilience on Wednesday, buoyed by optimism surrounding potential interest rate cuts from major central banks, including the Federal Reserve. The SMI index closed up, reflecting a steady investor confidence in the broader economic landscape. In this context of a robust market environment, dividend stocks continue to be a compelling consideration for those looking for potential steady income streams combined with the stability offered by established Swiss companies.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.18% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.16% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.50% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.34% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.35% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.45% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.02% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.87% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.34% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

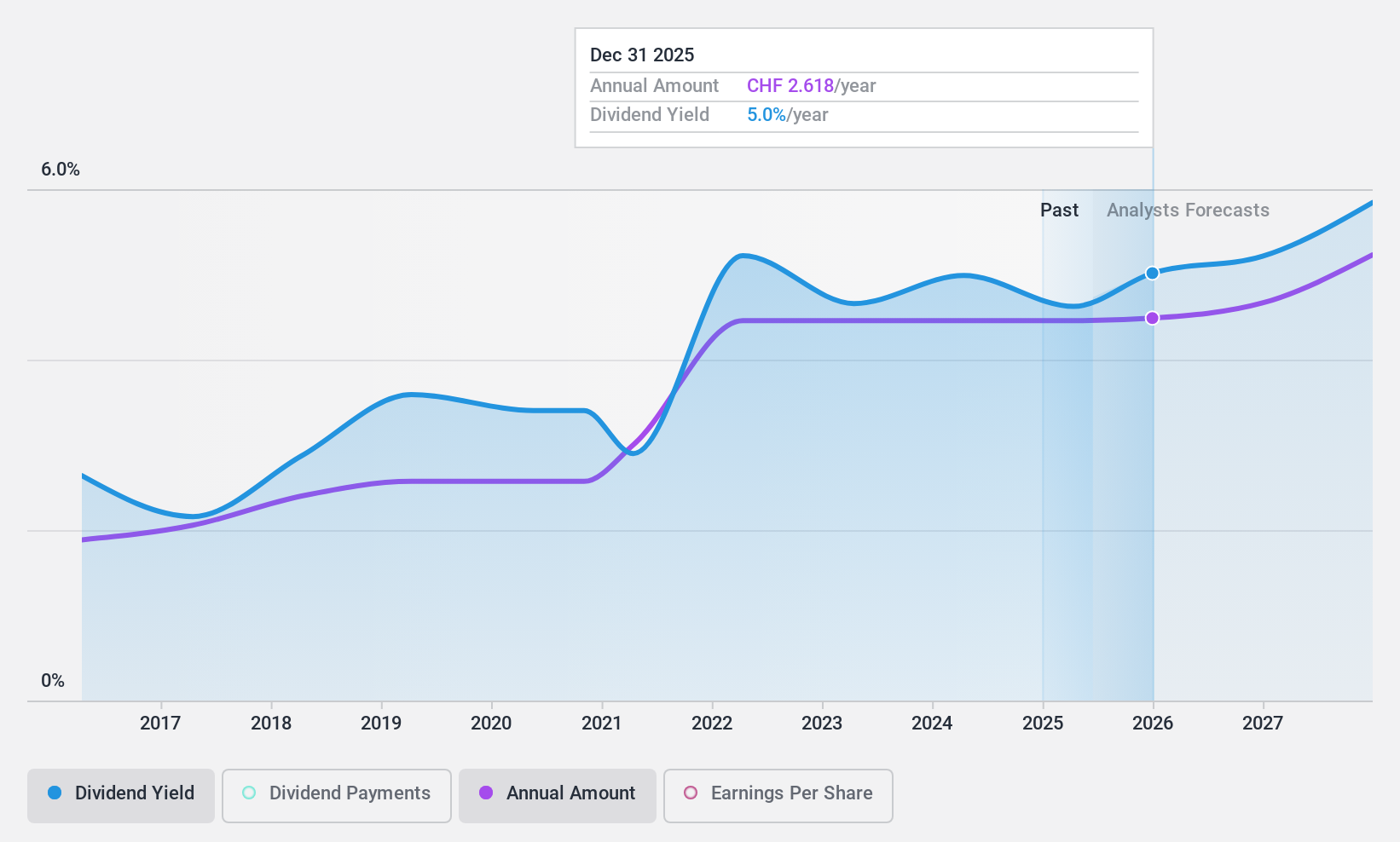

Julius Bär Gruppe (SWX:BAER)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG is a global wealth management firm operating across Switzerland, Europe, the Americas, and Asia with a market capitalization of CHF 10.61 billion.

Operations: Julius Bär Gruppe AG generates CHF 3.24 billion in revenue from its private banking segment.

Dividend Yield: 5%

Julius Bär Gruppe AG faces challenges with its dividend sustainability, evidenced by a high payout ratio of 117.8%, indicating dividends are not well covered by earnings. Despite this, the company has maintained reliable and growing dividends over the past decade. Financial performance shows a decline in profit margins from 24.6% to 14% year-over-year, yet earnings are expected to grow at an annual rate of 22.01%. Recent interest in acquiring HSBC's German wealth-management unit could impact future performance and market positioning.

- Take a closer look at Julius Bär Gruppe's potential here in our dividend report.

- Our valuation report here indicates Julius Bär Gruppe may be overvalued.

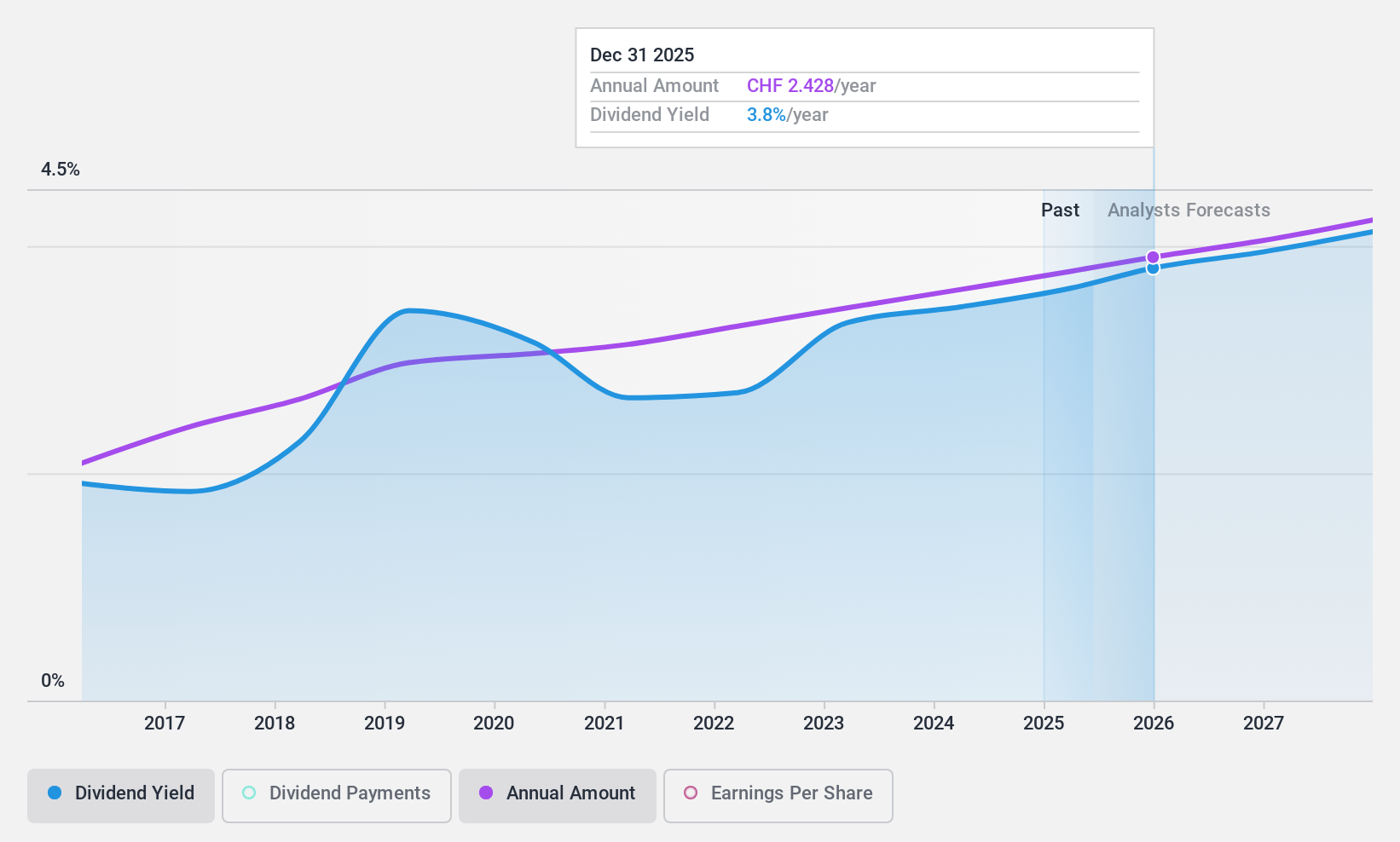

DKSH Holding (SWX:DKSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DKSH Holding AG operates as a provider of market expansion services across Thailand, Greater China, Malaysia, Singapore, the rest of the Asia Pacific, and internationally, with a market capitalization of CHF 4.37 billion.

Operations: DKSH Holding AG generates revenue through four primary segments: Healthcare (CHF 5.55 billion), Consumer Goods (CHF 3.43 billion), Performance Materials (CHF 1.38 billion), and Technology (CHF 0.53 billion).

Dividend Yield: 3.3%

DKSH Holding AG's recent earnings show a slight decrease in sales to CHF 5.44 billion but an increase in net income to CHF 111.2 million, indicating improved profitability. The company's dividend yield stands at 3.34%, lower than the top Swiss dividend payers, yet its dividends are supported by a stable payout ratio of 77% and a cash payout ratio of 45.8%. Despite trading below fair value, DKSH has consistently grown and reliably paid dividends over the last decade, with expected earnings growth of 9.44% per year.

- Click here to discover the nuances of DKSH Holding with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that DKSH Holding is priced higher than what may be justified by its financials.

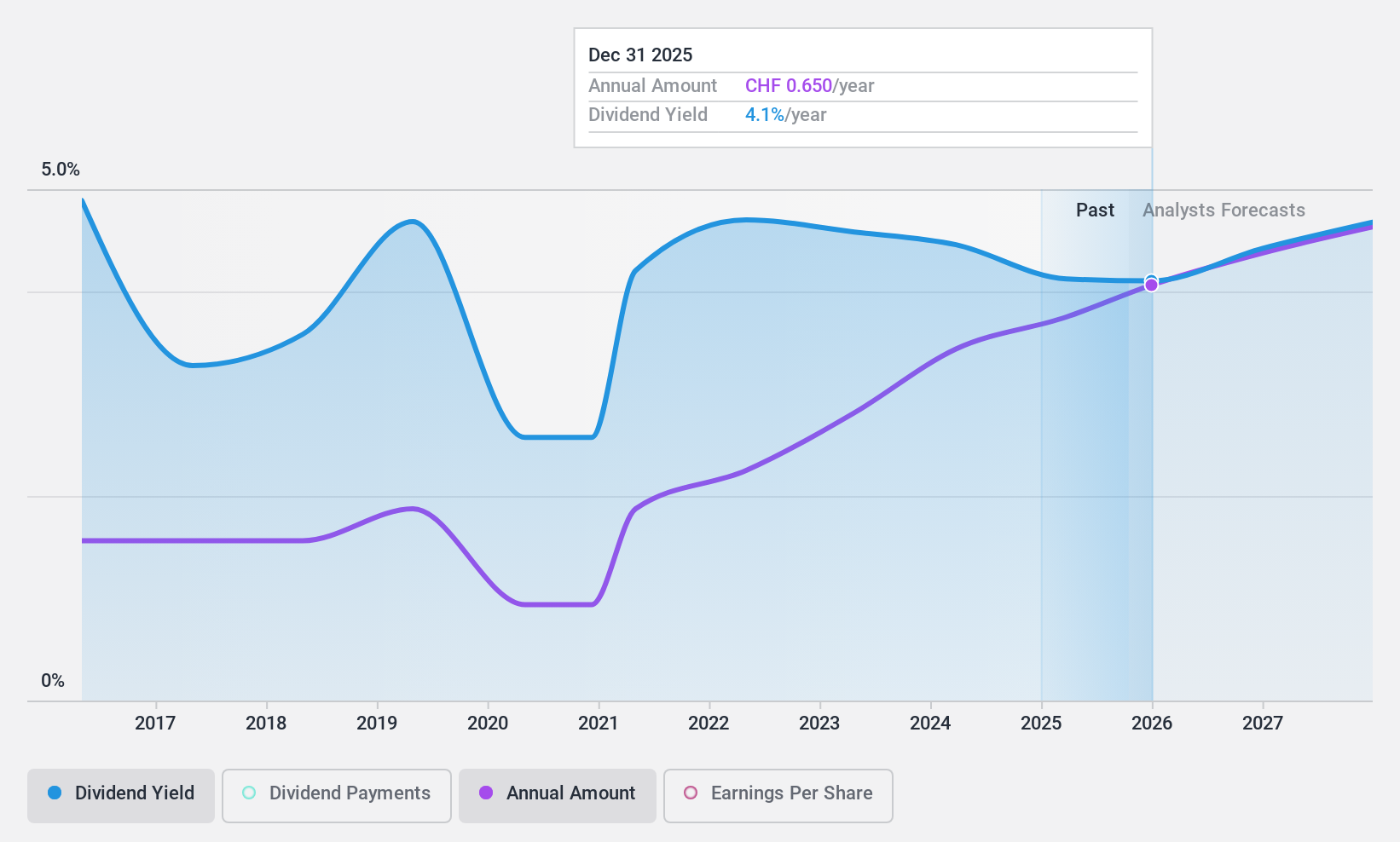

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG operates in private banking, wealth management, and asset management, with a market capitalization of approximately CHF 4.02 billion.

Operations: EFG International AG generates revenue through various regional and functional segments, including CHF 450.20 million from Switzerland & Italy, CHF 249.70 million from Continental Europe & Middle East, CHF 177.40 million from the United Kingdom, CHF 165.30 million from Asia Pacific, CHF 133.20 million from the Americas, CHF 122.40 million from Investment and Wealth Solutions, and CHF 83 million from Global Markets & Treasury.

Dividend Yield: 4.1%

EFG International, trading at 29.3% below its estimated fair value, has shown a robust earnings growth of 56.6% over the past year with forecasts predicting further annual growth of 5.42%. Despite this, its dividend history is marked by volatility and unreliability over the last decade. Currently, dividends are covered by earnings with a payout ratio of 58.5%, expected to slightly improve to 54.4% in three years. However, its dividend yield of 4.13% remains slightly below the top quartile in the Swiss market (4.21%).

- Click to explore a detailed breakdown of our findings in EFG International's dividend report.

- The valuation report we've compiled suggests that EFG International's current price could be quite moderate.

Key Takeaways

- Access the full spectrum of 28 Top SIX Swiss Exchange Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EFG International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:EFGN

EFG International

Provides private banking, wealth management, and asset management services.

Solid track record established dividend payer.