- Switzerland

- /

- Capital Markets

- /

- SWX:EFGN

3 European Dividend Stocks Offering Yields Up To 4.2%

Reviewed by Simply Wall St

As European markets face a pullback, with the STOXX Europe 600 Index down 1.24% amid concerns over artificial intelligence stock valuations, investors are increasingly looking for stability in dividend stocks. In this environment, a good dividend stock is often characterized by its ability to offer consistent yields and financial resilience, providing potential income even when broader market sentiment is cautious.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.25% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.13% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.24% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.08% | ★★★★★★ |

| Evolution (OM:EVO) | 4.77% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.07% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.65% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.21% | ★★★★★☆ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

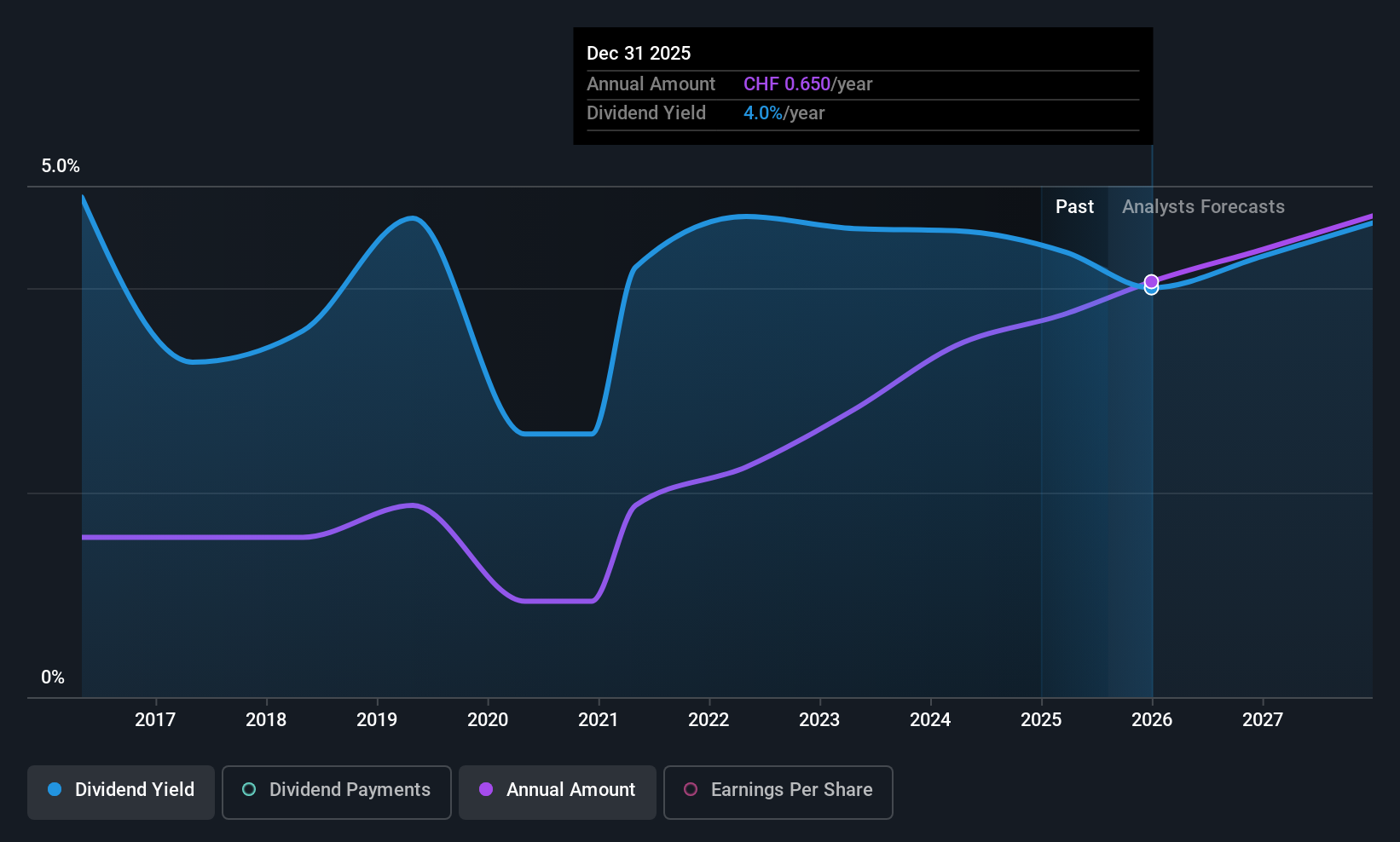

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG, along with its subsidiaries, offers private banking, wealth management, and asset management services, with a market cap of CHF5.24 billion.

Operations: EFG International's revenue segments include Corporate (CHF112.20 million), Global Markets & Treasury (CHF173.40 million), Investment and Wealth Solutions (CHF124.20 million), and Private Banking and Wealth Management across various regions: Americas (CHF126.80 million), Asia Pacific (CHF204.90 million), United Kingdom (CHF175.30 million), Switzerland & Italy (CHF448.80 million), and Continental Europe & Middle East (CHF236.10 million).

Dividend Yield: 3.5%

EFG International offers a mixed dividend profile. While dividends are well-covered by earnings with a current payout ratio of 49.9% and forecasted to remain sustainable, the dividend yield of 3.45% is below the top tier in Switzerland. Despite a decade-long growth in dividends, their volatility raises concerns about reliability. Recent executive changes and conference presentations suggest strategic shifts that may impact future performance without altering its current valuation advantage, trading below fair value estimates by 7.2%.

- Click here to discover the nuances of EFG International with our detailed analytical dividend report.

- Our valuation report unveils the possibility EFG International's shares may be trading at a discount.

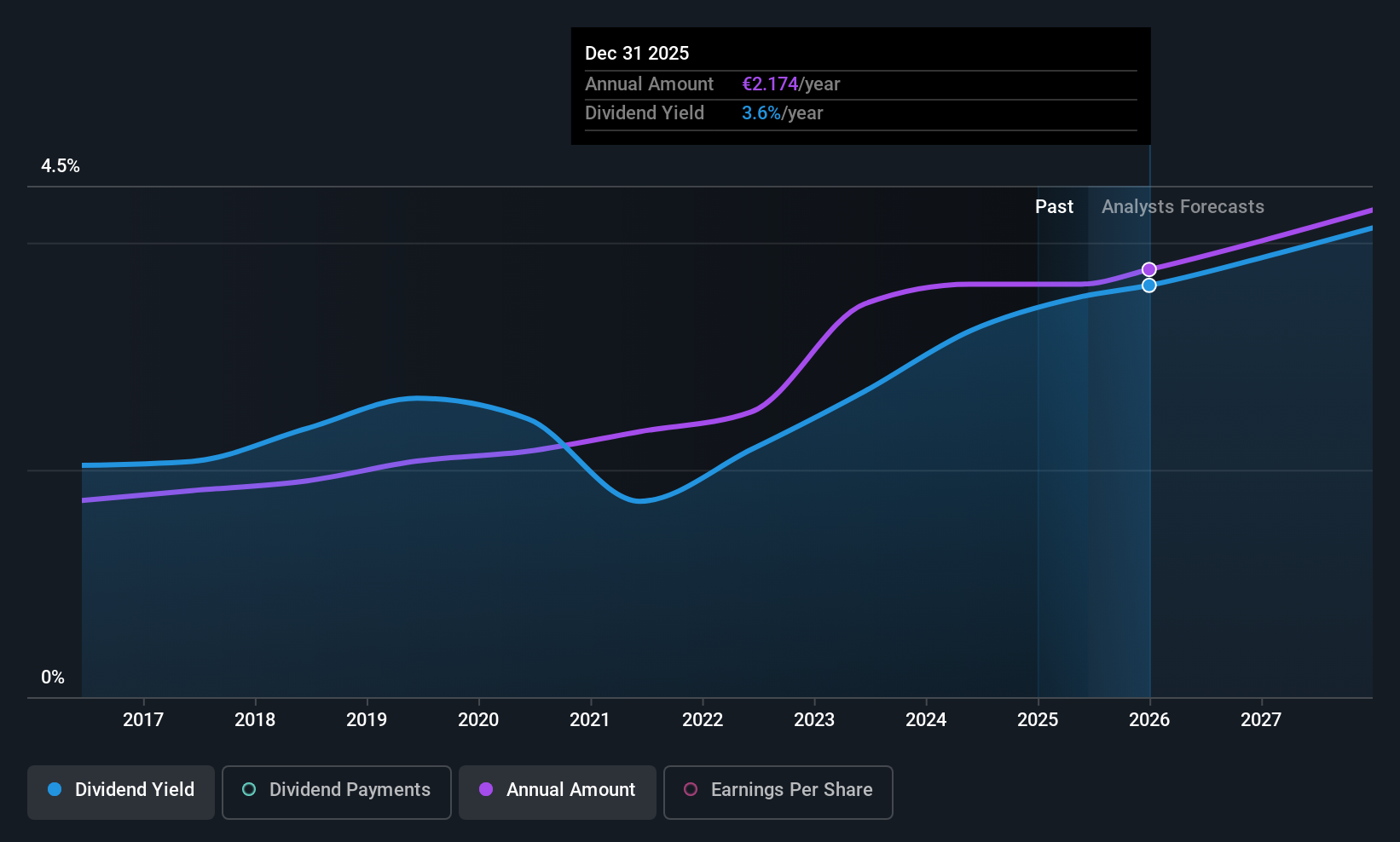

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE, with a market cap of €8.14 billion, operates through its subsidiaries in construction projects focusing on transportation infrastructures, building construction, and civil engineering.

Operations: Strabag SE generates revenue from its segments as follows: North + West (€7.46 billion), South + East (€7.33 billion), and International + Special Divisions (€3.48 billion).

Dividend Yield: 3.5%

Strabag SE presents a complex dividend profile. With a payout ratio of 34.9%, dividends are well-covered by earnings and cash flows, yet the yield of 3.55% falls short compared to Austria's top payers. Despite past volatility in dividend payments, recent growth offers some optimism for stability. The company's strategic projects, like the Emonika development and renewable energy initiatives, may bolster future revenue streams but do not guarantee immediate improvements in its dividend standing or stock valuation stability.

- Delve into the full analysis dividend report here for a deeper understanding of Strabag.

- Our valuation report here indicates Strabag may be undervalued.

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is involved in the distribution of chemicals and ingredients across various countries, including Germany, the United States, and China, with a market cap of €7.19 billion.

Operations: Brenntag SE's revenue segments focus on the distribution of chemicals and ingredients across a global network, including key markets such as Germany, the United States, and China.

Dividend Yield: 4.2%

Brenntag SE's dividend profile is supported by a payout ratio of 72.6%, indicating coverage by earnings, with cash flows further ensuring stability at a 45.2% cash payout ratio. Despite recent declines in sales and net income, dividends have remained stable and reliable over the past decade, growing consistently without volatility. However, its dividend yield of 4.22% is slightly below Germany's top quartile payers, and the company faces high debt levels that may impact future financial flexibility.

- Click to explore a detailed breakdown of our findings in Brenntag's dividend report.

- Our comprehensive valuation report raises the possibility that Brenntag is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 223 Top European Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EFG International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:EFGN

EFG International

Provides private banking, wealth management, and asset management services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives