- Switzerland

- /

- Professional Services

- /

- SWX:SGSN

SGS (SWX:SGSN) Valuation in Focus After EcoVadis Partnership Highlights ESG Leadership

Reviewed by Simply Wall St

SGS (SWX:SGSN) has been named an accredited partner within EcoVadis’ expanding Partnership & Alliance network, highlighting SGS’s expertise in ESG assessments and onsite audits. This collaboration addresses the increasing need for dependable and focused verification services among EcoVadis clients.

See our latest analysis for SGS.

SGS shares have climbed steadily in recent weeks, with a 10.96% one-month share price return and a three-month gain of 9.54%. This performance hints at renewed investor confidence following its EcoVadis partnership and industry conference appearances. Despite modest progress year-to-date, the company has delivered a 2.3% total shareholder return over the past year and a resilient long-term trend.

If you’re interested in what other resilient, fast-growing companies with high insider ownership are doing, this is your moment to discover fast growing stocks with high insider ownership

But after this strong run, is SGS still undervalued given its recent performance and sector leadership, or have investors already priced future growth into the share price?

Most Popular Narrative: 2.6% Undervalued

SGS’s most followed narrative puts its fair value slightly above the last close, suggesting shares still carry some upside after their recent rally. The reasoning behind this valuation offers a closer look at strategic shifts and growth investments driving analyst consensus.

The integration of ATS, along with 12 bolt-on acquisitions, is expected to unlock significant cross-selling opportunities and broaden SGS's service offering in high-growth regulated sectors (such as aerospace, life sciences, and insurance). This is also expected to realize at least $30M in annual synergies by year three, directly supporting future earnings and margin expansion.

Want to know the math behind this value call? The full narrative reveals ambitious expectations for future sales momentum, margin expansion, and a surprisingly assertive profit multiple. See which specific growth projections shape this fair value and why analysts are pushing for a premium price.

Result: Fair Value of $93.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in consulting or unexpected integration challenges could limit SGS's upside, particularly if digital disruption accelerates in core service lines.

Find out about the key risks to this SGS narrative.

Another View: Multiples Send a Caution Signal

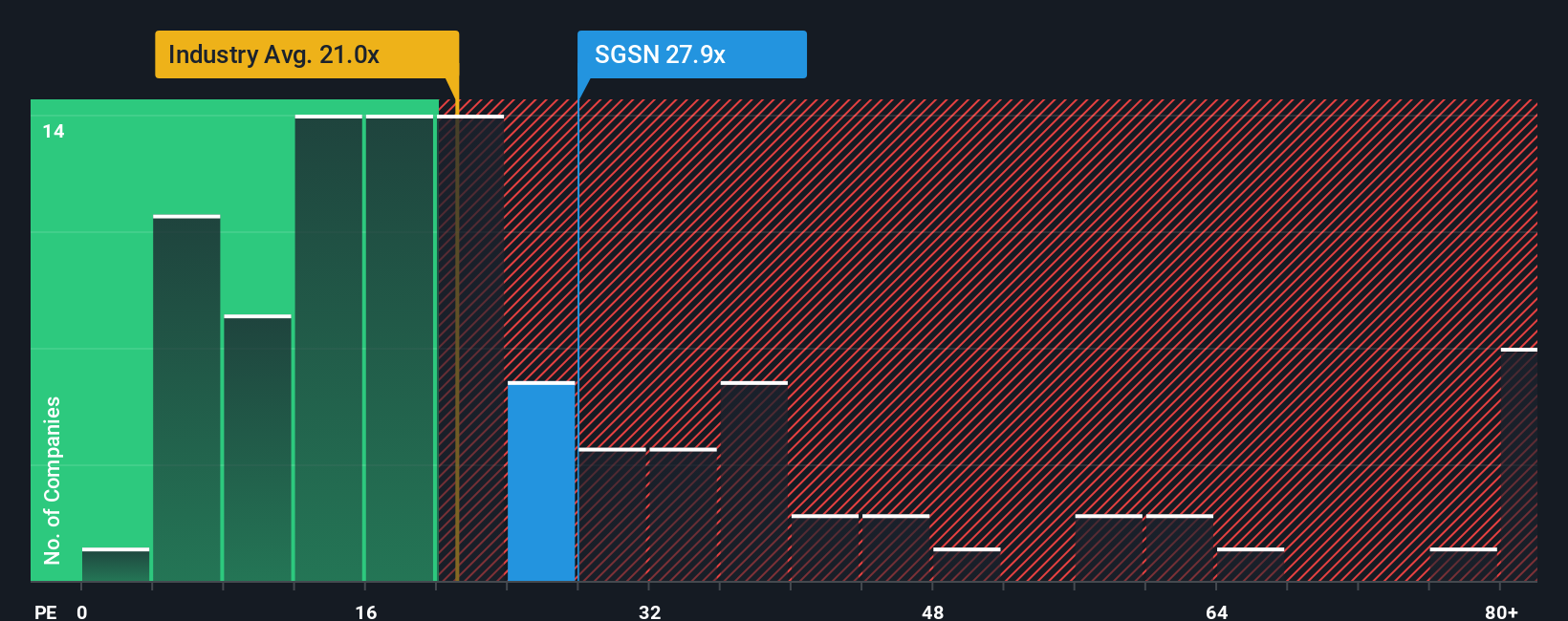

Looking beyond fair value estimates, the market’s preferred yardstick shows SGS trading at a price-to-earnings ratio of 28 times earnings. That is well above both the sector average (20.9x) and its fair ratio benchmark (20.5x), suggesting investors are already baking in optimism and offering little margin for error. Can these premium valuations hold up if growth slows or expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SGS Narrative

If you see things differently or want to dig into the numbers yourself, it’s easy to build your own SGS thesis in just a few minutes. Do it your way

A great starting point for your SGS research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by regularly searching for the next big opportunity. Don’t let market momentum leave you behind. Fresh ideas are only a step away.

- Spot up-and-coming innovators by reviewing these 3579 penny stocks with strong financials with strong financials that could gain ground before the crowd catches on.

- Catch rising stars in the healthcare sector by browsing these 34 healthcare AI stocks that are transforming medical research and patient outcomes.

- Boost your passive income strategy and lock in attractive yields through these 21 dividend stocks with yields > 3% delivering over 3% returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGSN

SGS

Provides inspection, testing, and certification services in Europe, Africa, the Middle East, Latin America, North America, and the Asia Pacific.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives