Stock Analysis

- Switzerland

- /

- Chemicals

- /

- SWX:SIKA

Julius Bär Gruppe And Two More Stocks Estimated To Be Undervalued On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market experienced a fluctuating session recently, with the benchmark SMI closing down after an initial recovery. Amidst these market movements, certain stocks on the SIX Swiss Exchange appear to be undervalued, presenting potential opportunities for investors. In light of current economic conditions, including falling producer and import prices, identifying stocks with strong fundamentals and potential for growth becomes particularly pertinent.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF133.00 | CHF220.71 | 39.7% |

| COLTENE Holding (SWX:CLTN) | CHF46.90 | CHF74.16 | 36.8% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF612.00 | CHF855.91 | 28.5% |

| Barry Callebaut (SWX:BARN) | CHF1391.00 | CHF1827.66 | 23.9% |

| Julius Bär Gruppe (SWX:BAER) | CHF52.22 | CHF94.77 | 44.9% |

| Sonova Holding (SWX:SOON) | CHF274.00 | CHF469.01 | 41.6% |

| SGS (SWX:SGSN) | CHF81.58 | CHF124.77 | 34.6% |

| Comet Holding (SWX:COTN) | CHF387.50 | CHF588.77 | 34.2% |

| Medartis Holding (SWX:MED) | CHF72.00 | CHF131.55 | 45.3% |

| medmix (SWX:MEDX) | CHF14.26 | CHF23.86 | 40.2% |

Let's review some notable picks from our screened stocks.

Julius Bär Gruppe (SWX:BAER)

Overview: Julius Bär Gruppe AG, a global provider of wealth management solutions based in Switzerland, operates across Europe, the Americas, and Asia with a market capitalization of CHF 10.70 billion.

Operations: The company's revenue from private banking amounts to CHF 3.24 billion.

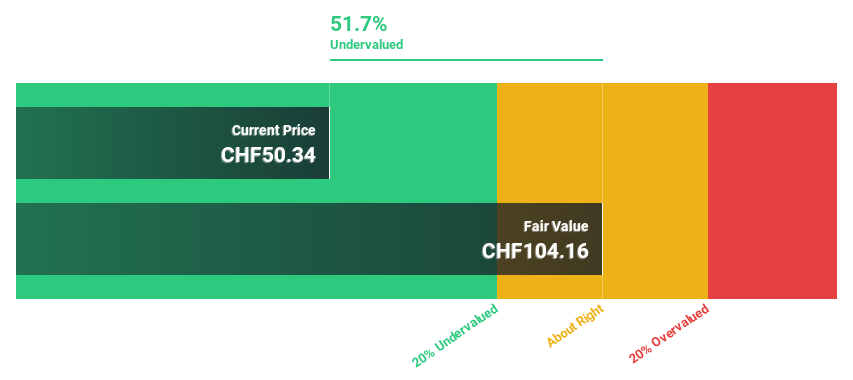

Estimated Discount To Fair Value: 44.9%

Julius Bär Gruppe, priced at CHF52.22, is notably undervalued based on cash flows, trading 44.9% below its estimated fair value of CHF94.77. Despite a substantial expected earnings growth of 22% annually over the next three years and revenue growth projections outpacing the Swiss market at 9.5% per year, concerns linger with a high bad loans ratio of 2% and profit margins declining from last year's 24.6% to this year's 14%. Recent strategic moves include exploring acquisition opportunities in HSBC’s German wealth-management sector and appointing Kenny Choy as team head for Greater China markets.

- The analysis detailed in our Julius Bär Gruppe growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Julius Bär Gruppe.

SGS (SWX:SGSN)

Overview: SGS SA operates globally, offering inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 15.44 billion.

Operations: SGS's revenue is generated from five key segments: Business Assurance (CHF 746 million), Natural Resources (CHF 1.58 billion), Health & Nutrition (CHF 857 million), Connectivity & Products (CHF 1.25 billion), and Industries & Environment (CHF 2.19 billion).

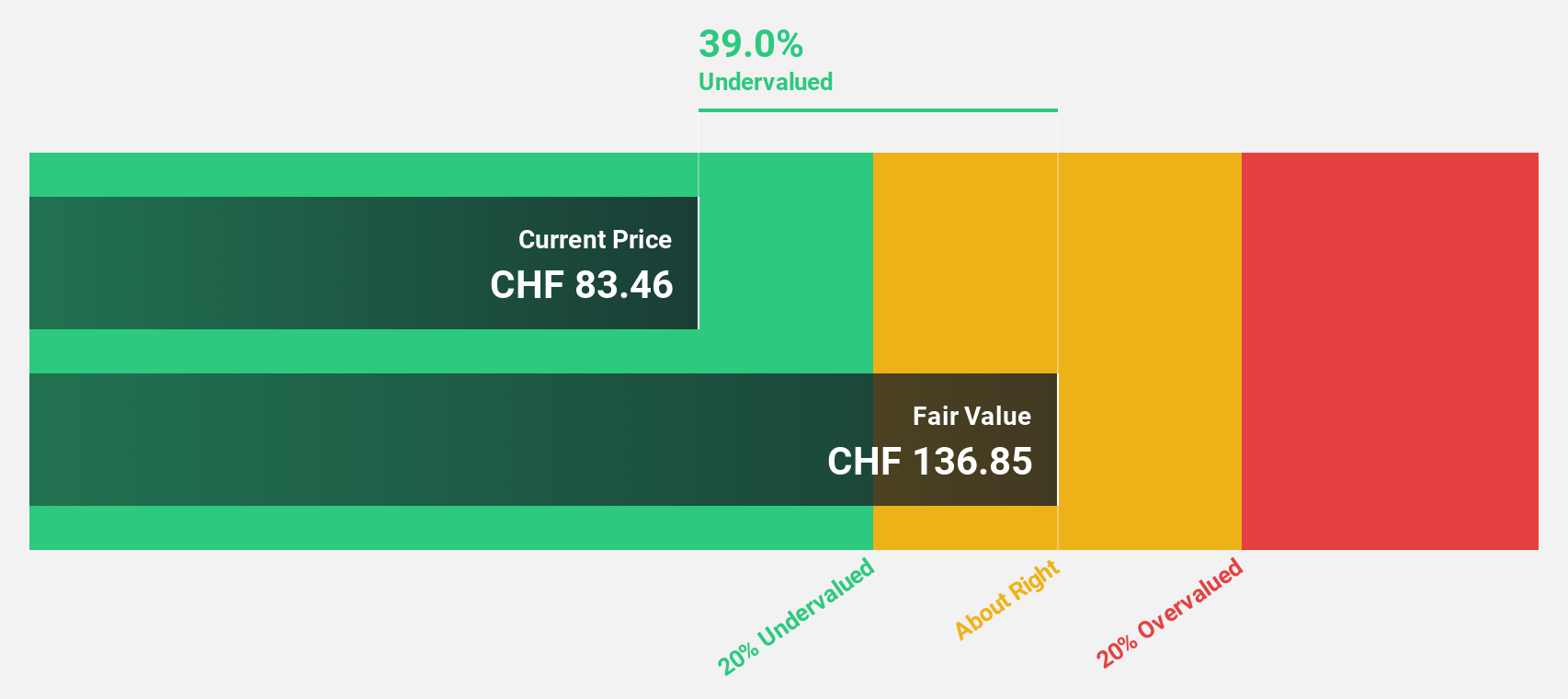

Estimated Discount To Fair Value: 34.6%

SGS, with a current price of CHF81.58, is considerably undervalued against a fair value estimate of CHF124.77, reflecting a 34.6% discount. Forecasted revenue and earnings growth at 4.7% and 9.8% respectively outpace the Swiss market averages, though the company faces challenges from high debt levels and shareholder dilution over the past year. Recent events include affirming mid to high single-digit organic growth for 2024 and reporting first-quarter sales of CHF1.58 billion, despite slight declines due to currency impacts.

- According our earnings growth report, there's an indication that SGS might be ready to expand.

- Get an in-depth perspective on SGS' balance sheet by reading our health report here.

Sika (SWX:SIKA)

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the construction and automotive industries globally, with a market capitalization of CHF 41.89 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

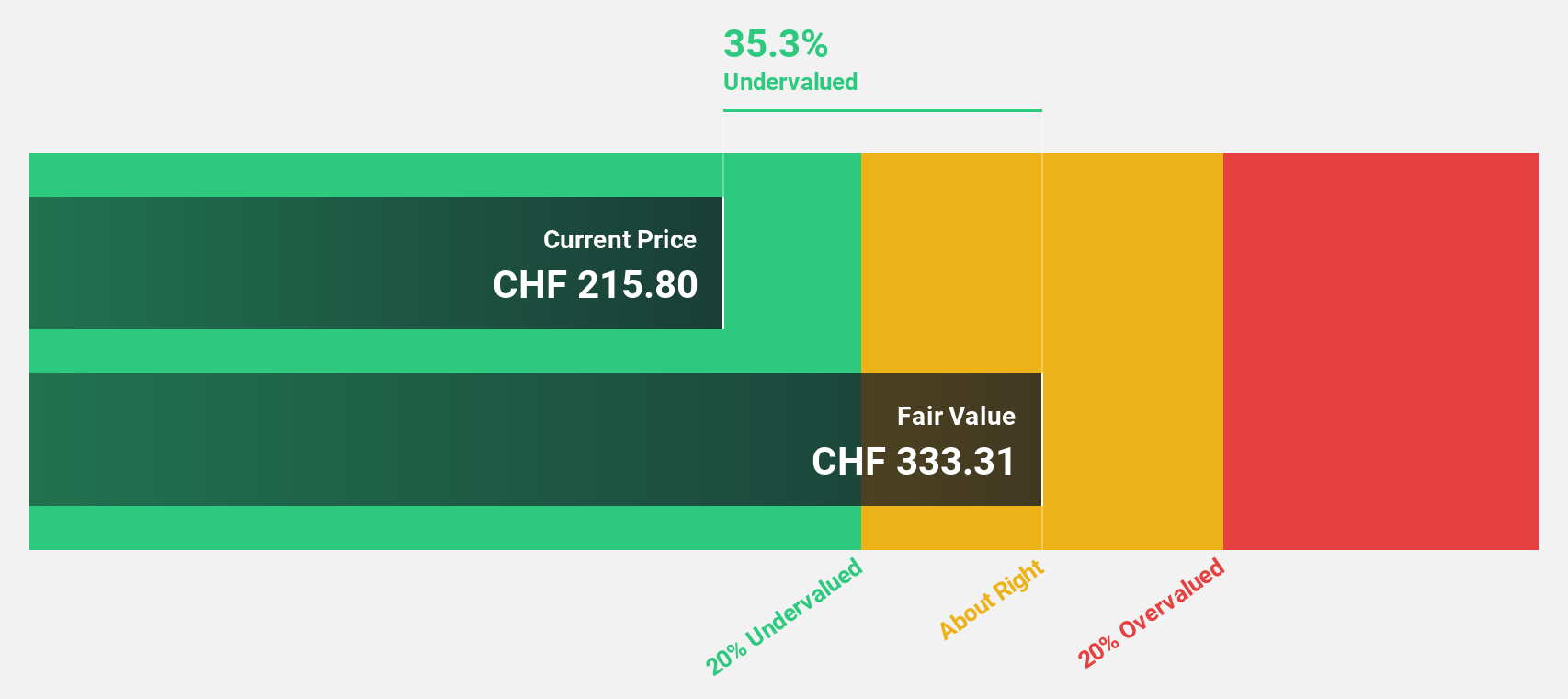

Estimated Discount To Fair Value: 22.6%

Sika, priced at CHF261.1, is trading 22.6% below its calculated fair value of CHF337.34, signaling potential undervaluation based on cash flows. Expected to outperform the Swiss market, Sika's earnings and revenue growth forecasts are 12.7% and 6.1% respectively, both higher than market averages of 8.2% and 4.4%. However, concerns include high debt levels and recent shareholder dilution. The opening of a new plant in China boosts its production capabilities while aligning with sustainability goals through increased use of recycled materials.

- In light of our recent growth report, it seems possible that Sika's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Sika's balance sheet health report.

Turning Ideas Into Actions

- Investigate our full lineup of 15 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sika is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SIKA

Sika

A specialty chemicals company, develops, produces, and sells systems and products for bonding, sealing, damping, reinforcing, and protecting in the building sector and motor vehicle industry worldwide.

Reasonable growth potential with adequate balance sheet.