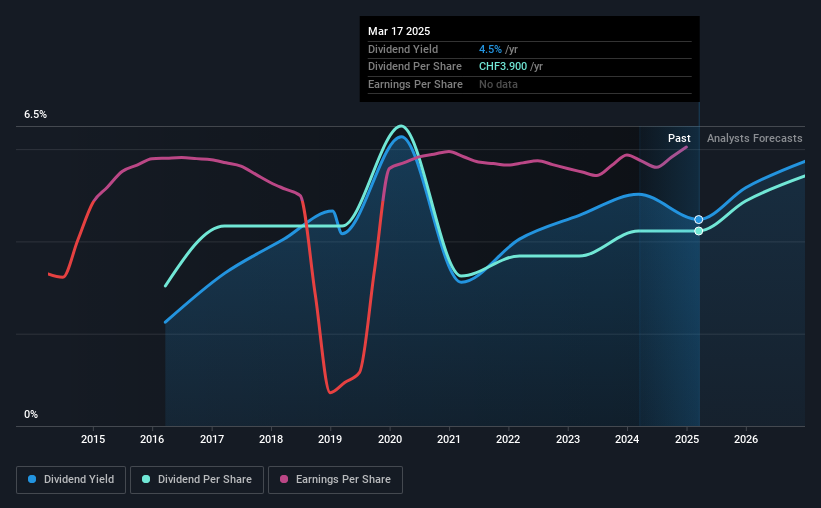

Orell Füssli AG (VTX:OFN) has announced that it will be increasing its periodic dividend on the 19th of May to CHF4.40, which will be 13% higher than last year's comparable payment amount of CHF3.90. This will take the dividend yield to an attractive 4.5%, providing a nice boost to shareholder returns.

View our latest analysis for Orell Füssli

Orell Füssli's Future Dividend Projections Appear Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Orell Füssli's dividend made up quite a large proportion of earnings but only 47% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

The next year is set to see EPS grow by 3.1%. If the dividend continues along recent trends, we estimate the payout ratio will be 59%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Orell Füssli's Dividend Has Lacked Consistency

Looking back, Orell Füssli's dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. Since 2016, the annual payment back then was CHF2.80, compared to the most recent full-year payment of CHF3.90. This means that it has been growing its distributions at 3.8% per annum over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Orell Füssli's Dividend Might Lack Growth

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see that Orell Füssli has been growing its earnings per share at 11% a year over the past five years. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

Our Thoughts On Orell Füssli's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Orell Füssli's payments are rock solid. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Orell Füssli that investors need to be conscious of moving forward. Is Orell Füssli not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:OFN

Orell Füssli

Engages in security printing and technology, book retailing, and publishing business in Switzerland Germany, rest of Europe and Africa, North and South America, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives