- Switzerland

- /

- Building

- /

- SWX:ZEHN

Benign Growth For Zehnder Group AG (VTX:ZEHN) Underpins Its Share Price

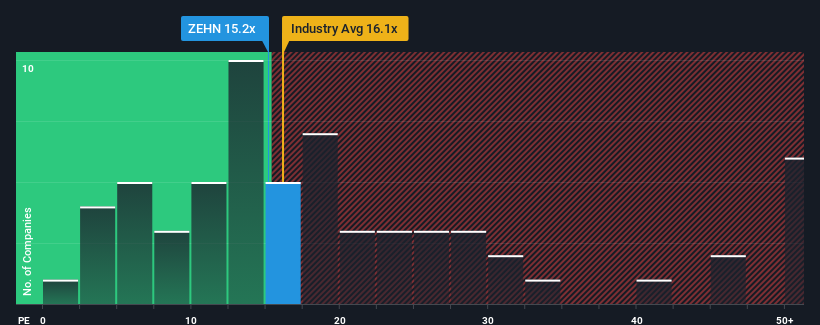

When close to half the companies in Switzerland have price-to-earnings ratios (or "P/E's") above 22x, you may consider Zehnder Group AG (VTX:ZEHN) as an attractive investment with its 15.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Zehnder Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zehnder Group

How Is Zehnder Group's Growth Trending?

In order to justify its P/E ratio, Zehnder Group would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 6.3% each year over the next three years. With the market predicted to deliver 10% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Zehnder Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Zehnder Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zehnder Group you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zehnder Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:ZEHN

Zehnder Group

Develops, manufactures, and sells indoor climate systems in Europe, North America, and China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives