- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

How Declining Returns and Rising Short-Term Liabilities at Stadler Rail (SWX:SRAIL) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Stadler Rail recently reported a decline in return on capital employed over the past five years, falling to 6.3% and lagging the Machinery industry average of 16%, while capital employed remained largely unchanged.

- This drop in returns, combined with a current liabilities to total assets ratio of 69%, points to both a more mature business profile and heightened financial risk due to increased reliance on short-term funding.

- We'll now explore how the reduced return on capital employed alters the outlook for Stadler Rail's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Stadler Rail Investment Narrative Recap

To be a shareholder in Stadler Rail today, you need to believe that the company's sizable order backlog, leading position in alternative propulsion, and ambitious revenue guidance for the next few years will outweigh the near-term pressure from declining returns and heightened financial risk. The recent drop in return on capital employed does not appear to materially change the primary short term catalyst, which is the scheduled conversion of the order backlog into reported revenue; however, it does reinforce concerns about margin stability and short-term funding exposure.

Of the recent announcements, the company’s updated revenue guidance, calling for over 10% sales growth in 2025 and CHF 5 billion in 2026, stands out as directly relevant. While this outlook emphasizes strong demand and order visibility, it comes at a time when low profitability and high reliance on short-term creditors could make the impact of any execution hiccups more acute.

Yet, with an unusually high ratio of current liabilities to total assets, investors should also be mindful of the risk that...

Read the full narrative on Stadler Rail (it's free!)

Stadler Rail's outlook anticipates CHF5.2 billion in revenue and CHF286.7 million in earnings by 2028. This scenario implies a 15.8% annual revenue growth rate and an earnings increase of CHF255.2 million from the current CHF31.5 million.

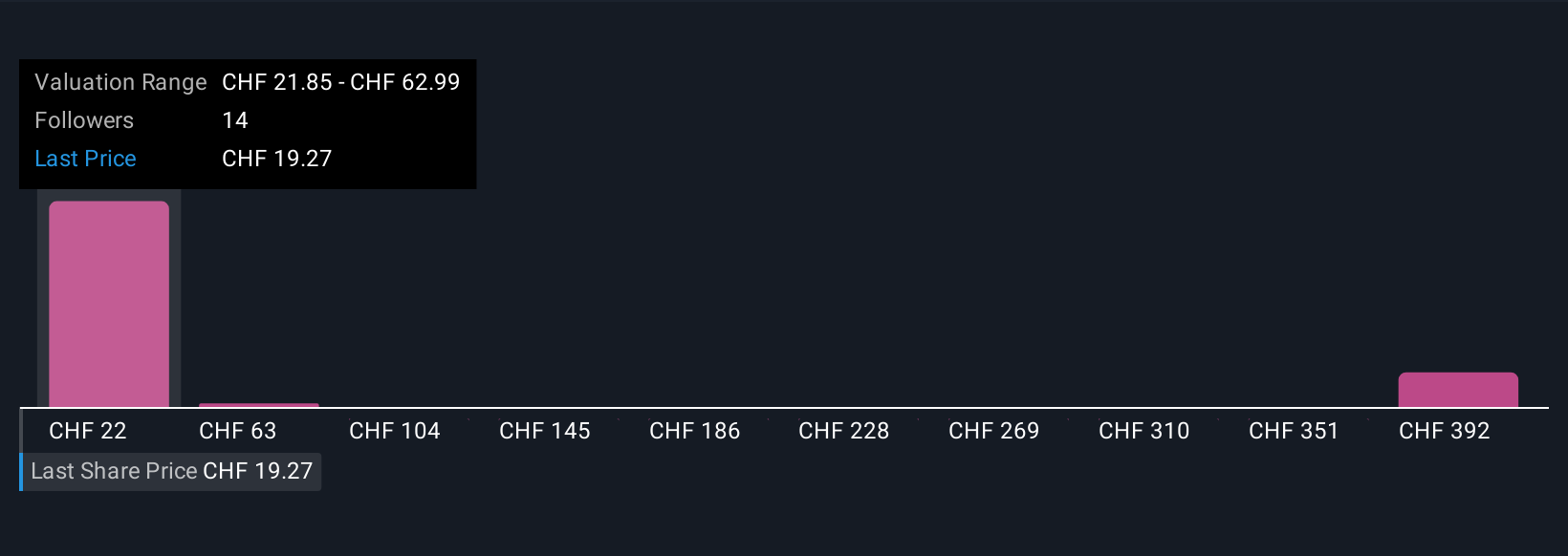

Uncover how Stadler Rail's forecasts yield a CHF21.85 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate fair value for Stadler Rail between CHF21.85 and CHF417.86. Despite this wide spread, many are still talking about the tension between expected revenue growth and the company’s short-term financial risk profile.

Explore 4 other fair value estimates on Stadler Rail - why the stock might be worth just CHF21.85!

Build Your Own Stadler Rail Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stadler Rail research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Stadler Rail research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stadler Rail's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives