- Switzerland

- /

- Machinery

- /

- SWX:SCHN

Schindler (SWX:SCHN) Margin Gains Reinforce Bull Case Despite Premium Valuation

Reviewed by Simply Wall St

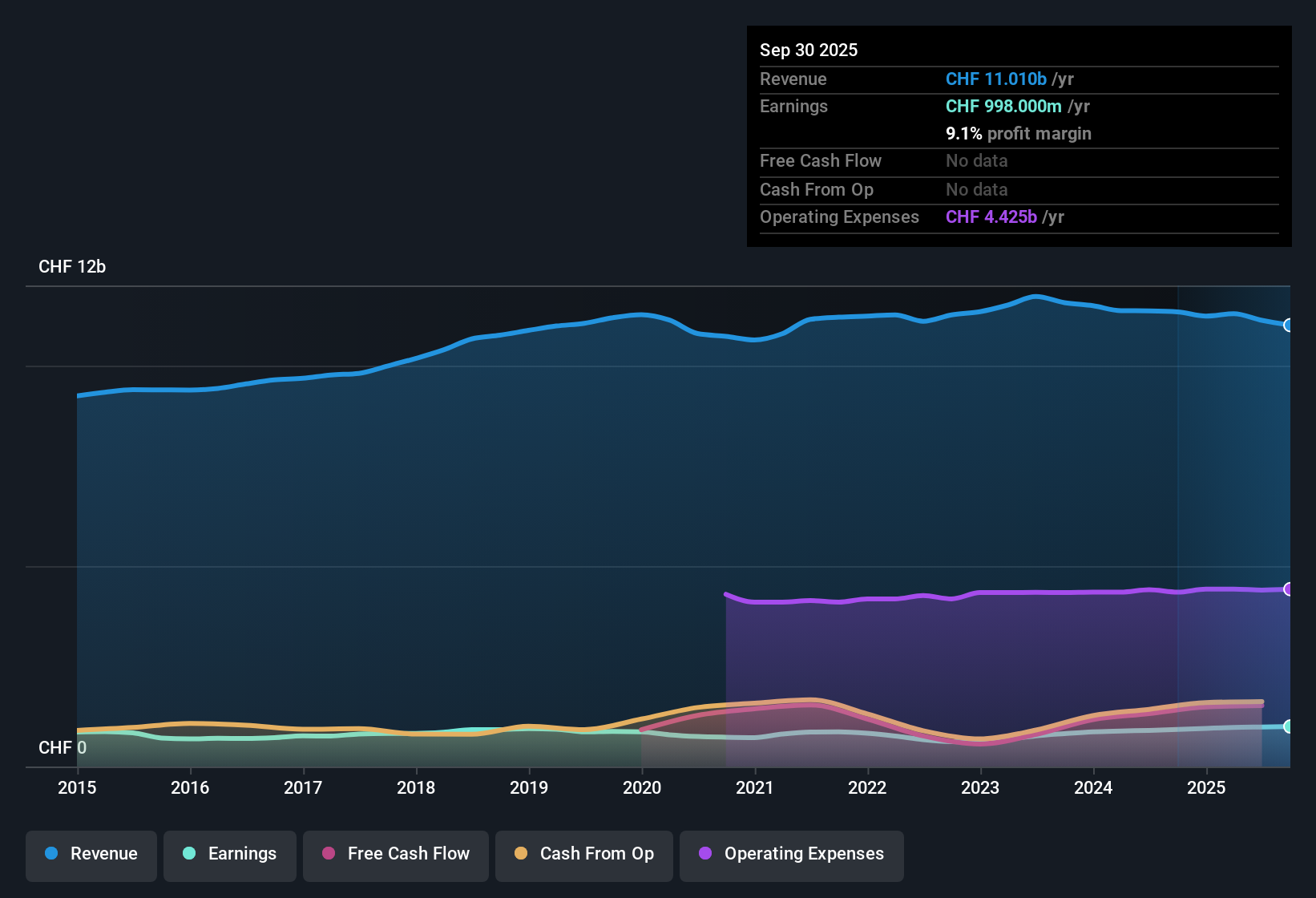

Schindler Holding (SWX:SCHN) posted a steady 8.1% earnings growth over the past year, topping its five-year average of 5.9%. Profit margins improved from 8.1% to 9.1%. Earnings are forecast to rise 7.93% annually and revenue growth is expected at 4.3% per year, slightly ahead of the Swiss market’s 4% average. However, this pace still trails the broader market’s projected 10.6% earnings growth. Key investor takeaways include the margin gains and above-market revenue trajectory, balanced by Schindler’s relatively high P/E ratio compared to peers and industry averages.

See our full analysis for Schindler Holding.Next up, we’ll see how these headline numbers measure up against the more popular narratives in the community and what investors are really debating about Schindler’s outlook.

See what the community is saying about Schindler Holding

Service and Modernization Outpace Installation Growth

- Schindler's Modernization business saw double-digit global growth, with especially strong order momentum in China. This signals that higher-margin, recurring revenue streams are driving the company's earnings durability.

- The analysts' consensus view highlights that service and modernization strength is expected to support recurring, higher-margin revenue, while near-term new installation activity in China remains subdued.

- Modernization gains globally, particularly in China, are offsetting challenges in new installations and underpin future stability in results.

- Analysts expect these trends to improve operating margins as steady portfolio expansion in Service continues.

- Consensus narrative notes operational streamlining and digital innovation are enhancing profitability and supporting margin expansion amid slowing topline growth.

- Efficiency moves, procurement savings, and SG&A cost reductions are starting to show up in margin improvements. This is setting the stage for sustained profitability even as installation volumes soften.

- Margin improvement is further supported by growth in higher-quality, recurring revenue segments.

Valuation Sits Between DCF and Analyst Targets

- The current share price of CHF279.0 trades at a significant discount to the DCF fair value of CHF356.03, but only a slight discount to the analyst target of CHF296.42. This highlights valuation tension.

- According to the analysts' consensus view, the relatively small 3.2% distance between share price and target suggests average expectations for upside. In contrast, a much wider gap to DCF value implies that long-term cash flow optimism has not fully filtered into current sentiment.

- Bears often argue that Schindler’s high P/E of 30x (compared to the industry average of 19.7x) makes the stock expensive and could cap returns until earnings catch up.

- However, the consensus narrative points out the market appears to already price in much of the expected margin and revenue improvement, dampening near-term rerating potential even as fundamentals improve.

Currency and Tariff Risks Add Pressure to Growth Outlook

- Persistent Swiss franc strength and the threat from global tariffs on input materials such as copper continue to weigh down revenue reported in Swiss francs and create uncertainty around project viability and profitability.

- Analysts' consensus view calls out that prolonged residential real estate contraction in China and sectoral exposure to low-growth, highly competitive regions could limit sustainable margin improvement over the next few years.

- Ongoing efficiency efforts in China address some of the pressure, but low-margin orders and challenging dynamics may still compress group-wide margins.

- Bears highlight these macro risks because they remain difficult to forecast and may extend margin headwinds despite progress in higher-margin service and modernization.

To see which themes are shaping the current consensus outlook and how the numbers stack up in context, check the full narrative link for all perspectives. 📊 Read the full Schindler Holding Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Schindler Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Put your viewpoint at the center of the conversation and build your narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Schindler Holding.

See What Else Is Out There

Despite improvements in margins and modernization, Schindler’s premium valuation and softening new installations make future upside less certain.

If you’re looking for companies offering greater value for their price, check out these 877 undervalued stocks based on cash flows to spot opportunities the market may be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SCHN

Schindler Holding

Engages in the production, installation, maintenance, and modernization of elevators, escalators, and moving walks worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives