As European markets experience a pullback amid concerns over AI-related stock valuations, investors are closely watching the Bank of England's interest rate decisions and ongoing economic indicators like retail sales. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to navigate market fluctuations with a focus on consistent returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.28% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 3.86% | ★★★★★☆ |

| Sanok Rubber Company Spólka Akcyjna (WSE:SNK) | 7.25% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.21% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| Evolution (OM:EVO) | 4.71% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.14% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.65% | ★★★★★★ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across various regions including Europe, the Middle East, Africa, the United States, Asia-Pacific, Australia, and New Zealand with a market cap of approximately SEK10.45 billion.

Operations: BioGaia AB's revenue is primarily derived from its Pediatrics segment, which accounts for SEK1.09 billion, followed by the Adult Health segment at SEK357.59 million.

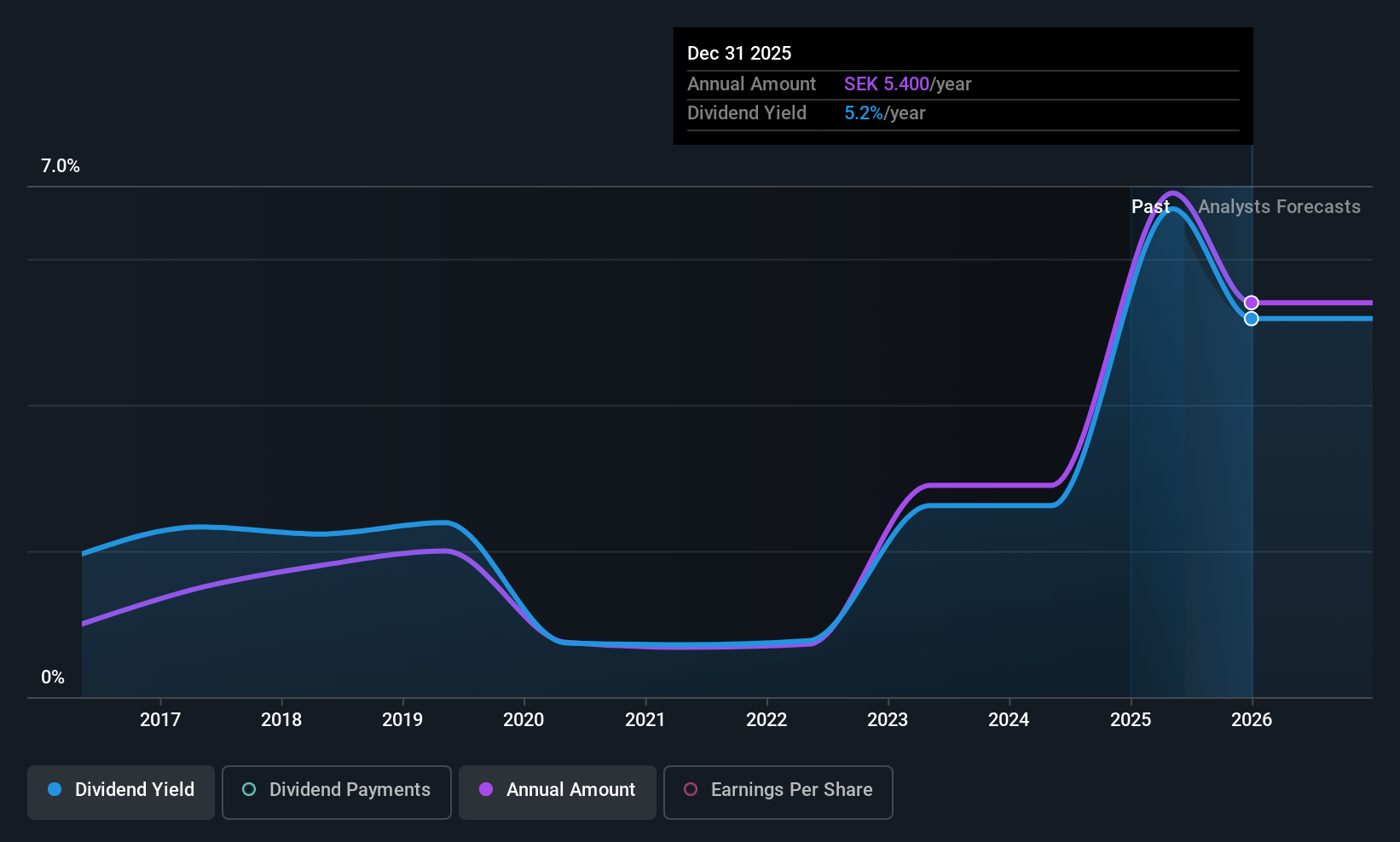

Dividend Yield: 6.7%

BioGaia's dividend yield is attractive, ranking in the top 25% of Swedish market payers at 6.68%. However, despite an increase in dividends over the past decade, their stability is questionable due to volatility and a high cash payout ratio of 216.8%, indicating dividends are not well-covered by free cash flows. Recent earnings showed growth with net income rising to SEK 65.88 million for Q3 2025, suggesting potential for future dividend sustainability if trends continue positively.

- Delve into the full analysis dividend report here for a deeper understanding of BioGaia.

- The valuation report we've compiled suggests that BioGaia's current price could be quite moderate.

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF403.69 million, manufactures and sells components for industrial customers globally through its subsidiaries.

Operations: Phoenix Mecano AG generates its revenue from three main segments: Enclosure Systems (€215.03 million), Industrial Components (€186.42 million), and Dewertokin Technology Group (€370.23 million).

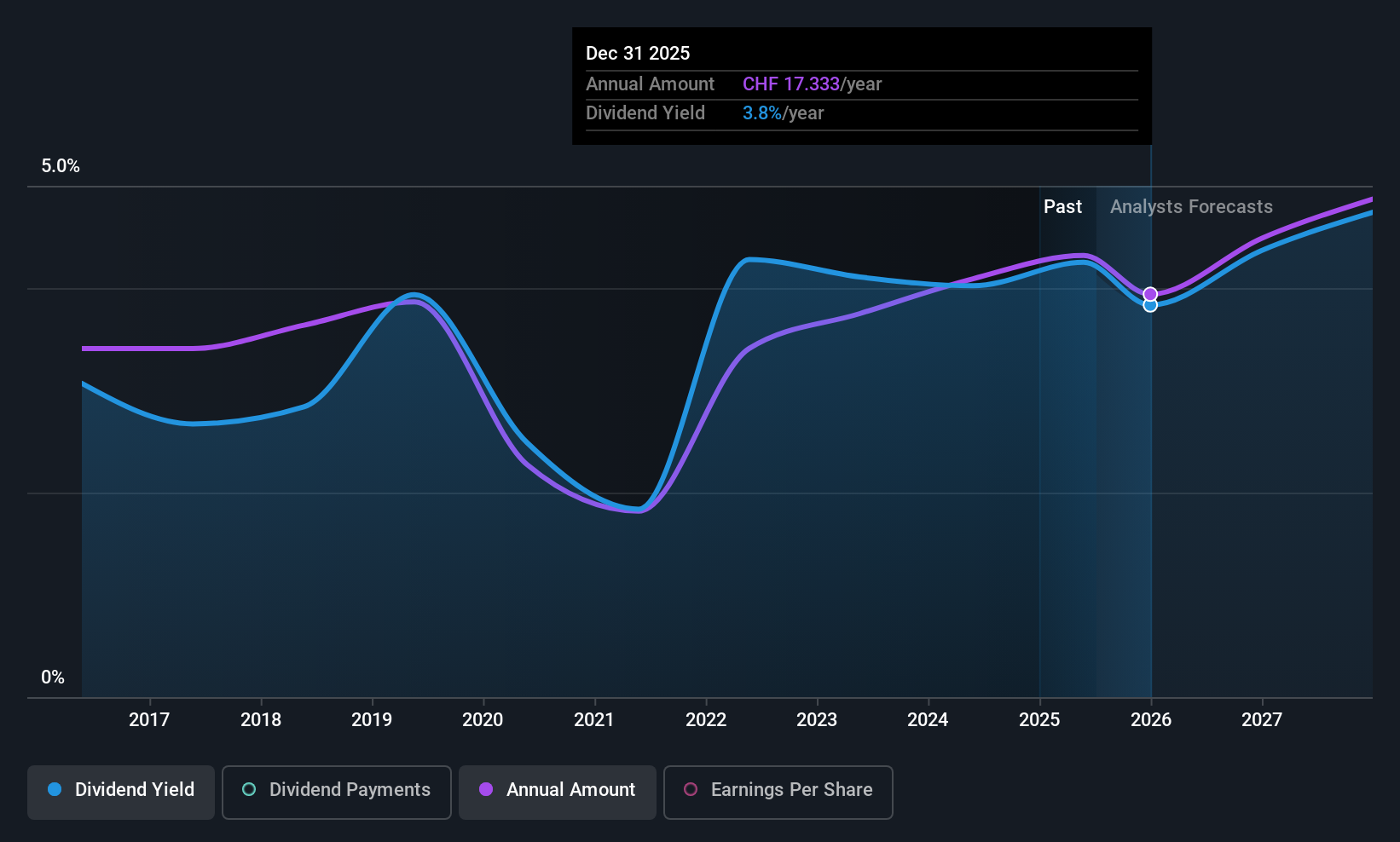

Dividend Yield: 4.3%

Phoenix Mecano's dividend yield of 4.27% is among the top 25% in Switzerland, but its sustainability is questionable due to a high cash payout ratio of 110.3%, indicating dividends aren't well-covered by free cash flows. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings showed a decline with net income at €13.9 million for H1 2025, down from €17.2 million the previous year, potentially impacting future payouts.

- Navigate through the intricacies of Phoenix Mecano with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Phoenix Mecano shares in the market.

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and sells chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses with a market cap of €655.49 million.

Operations: SAF-Holland SE's revenue is segmented into the Americas (€687.54 million), Asia/Pacific (APAC)/China/India (€221.08 million), and Europe, The Middle East, Africa (EMEA) (€847.17 million).

Dividend Yield: 5.9%

SAF-Holland's dividend yield of 5.89% ranks in the top 25% of German market payers, with coverage by both earnings and cash flows, evidenced by a payout ratio of 75.5% and a cash payout ratio of 35.4%. However, despite a decade-long increase in dividends, their reliability is undermined by volatility and an unstable track record. Additionally, profit margins have decreased from last year, which could affect future dividend sustainability amidst its high debt levels.

- Take a closer look at SAF-Holland's potential here in our dividend report.

- Our expertly prepared valuation report SAF-Holland implies its share price may be lower than expected.

Key Takeaways

- Reveal the 223 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives