- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Exploring Switzerland's Hidden Stock Gems In September 2024

Reviewed by Simply Wall St

The Switzerland market shrugged off early weakness and moved modestly higher on Friday, tracking positive global cues. Investors continued to cheer the Swiss National Bank's interest rate move, in addition to digesting U.S. personal consumption expenditure data. In this favorable economic climate, identifying undervalued stocks with strong fundamentals can offer promising opportunities for investors looking to capitalize on Switzerland's resilient market performance.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.21 billion.

Operations: The company generates revenue from three main regions: Americas (CHF352.67 million), Asia-Pacific (CHF273.16 million), and Europe, Middle East, and Africa (CHF452.85 million).

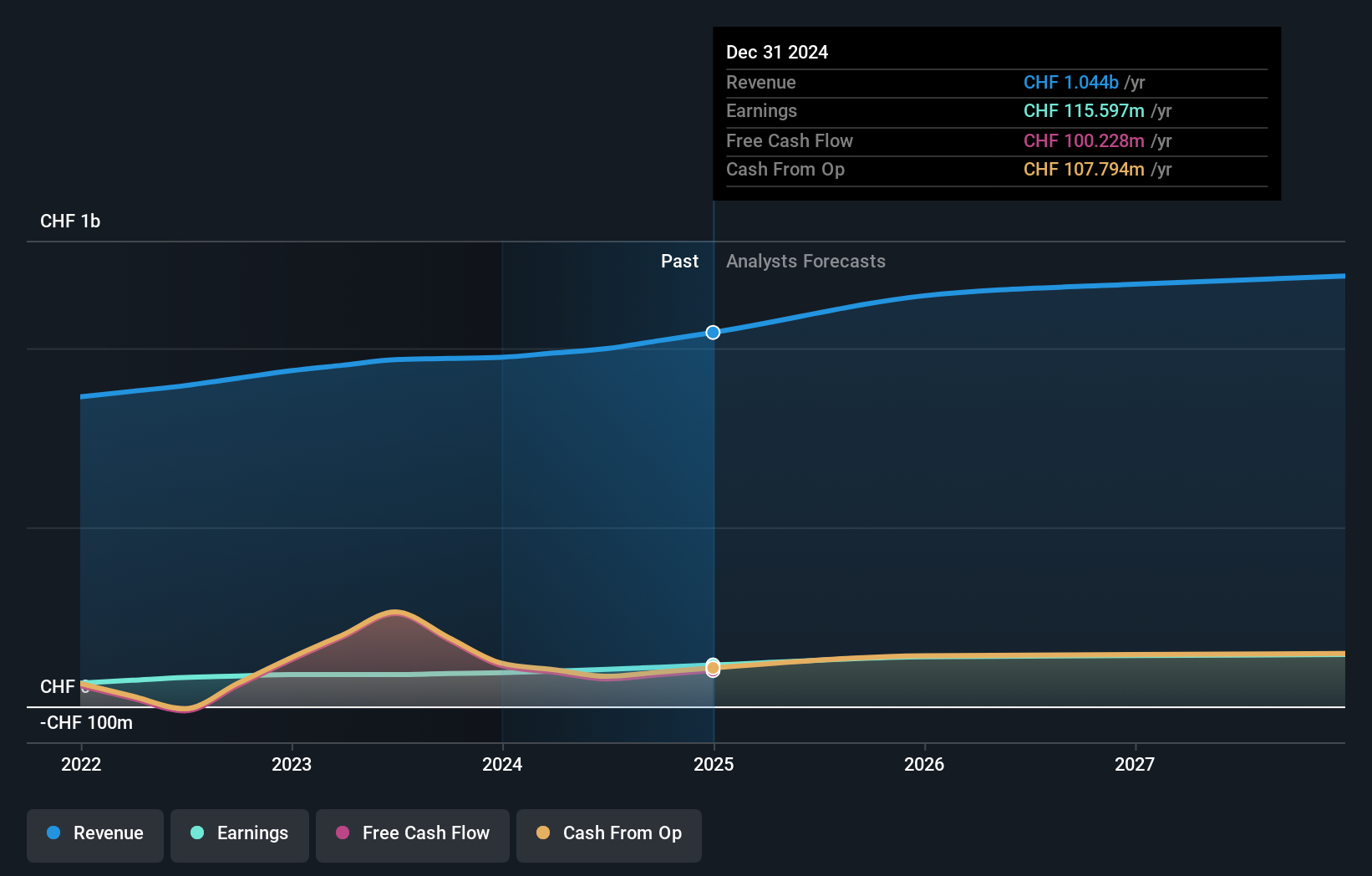

Earnings for Compagnie Financière Tradition grew by 16.1% over the past year, outperforming the Capital Markets industry at -12.1%. The company reported half-year revenue of CHF 538.34 million and net income of CHF 59.99 million, up from CHF 513.96 million and CHF 51.02 million respectively a year ago. Trading at 30% below its estimated fair value, CFT’s debt to equity ratio improved from 75% to 47% over five years while basic earnings per share rose to CHF 7.98 from CHF 6.86 last year.

Phoenix Mecano (SWX:PMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Phoenix Mecano AG, together with its subsidiaries, manufactures and sells components for industrial customers worldwide and has a market cap of CHF433.59 million.

Operations: Phoenix Mecano AG generates revenue primarily from three segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348 million).

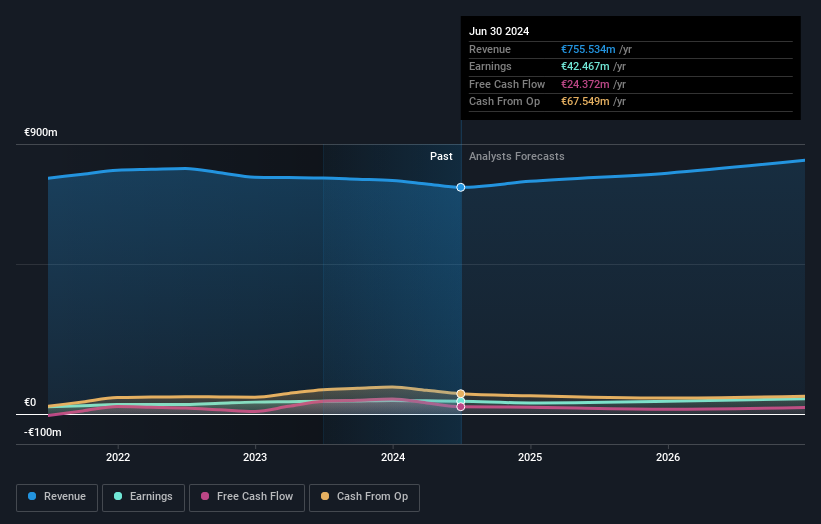

Phoenix Mecano, a Swiss industrial company, reported H1 2024 sales of €382.8M and net income of €17.2M, reflecting a slight dip from last year’s figures. Despite this, the firm shows strong financial health with an impressive debt reduction from 62.6% to 44.8% over five years and satisfactory net debt to equity ratio at 13.3%. Trading at a P/E ratio of 10.9x below the market average (22x), it offers good value relative to peers in its industry.

- Navigate through the intricacies of Phoenix Mecano with our comprehensive health report here.

Examine Phoenix Mecano's past performance report to understand how it has performed in the past.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.51 billion.

Operations: The company generates revenue primarily from its segments Tamedia (CHF427 million), Goldbach (CHF299.10 million), 20 Minutes (CHF115.60 million), TX Markets (CHF126.40 million), and Groups & Ventures (CHF159.40 million).

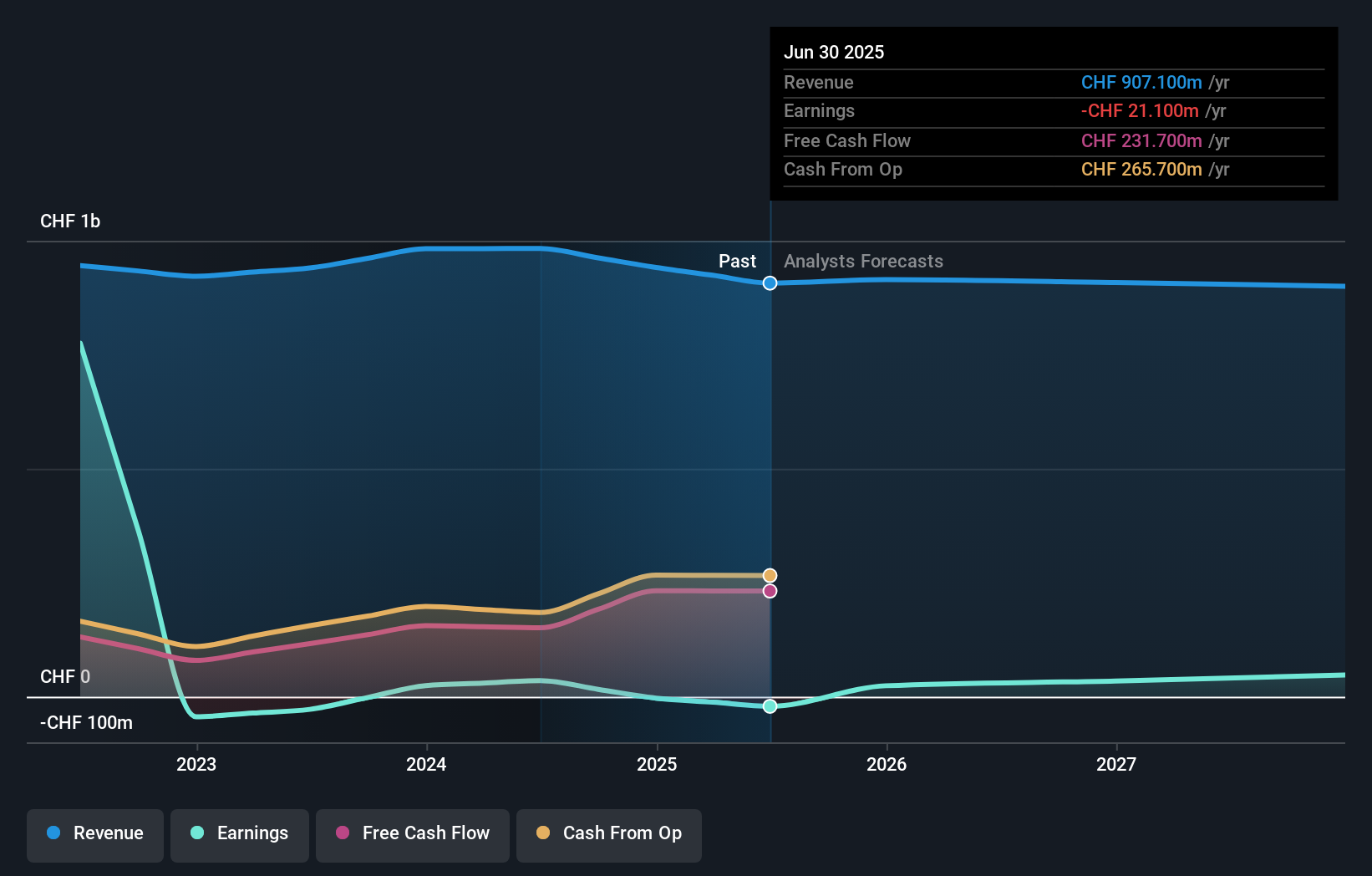

TX Group, a small cap media company in Switzerland, has demonstrated significant financial improvements. Over the past five years, its debt to equity ratio decreased from 4.4 to 0.9. Recently added to the S&P Global BMI Index, TXGN reported half-year sales of CHF 111M and net income of CHF 9.6M compared to a loss last year. Trading at 65% below estimated fair value and with earnings forecasted to grow annually by over 32%, it offers promising potential for growth.

- Get an in-depth perspective on TX Group's performance by reading our health report here.

Evaluate TX Group's historical performance by accessing our past performance report.

Taking Advantage

- Click this link to deep-dive into the 19 companies within our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.