- Switzerland

- /

- Real Estate

- /

- BRSE:SEGN

Top 3 Dividend Stocks On SIX Swiss Exchange Yielding Up To 5.1%

Reviewed by Simply Wall St

The Swiss market has shown resilience, moving modestly higher despite early weakness, as investors responded positively to the Swiss National Bank's interest rate decision and U.S. personal consumption expenditure data. With the SMI index ending with a gain of 0.2%, it's an opportune moment to explore dividend stocks on the SIX Swiss Exchange that offer attractive yields up to 5.1%. In such a stable economic environment, selecting dividend stocks with solid financial structures and consistent performance can be a prudent strategy for income-focused investors.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.03% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.73% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.77% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.35% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.03% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.97% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.32% | ★★★★★☆ |

Let's dive into some prime choices out of the screener.

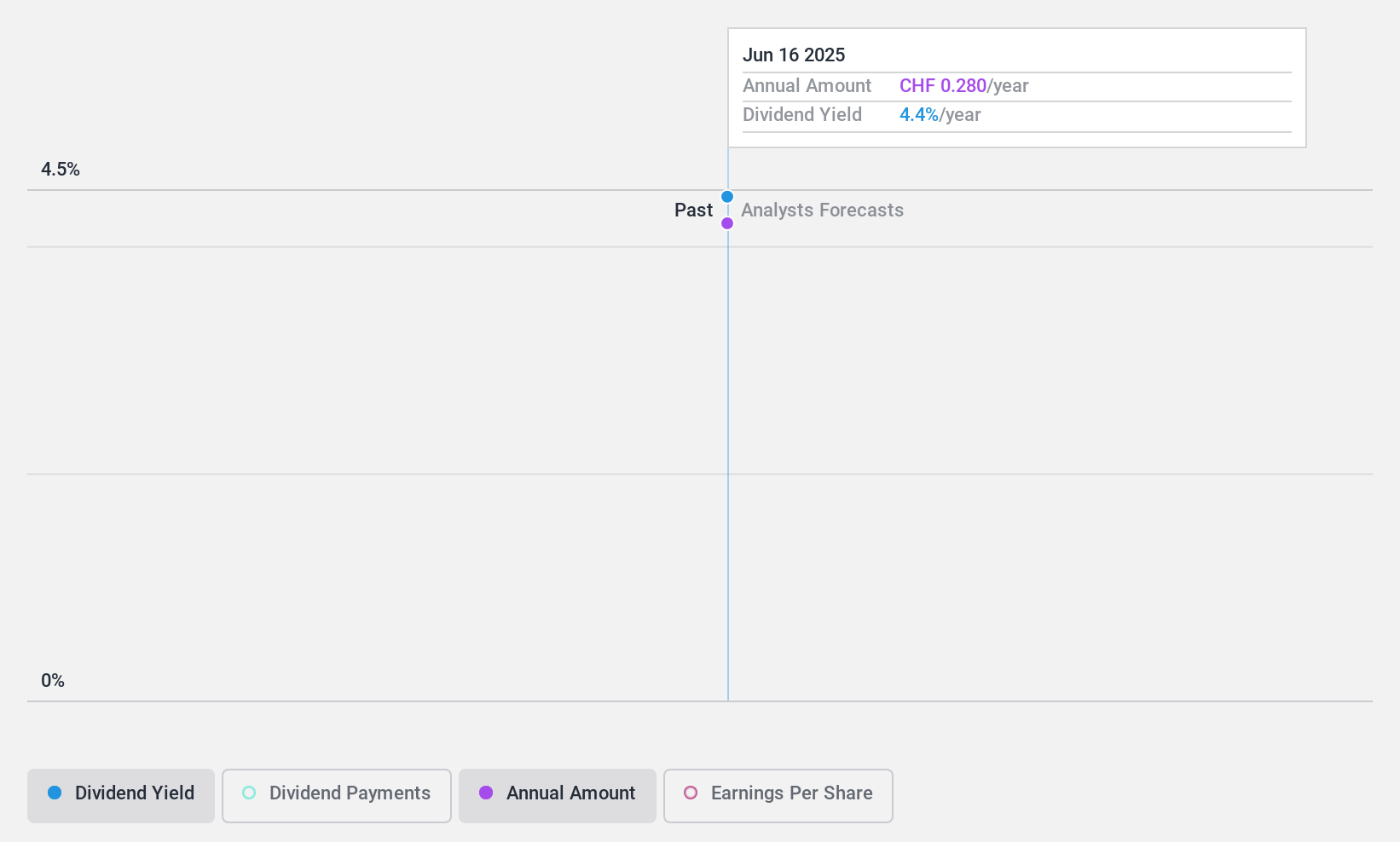

Procimmo Group (BRSE:SEGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Procimmo Group AG is a holding company that invests in, manages, and sells real estate properties in Switzerland, with a market cap of CHF175.68 million.

Operations: Procimmo Group AG generates revenue through investment, management, and sale of real estate properties in Switzerland.

Dividend Yield: 5.1%

Procimmo Group's dividend payments are well-covered by earnings (payout ratio: 63.3%) and cash flows (cash payout ratio: 51.8%). Despite a high level of debt and only five years of dividend history, the dividends have been stable and increasing. Recent earnings results show growth, with half-year net income rising to CHF 8.17 million from CHF 7.71 million, indicating robust financial health supporting future dividends. However, shares remain highly illiquid.

- Delve into the full analysis dividend report here for a deeper understanding of Procimmo Group.

- The valuation report we've compiled suggests that Procimmo Group's current price could be quite moderate.

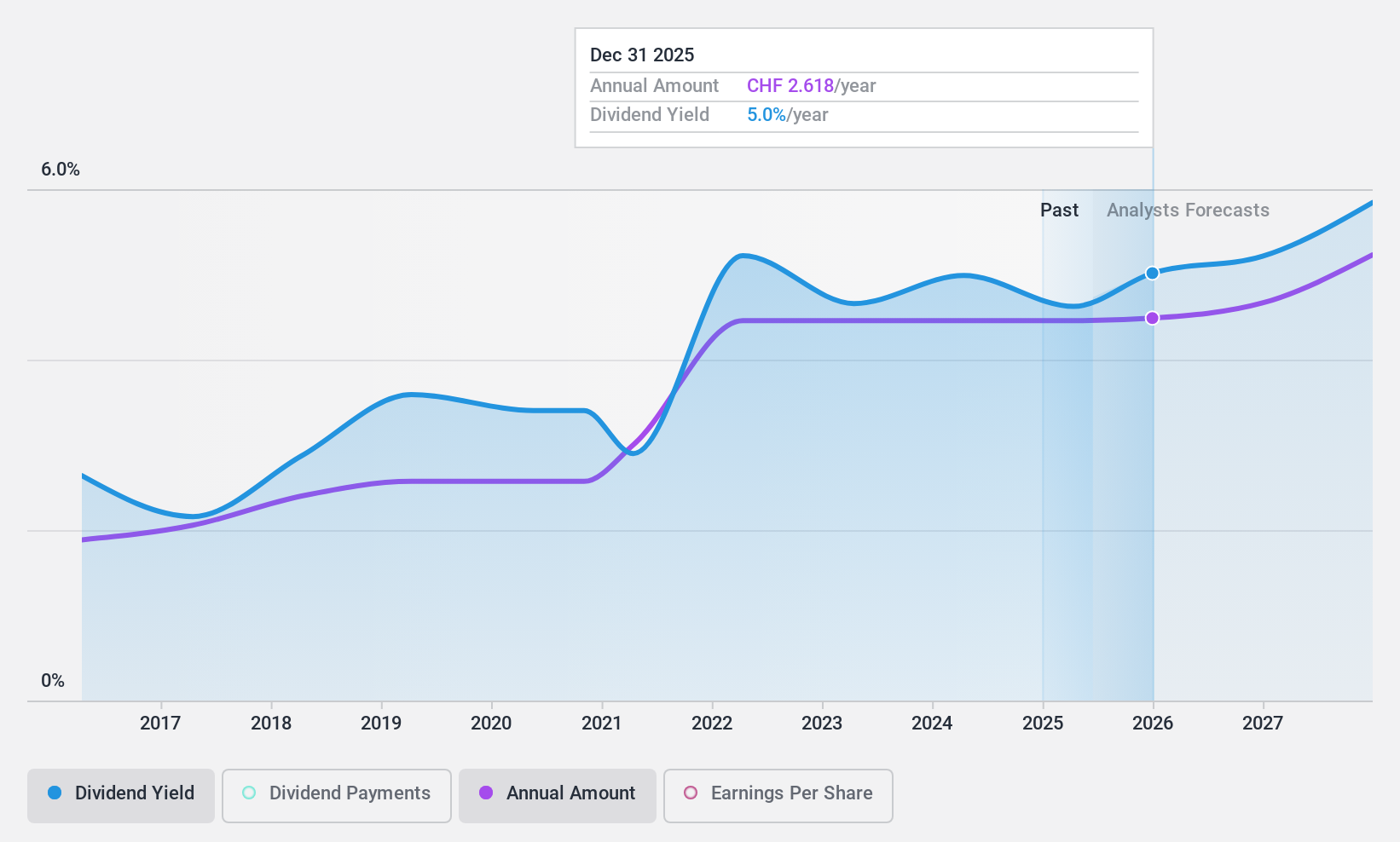

Julius Bär Gruppe (SWX:BAER)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG offers wealth management solutions across Switzerland, Europe, the Americas, Asia, and internationally with a market cap of CHF10.58 billion.

Operations: Julius Bär Gruppe AG generates CHF3.15 billion in revenue from its Private Banking segment.

Dividend Yield: 5%

Julius Bär Gruppe's dividends have been stable and growing over the past decade, but their high payout ratio (142.7%) indicates they are not well covered by earnings. Despite being in the top 25% of Swiss dividend payers, sustainability is a concern as current and near-future earnings do not cover payouts. Recent executive changes, including appointing Stefan Bollinger as CEO starting February 2025, may impact strategic direction and financial performance.

- Click here to discover the nuances of Julius Bär Gruppe with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Julius Bär Gruppe shares in the market.

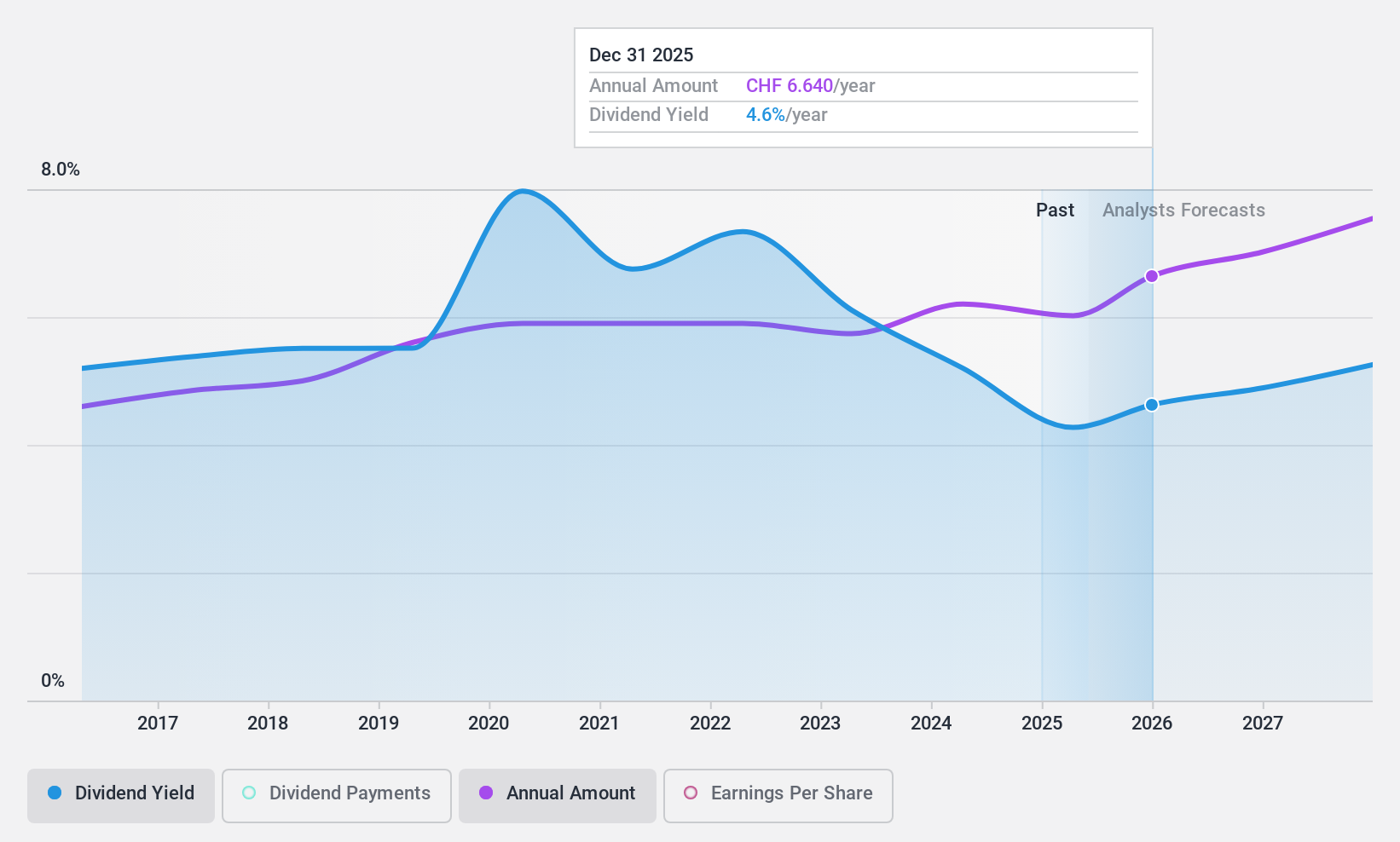

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF34.12 billion, offers wholesale reinsurance, insurance, risk transfer solutions, and related services globally.

Operations: Swiss Re AG's revenue segments include Property & Casualty Reinsurance ($25.39 billion), Life & Health Reinsurance ($18.71 billion), Corporate Solutions ($6.10 billion), and Group Items ($2.09 billion).

Dividend Yield: 4.9%

Swiss Re's dividend payments have been volatile over the past decade, with recent earnings growth of US$2.09 billion for H1 2024 compared to US$1.79 billion a year ago. Despite this volatility, the dividends are covered by earnings (payout ratio: 55.8%) and cash flows (cash payout ratio: 50%). The dividend yield is in the top 25% of Swiss market payers, though sustainability remains a concern due to its unstable track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Swiss Re.

- According our valuation report, there's an indication that Swiss Re's share price might be on the cheaper side.

Key Takeaways

- Get an in-depth perspective on all 27 Top SIX Swiss Exchange Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BRSE:SEGN

Procimmo Group

A holding company, engages in the investment, management, and sale of real estate properties in Switzerland.

Solid track record, good value and pays a dividend.