David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Mikron Holding AG (VTX:MIKN) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Mikron Holding

What Is Mikron Holding's Net Debt?

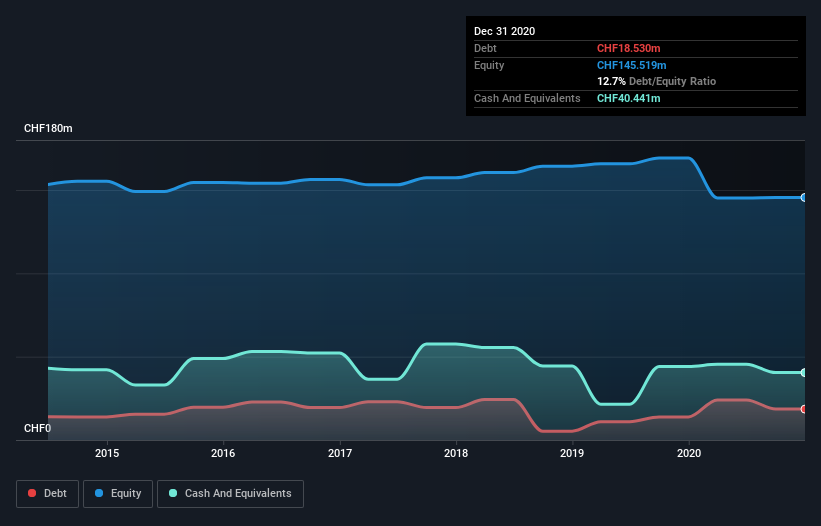

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Mikron Holding had CHF18.5m of debt, an increase on CHF13.8m, over one year. However, its balance sheet shows it holds CHF40.4m in cash, so it actually has CHF21.9m net cash.

How Strong Is Mikron Holding's Balance Sheet?

We can see from the most recent balance sheet that Mikron Holding had liabilities of CHF115.6m falling due within a year, and liabilities of CHF16.0m due beyond that. Offsetting these obligations, it had cash of CHF40.4m as well as receivables valued at CHF62.4m due within 12 months. So its liabilities total CHF28.8m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Mikron Holding is worth CHF104.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Mikron Holding also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Mikron Holding will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Mikron Holding had a loss before interest and tax, and actually shrunk its revenue by 21%, to CHF258m. To be frank that doesn't bode well.

So How Risky Is Mikron Holding?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Mikron Holding lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CHF6.2m of cash and made a loss of CHF22m. With only CHF21.9m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Mikron Holding is showing 1 warning sign in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Mikron Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:MIKN

Mikron Holding

Develops, produces, and markets automation solutions, machining systems, and cutting tools in the Switzerland, Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026