As global markets experience fluctuations with cooling inflation and strong bank earnings propelling U.S. stocks higher, investors are increasingly focused on identifying opportunities amidst these shifting conditions. In this environment, finding undervalued stocks can be a compelling strategy, as they may offer potential value when market sentiment is volatile and certain sectors outperform others.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.94 | TRY77.88 | 50% |

| Aidma Holdings (TSE:7373) | ¥1810.00 | ¥3616.14 | 49.9% |

| Tabuk Cement (SASE:3090) | SAR13.46 | SAR26.85 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.595 | £13.12 | 49.7% |

| World Fitness Services (TWSE:2762) | NT$92.60 | NT$183.67 | 49.6% |

| CYND (TSE:4256) | ¥1055.00 | ¥2100.49 | 49.8% |

| Mentice (OM:MNTC) | SEK25.10 | SEK49.91 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥14.00 | CN¥27.77 | 49.6% |

| Verra Mobility (NasdaqCM:VRRM) | US$26.08 | US$52.02 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.41 | 49.8% |

Here's a peek at a few of the choices from the screener.

ALK-Abelló (CPSE:ALK B)

Overview: ALK-Abelló A/S is an allergy solutions company operating in Europe, North America, and internationally, with a market cap of DKK33.55 billion.

Operations: The company's revenue primarily comes from its Allergy Treatment segment, which generated DKK5.38 billion.

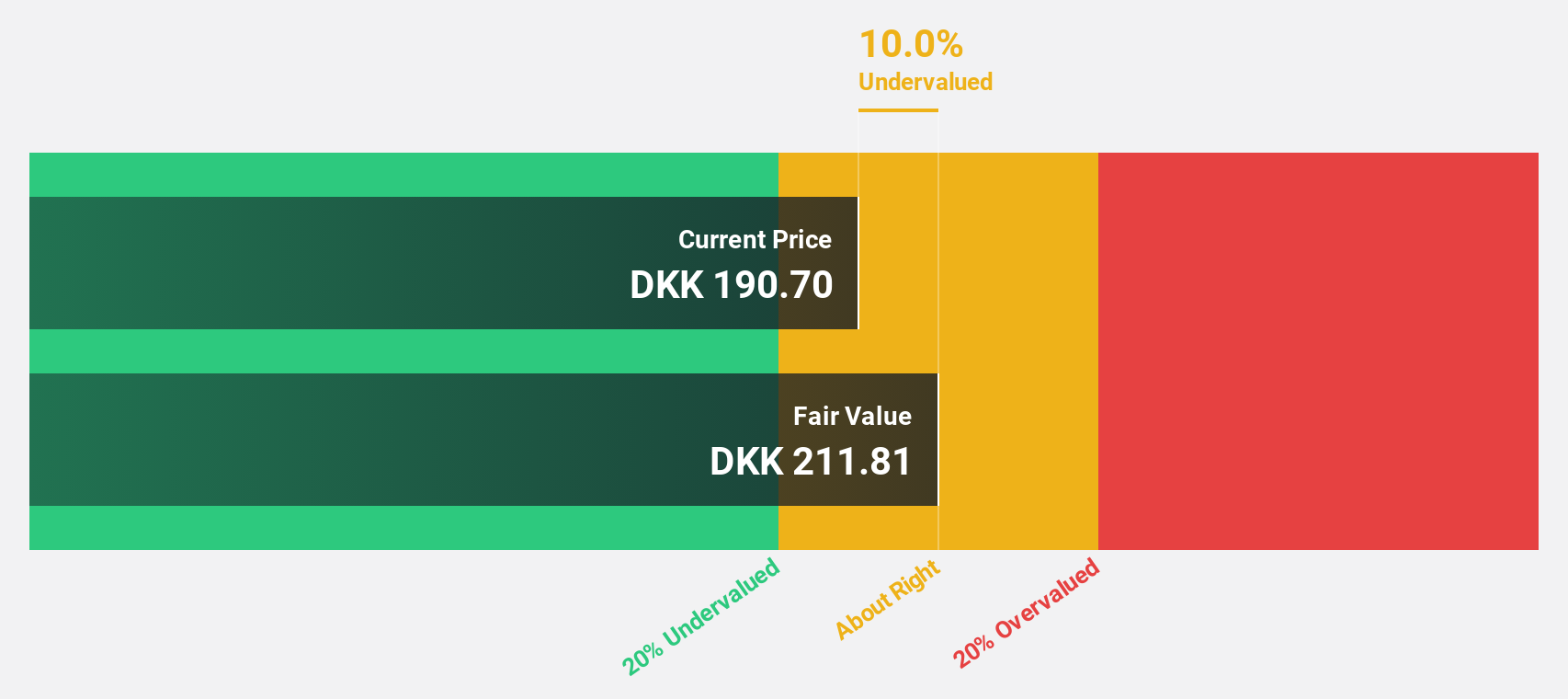

Estimated Discount To Fair Value: 26%

ALK-Abelló's stock appears undervalued based on cash flow analysis, trading at DKK151.7, which is significantly below its estimated fair value of DKK204.93. Recent earnings reports show substantial growth, with net income rising to DKK645 million for the first nine months of 2024 from DKK346 million a year ago. The company's revenue is projected to grow faster than the Danish market, supported by successful product developments and regulatory approvals in Europe for its allergy treatments.

- Our earnings growth report unveils the potential for significant increases in ALK-Abelló's future results.

- Get an in-depth perspective on ALK-Abelló's balance sheet by reading our health report here.

Metsä Board Oyj (HLSE:METSB)

Overview: Metsä Board Oyj operates globally in the folding boxboard, fresh fibre linerboard, and market pulp sectors, with a market capitalization of €1.69 billion.

Operations: The company's revenue from its folding boxboard, fresh fibre linerboard, and market pulp businesses amounts to €1.92 billion.

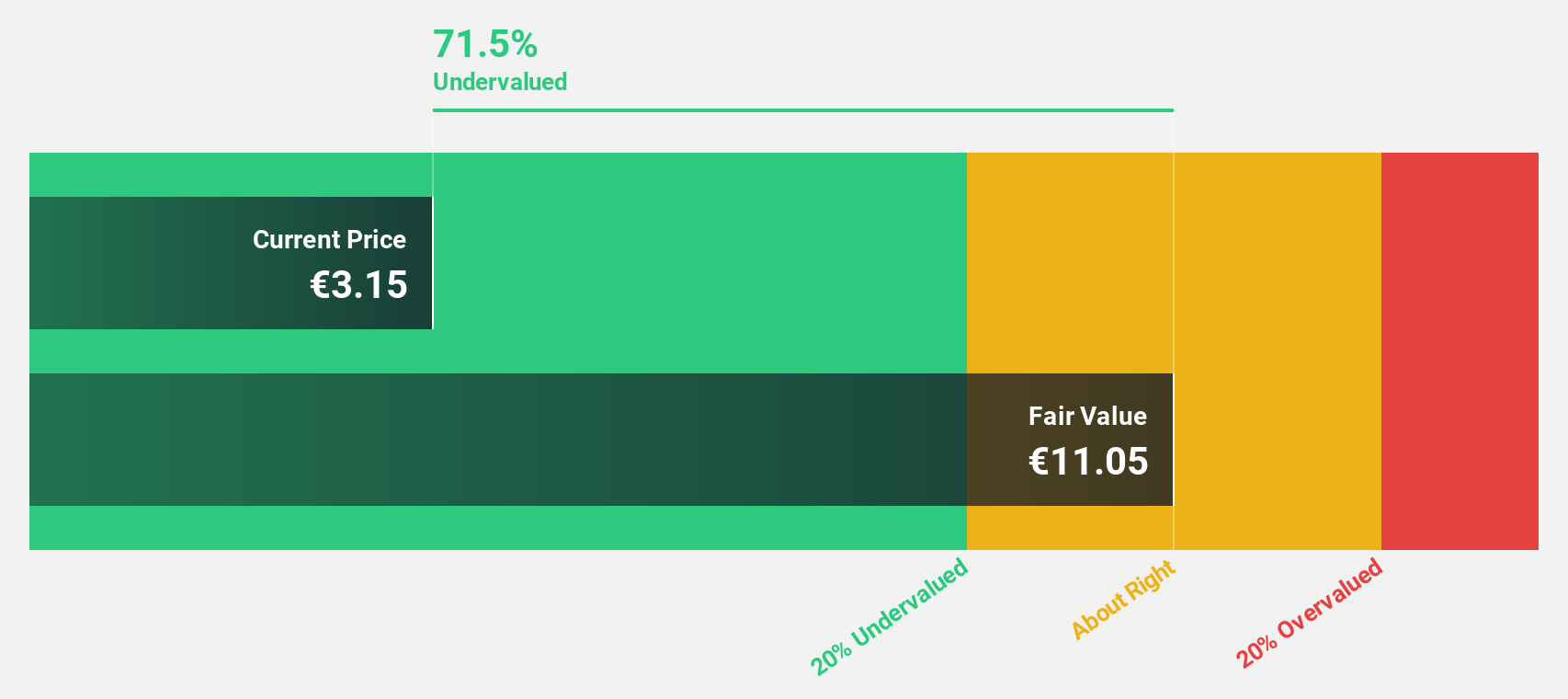

Estimated Discount To Fair Value: 35%

Metsä Board Oyj is trading at €4.57, significantly below its estimated fair value of €7.03, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity of 11.3% in three years, earnings are expected to grow significantly at 52.5% per year, outpacing the Finnish market's growth rate of 14.7%. Recent operational changes include downsizing initiatives aimed at enhancing profitability and efficiency amidst fluctuating profit margins and dividend sustainability challenges.

- Insights from our recent growth report point to a promising forecast for Metsä Board Oyj's business outlook.

- Unlock comprehensive insights into our analysis of Metsä Board Oyj stock in this financial health report.

Komax Holding (SWX:KOMN)

Overview: Komax Holding AG, with a market cap of CHF695.99 million, operates in the automated wire processing industry through its subsidiaries.

Operations: The company generates revenue of CHF663.72 million from its wire processing segment.

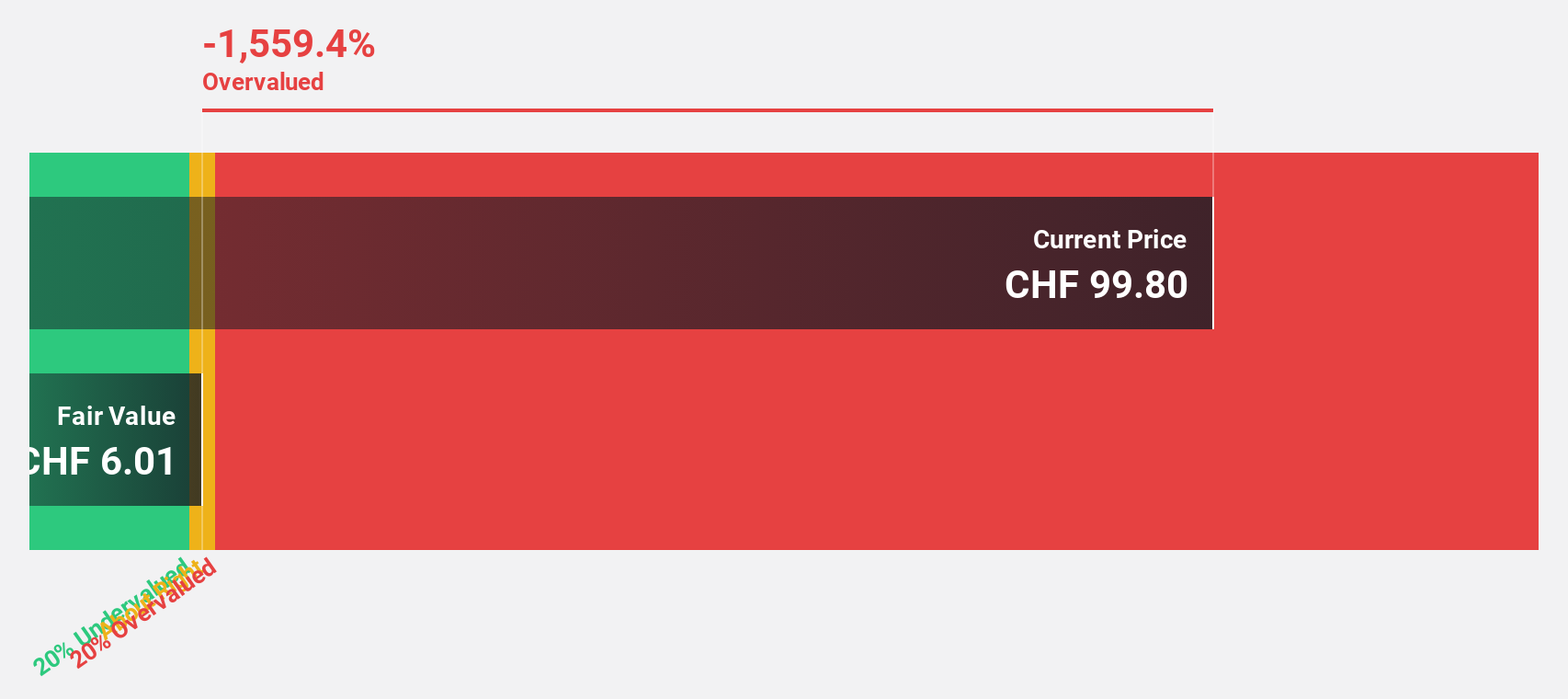

Estimated Discount To Fair Value: 44%

Komax Holding is trading at CHF136, which is 44% below its estimated fair value of CHF242.81, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 53.13% annually, outpacing the Swiss market's growth rate of 11.2%. However, profit margins have declined to 0.9%, and dividend coverage remains weak at 2.21%. The share price has been highly volatile recently, and one-off items have impacted financial results.

- Upon reviewing our latest growth report, Komax Holding's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Komax Holding.

Next Steps

- Explore the 878 names from our Undervalued Stocks Based On Cash Flows screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ALK B

ALK-Abelló

Operates as an allergy solutions company in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives