- Switzerland

- /

- Electrical

- /

- SWX:GAV

Carlo Gavazzi Holding's(VTX:GAV) Share Price Is Down 48% Over The Past Three Years.

While it may not be enough for some shareholders, we think it is good to see the Carlo Gavazzi Holding AG (VTX:GAV) share price up 19% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 48% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Carlo Gavazzi Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

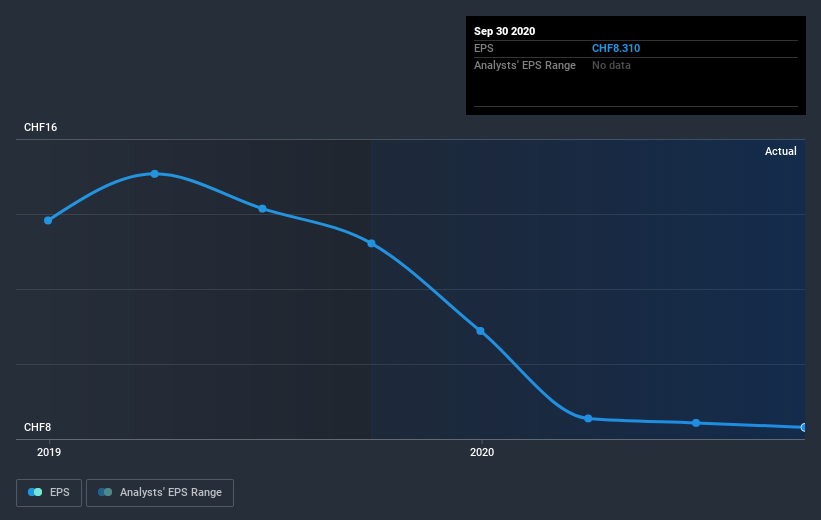

Carlo Gavazzi Holding saw its EPS decline at a compound rate of 19% per year, over the last three years. The 20% average annual share price decline is remarkably close to the EPS decline. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Carlo Gavazzi Holding's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Carlo Gavazzi Holding shareholders, and that cash payout explains why its total shareholder loss of 44%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 4.5% in the last year, Carlo Gavazzi Holding shareholders lost 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 0.2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Carlo Gavazzi Holding better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Carlo Gavazzi Holding (of which 1 is significant!) you should know about.

But note: Carlo Gavazzi Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you decide to trade Carlo Gavazzi Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:GAV

Carlo Gavazzi Holding

Designs, manufactures, and sells electronic control components for building and industrial automation markets.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives