- Switzerland

- /

- Building

- /

- SWX:FORN

Forbo Holding (VTX:FORN) sheds CHF55m, company earnings and investor returns have been trending downwards for past five years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. So we wouldn't blame long term Forbo Holding AG (VTX:FORN) shareholders for doubting their decision to hold, with the stock down 54% over a half decade.

After losing 5.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

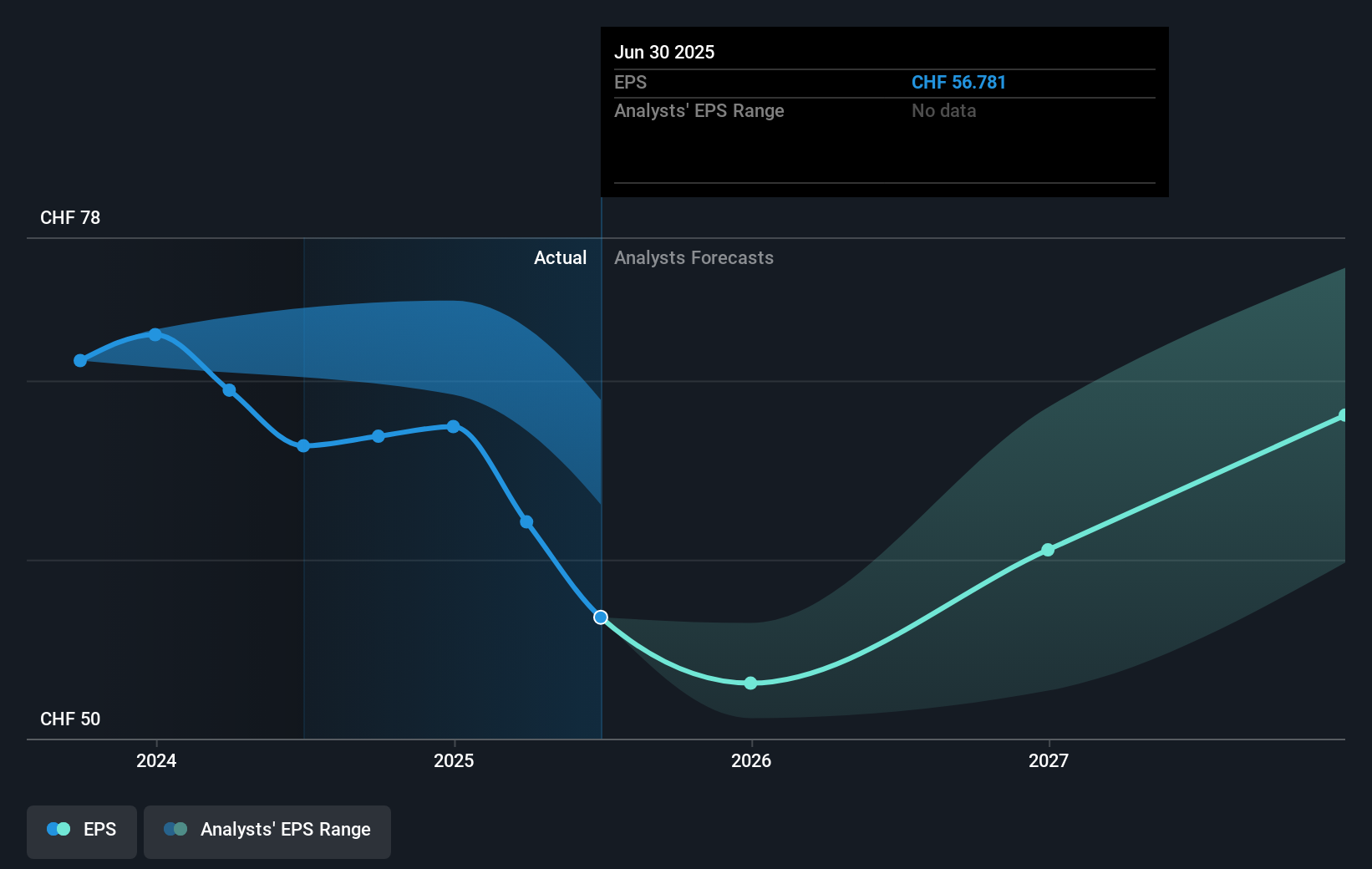

During the five years over which the share price declined, Forbo Holding's earnings per share (EPS) dropped by 3.5% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 14% per year, over the period. This implies that the market was previously too optimistic about the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Forbo Holding's key metrics by checking this interactive graph of Forbo Holding's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Forbo Holding, it has a TSR of -49% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Investors in Forbo Holding had a tough year, with a total loss of 12% (including dividends), against a market gain of about 8.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Keeping this in mind, a solid next step might be to take a look at Forbo Holding's dividend track record. This free interactive graph is a great place to start.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:FORN

Forbo Holding

Engages in the production and sale floor coverings, building and construction adhesives, and power transmission and conveyor technology worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives