- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

European Value Stocks That May Be Trading Below Estimated Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, the European stock market has shown mixed results, with the pan-European STOXX Europe 600 Index remaining relatively flat as investors closely monitor developments in U.S. and European trade talks. Amidst these uncertainties, identifying stocks that may be trading below their estimated intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.53 | €6.95 | 49.2% |

| Surgical Science Sweden (OM:SUS) | SEK148.40 | SEK294.49 | 49.6% |

| RVRC Holding (OM:RVRC) | SEK45.68 | SEK90.96 | 49.8% |

| InPost (ENXTAM:INPST) | €12.82 | €25.24 | 49.2% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.90 | 49.3% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.74 | €5.40 | 49.2% |

| Green Oleo (BIT:GRN) | €0.79 | €1.57 | 49.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.42 | €6.75 | 49.3% |

| ATON Green Storage (BIT:ATON) | €2.13 | €4.22 | 49.5% |

| Atea (OB:ATEA) | NOK143.00 | NOK284.22 | 49.7% |

Let's uncover some gems from our specialized screener.

Dynavox Group (OM:DYVOX)

Overview: Dynavox Group AB (publ) specializes in developing and selling assistive technology products for individuals with impaired communication skills, with a market capitalization of approximately SEK13.12 billion.

Operations: Dynavox Group AB generates revenue through the development and sale of assistive technology products designed for individuals with communication impairments.

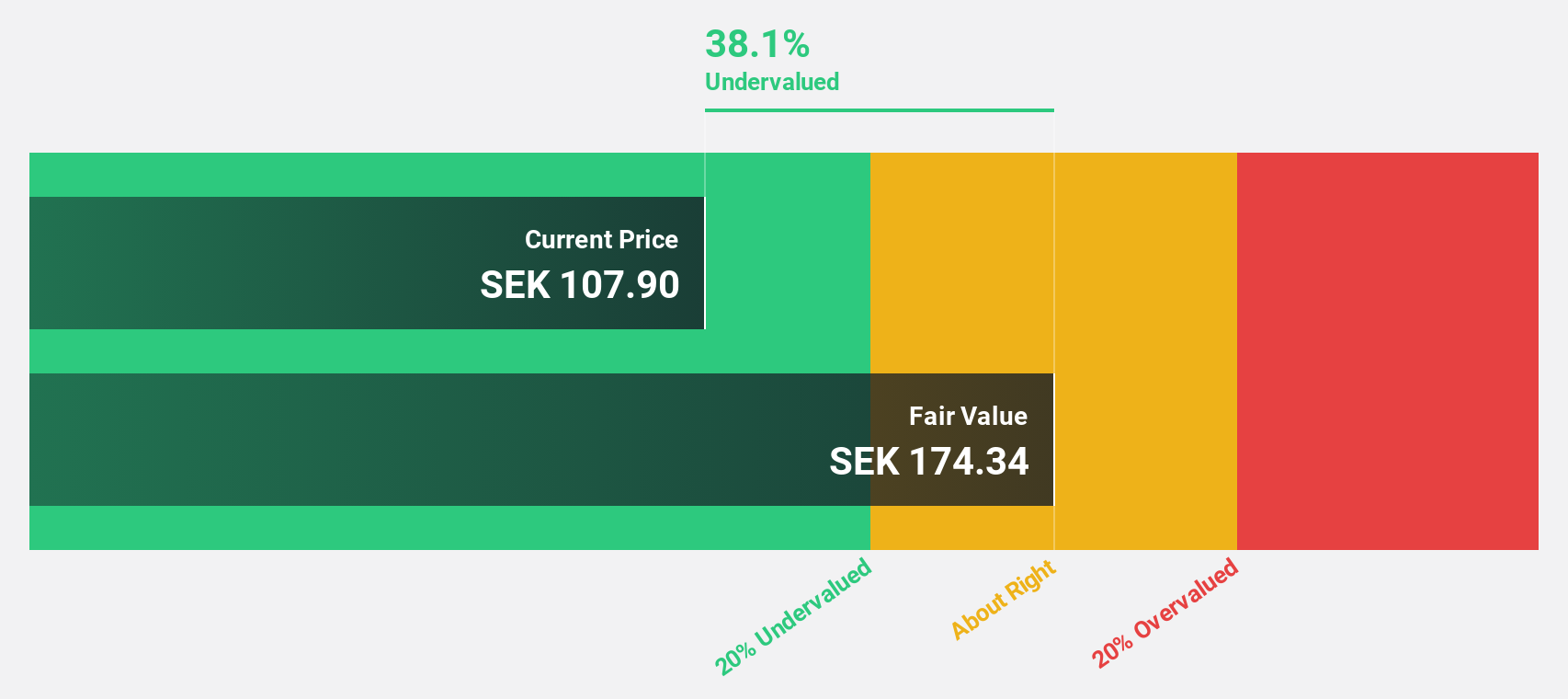

Estimated Discount To Fair Value: 37.4%

Dynavox Group, trading at SEK122.8, is significantly undervalued compared to its estimated fair value of SEK196.07. Despite recent volatility and high debt levels, its earnings are projected to grow 48.7% annually over the next three years, outpacing the Swedish market's growth rate of 16.8%. Recent earnings reports show steady revenue increases but a slight dip in net income for Q2 2025 compared to last year, reflecting mixed financial performance amidst robust future growth prospects.

- Our expertly prepared growth report on Dynavox Group implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Dynavox Group.

Montana Aerospace (SWX:AERO)

Overview: Montana Aerospace AG designs, develops, and manufactures system components and complex assemblies globally, with a market cap of CHF1.68 billion.

Operations: The company's revenue is primarily derived from its Aerostructures segment at €829.17 million and its Energy segment at €665.38 million.

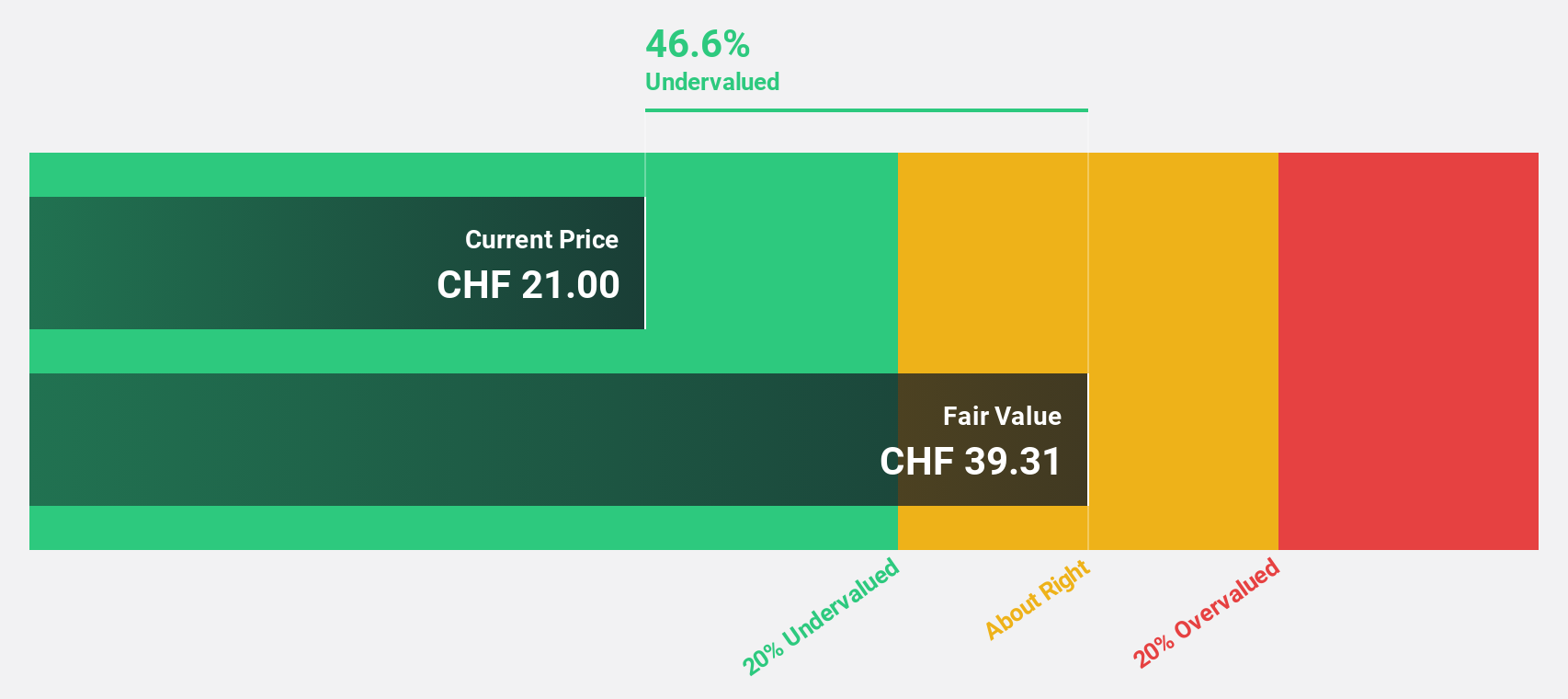

Estimated Discount To Fair Value: 30.7%

Montana Aerospace, trading at CHF27.05, is significantly undervalued compared to its estimated fair value of CHF39.03. Despite recent share price volatility, the company reported strong Q1 2025 results with sales of €410.86 million and net income growth to €5.27 million year-on-year. Earnings are expected to grow substantially at 42% annually over the next three years, surpassing Swiss market averages, although revenue growth remains moderate at 5.8% per year amidst low projected return on equity.

- Our comprehensive growth report raises the possibility that Montana Aerospace is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Montana Aerospace's balance sheet health report.

Dätwyler Holding (SWX:DAE)

Overview: Dätwyler Holding AG produces and sells elastomer components for various industries including healthcare, mobility, connectors, general, and food and beverage sectors across Europe, North America, South America, Australia, and Asia with a market cap of CHF2.50 billion.

Operations: The company's revenue is derived from the production and sale of elastomer components for industries such as healthcare, mobility, connectors, general applications, and food and beverage across multiple continents including Europe, North America, South America, Australia, and Asia.

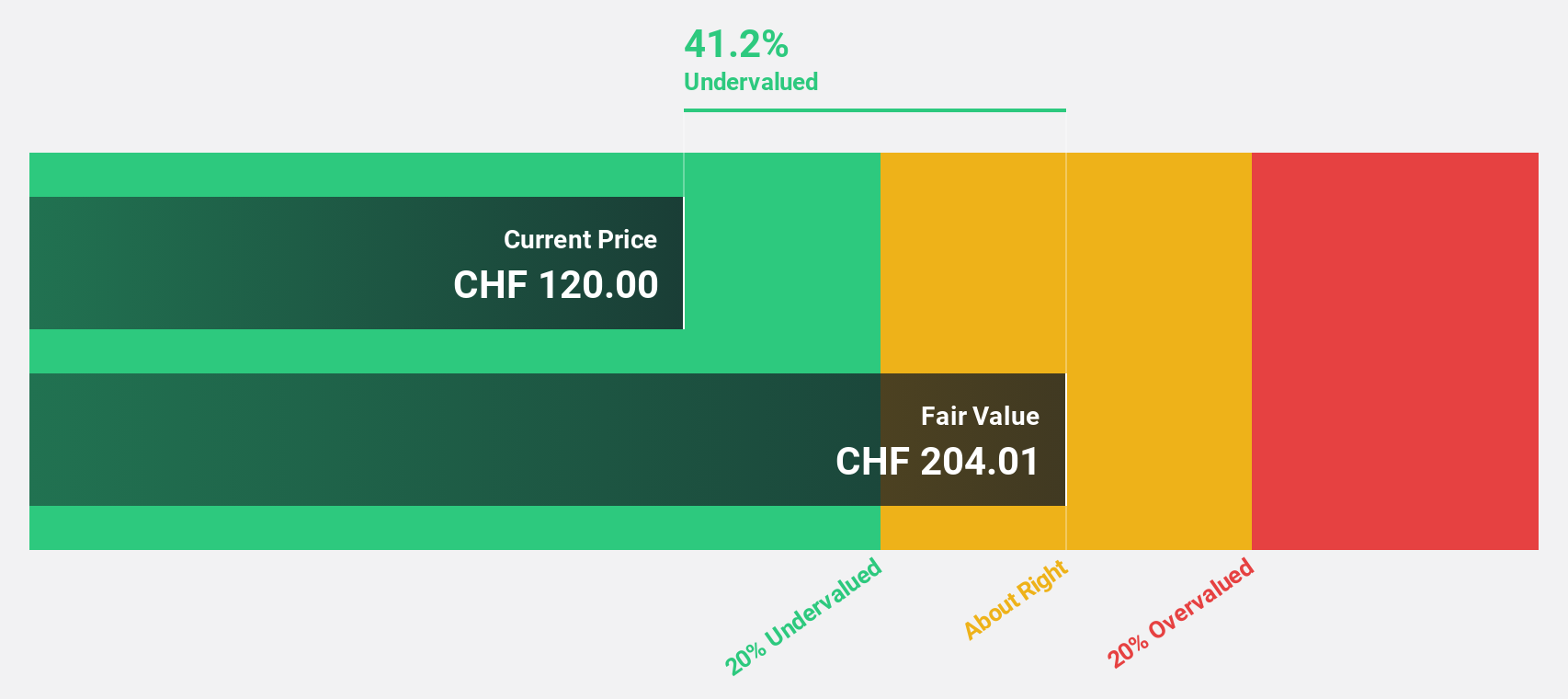

Estimated Discount To Fair Value: 31.5%

Dätwyler Holding is trading at CHF147, well below its estimated fair value of CHF214.48, indicating significant undervaluation. Despite a volatile share price and high debt levels, the company forecasts robust earnings growth of 37.7% annually over the next three years, outpacing Swiss market averages. Recent half-year results show stable performance with sales at CHF563 million and net income slightly down to CHF37.9 million compared to last year’s figures.

- Insights from our recent growth report point to a promising forecast for Dätwyler Holding's business outlook.

- Click here to discover the nuances of Dätwyler Holding with our detailed financial health report.

Where To Now?

- Click this link to deep-dive into the 177 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for customers with impaired communication skills.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives