- Switzerland

- /

- Machinery

- /

- SWX:DAE

3 Swiss Stocks On SIX Swiss Exchange Trading At Up To 30.6% Below Intrinsic Value

Reviewed by Simply Wall St

The Switzerland stock market closed on a firm note on Thursday, tracking gains in global markets after the Federal Reserve's decision to cut interest rates by 50 points. Despite a below-average economic growth forecast for this year, the Swiss market showed resilience with notable gains in key stocks. In this environment, identifying undervalued stocks can be particularly rewarding for investors seeking opportunities amidst fluctuating economic conditions. Here are three Swiss stocks on the SIX Swiss Exchange trading at up to 30.6% below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF308.80 | CHF569.43 | 45.8% |

| LEM Holding (SWX:LEHN) | CHF1364.00 | CHF1835.68 | 25.7% |

| ALSO Holding (SWX:ALSN) | CHF268.00 | CHF416.30 | 35.6% |

| Georg Fischer (SWX:GF) | CHF64.95 | CHF113.27 | 42.7% |

| Barry Callebaut (SWX:BARN) | CHF1520.00 | CHF2370.57 | 35.9% |

| lastminute.com (SWX:LMN) | CHF19.50 | CHF29.68 | 34.3% |

| Clariant (SWX:CLN) | CHF12.25 | CHF21.46 | 42.9% |

| Comet Holding (SWX:COTN) | CHF320.50 | CHF530.99 | 39.6% |

| SGS (SWX:SGSN) | CHF94.42 | CHF144.59 | 34.7% |

| Dätwyler Holding (SWX:DAE) | CHF174.40 | CHF251.46 | 30.6% |

We're going to check out a few of the best picks from our screener tool.

Dätwyler Holding (SWX:DAE)

Overview: Dätwyler Holding AG produces and sells elastomer components for various industries including health care, mobility, connectors, general, and food and beverage across Europe, North America, South America, Australia, and Asia with a market cap of CHF2.96 billion.

Operations: The company's revenue segments include Healthcare Solutions at CHF445.90 million and Industrial Solutions at CHF679.80 million.

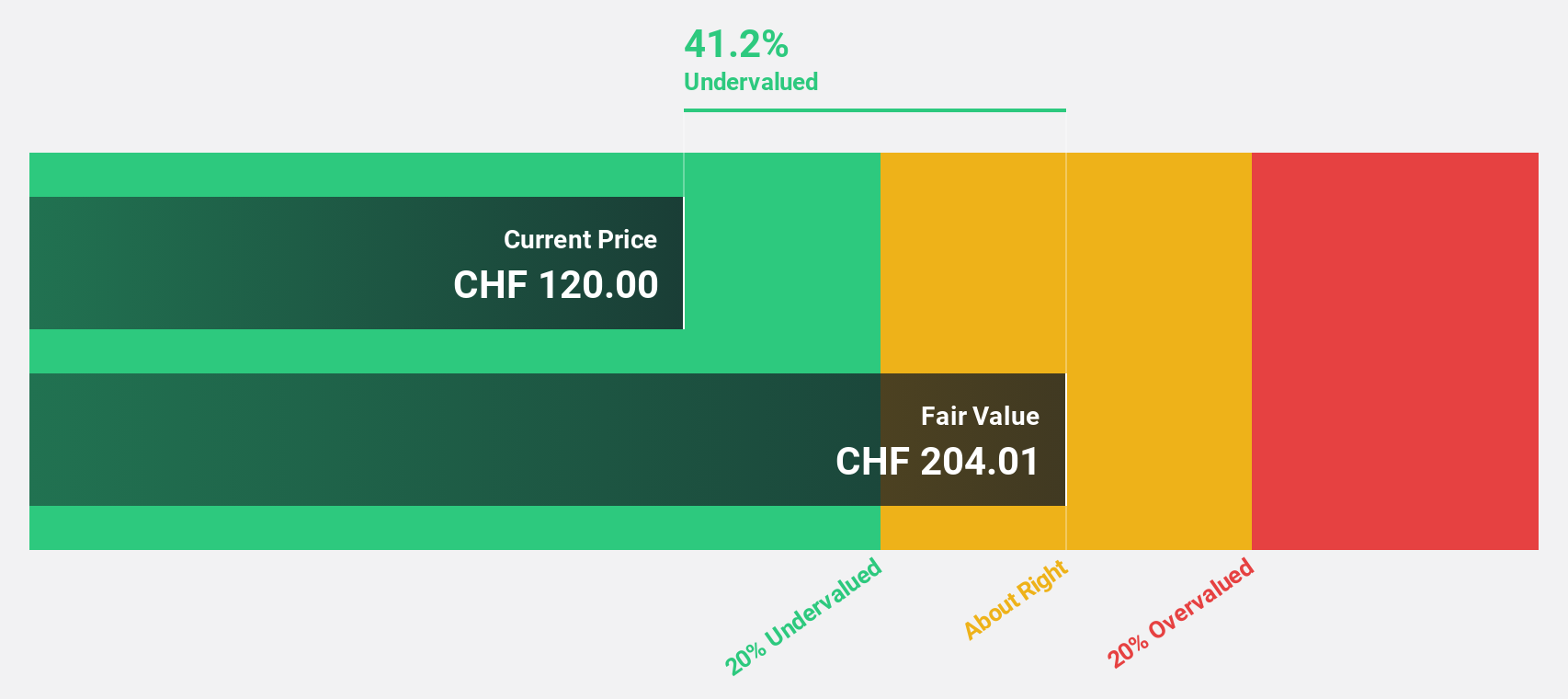

Estimated Discount To Fair Value: 30.6%

Dätwyler Holding AG is trading at CHF 174.4, significantly below its estimated fair value of CHF 251.46, indicating a potential undervaluation based on cash flows. Despite a slight dip in half-year sales to CHF 572.5 million from CHF 602.7 million, net income increased to CHF 38.6 million from CHF 32.1 million last year, reflecting improved profitability with basic earnings per share rising to CHF 2.27 from CHF 1.89. Earnings are forecasted to grow significantly at an annual rate of over 20%, outpacing the Swiss market's growth rate and suggesting strong future performance despite high debt levels and slower revenue growth projections (5.7% annually).

- Upon reviewing our latest growth report, Dätwyler Holding's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Dätwyler Holding with our detailed financial health report.

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF12.51 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland and internationally.

Operations: The company's revenue segments include Valves at CHF783.51 million and Global Service at CHF163.83 million.

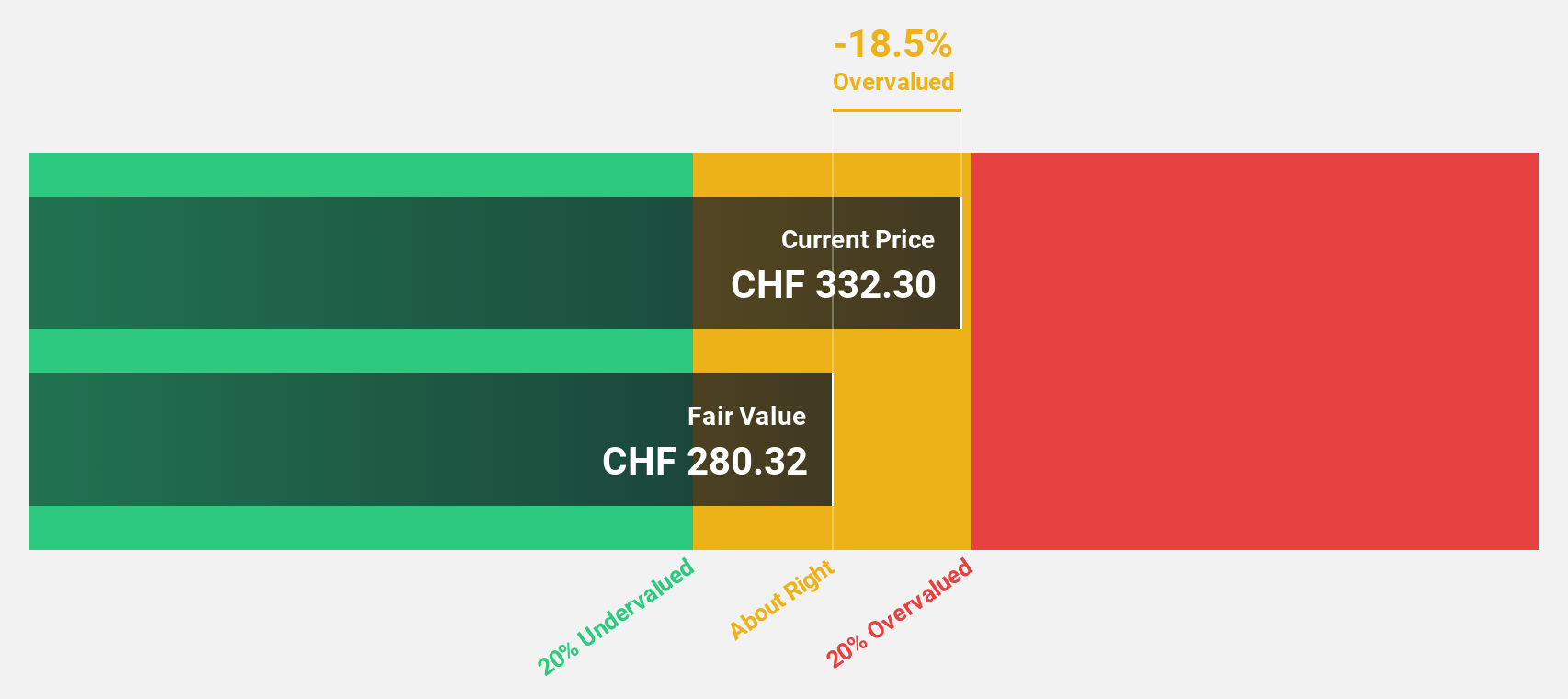

Estimated Discount To Fair Value: 25.3%

VAT Group AG is trading at CHF 417.3, significantly below its estimated fair value of CHF 558.38, indicating potential undervaluation based on cash flows. Despite a slight dip in half-year sales to CHF 449.61 million from CHF 453.75 million, net income rose to CHF 94 million from CHF 84.2 million last year, with basic earnings per share increasing to CHF 3.14 from CHF 2.81. Earnings are forecasted to grow at an annual rate of over 20%, outpacing the Swiss market's growth rate and suggesting strong future performance despite recent share price volatility.

- In light of our recent growth report, it seems possible that VAT Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of VAT Group.

Zehnder Group (SWX:ZEHN)

Overview: Zehnder Group AG, with a market cap of CHF579.37 million, develops, manufactures, and sells indoor climate systems in Europe, North America, and China.

Operations: The company's revenue segments are comprised of €299.90 million from Radiators and €399.90 million from Ventilation.

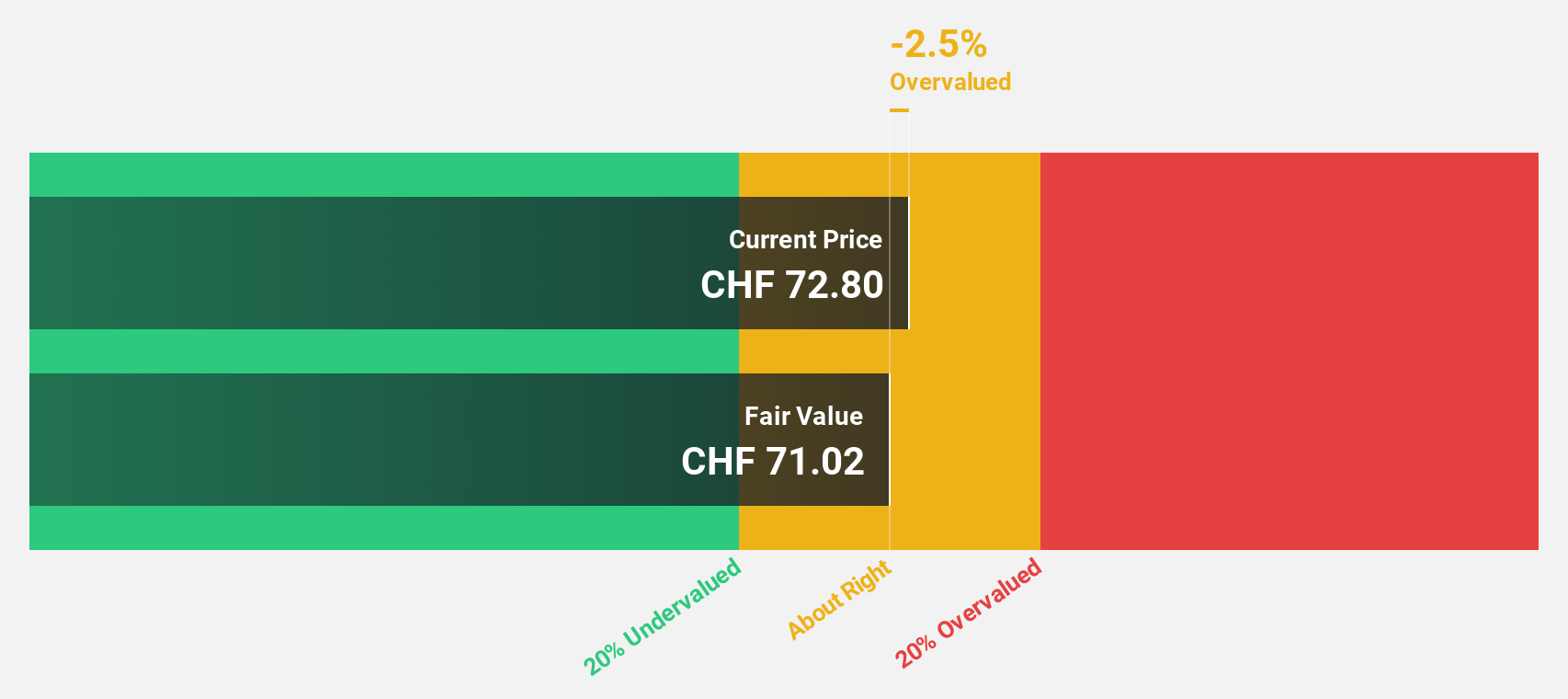

Estimated Discount To Fair Value: 11.7%

Zehnder Group is trading at CHF 53.1, slightly below its estimated fair value of CHF 60.15, indicating modest undervaluation based on cash flows. Despite a drop in half-year sales to EUR 346.1 million from EUR 408.4 million and net income falling to EUR 6.6 million from EUR 27 million, earnings are forecasted to grow significantly at an annual rate of over 32%, outpacing the Swiss market's growth rate and suggesting strong future performance potential despite recent financial setbacks.

- Our expertly prepared growth report on Zehnder Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Zehnder Group here with our thorough financial health report.

Key Takeaways

- Unlock our comprehensive list of 15 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DAE

Dätwyler Holding

Engages in the production and sale of elastomer components for healthcare, mobility, connectors, general, and food and beverage industries in Europe, North America, South America, Australia, and Asia.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives