- Switzerland

- /

- Machinery

- /

- SWX:BYS

Will Weakness in Bystronic AG's (VTX:BYS) Stock Prove Temporary Given Strong Fundamentals?

With its stock down 3.5% over the past week, it is easy to disregard Bystronic (VTX:BYS). However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. In this article, we decided to focus on Bystronic's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Bystronic

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bystronic is:

9.2% = CHF74m ÷ CHF804m (Based on the trailing twelve months to June 2021).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every CHF1 worth of equity, the company was able to earn CHF0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Bystronic's Earnings Growth And 9.2% ROE

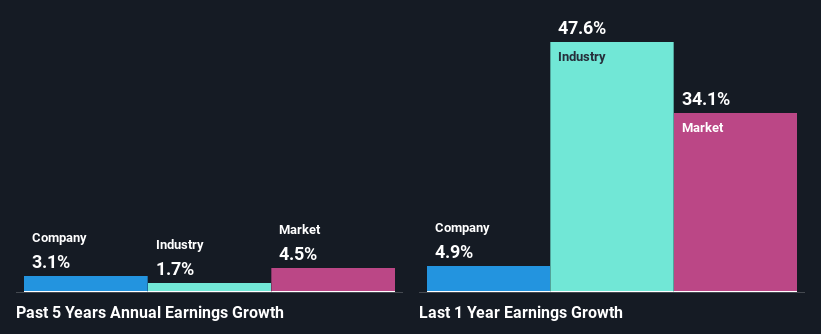

To start with, Bystronic's ROE looks acceptable. Even so, when compared with the average industry ROE of 12%, we aren't very excited. Additionally, the low net income growth of 3.1% seen by Bystronic over the past five years doesn't paint a very bright picture. Bear in mind, the company does have a respectable level of ROE. It is just that the industry ROE is higher. Hence there might be some other aspects that are keeping growth in earnings low. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

We then compared Bystronic's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 1.7% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Bystronic's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Bystronic Efficiently Re-investing Its Profits?

While Bystronic has a decent three-year median payout ratio of 37% (or a retention ratio of 63%), it has seen very little growth in earnings. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Additionally, Bystronic has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 43%. However, Bystronic's ROE is predicted to rise to 12% despite there being no anticipated change in its payout ratio.

Summary

In total, we are pretty happy with Bystronic's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bystronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:BYS

Bystronic

Through its subsidiaries, engages in the provision of sheet metal processing solutions for cutting, bending, and automation worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion