- Poland

- /

- Healthtech

- /

- WSE:SNT

European Stocks That May Be Undervalued In November 2025

Reviewed by Simply Wall St

As European markets navigate a period of mixed performance, with the STOXX Europe 600 Index recently pulling back after reaching new highs, investors are closely watching for opportunities amid shifting interest rate expectations from the European Central Bank. In this environment, identifying potentially undervalued stocks becomes crucial, as they may offer attractive entry points for those looking to capitalize on market inefficiencies and economic resilience across the region.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| STEICO (XTRA:ST5) | €19.72 | €39.39 | 49.9% |

| Roche Bobois (ENXTPA:RBO) | €35.40 | €69.90 | 49.4% |

| Recupero Etico Sostenibile (BIT:RES) | €6.42 | €12.84 | 50% |

| PVA TePla (XTRA:TPE) | €24.02 | €47.55 | 49.5% |

| NEUCA (WSE:NEU) | PLN790.00 | PLN1553.92 | 49.2% |

| E-Globe (BIT:EGB) | €0.66 | €1.30 | 49.4% |

| doValue (BIT:DOV) | €2.64 | €5.20 | 49.3% |

| Daldrup & Söhne (XTRA:4DS) | €15.80 | €31.43 | 49.7% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

| Atea (OB:ATEA) | NOK149.40 | NOK298.49 | 49.9% |

Let's dive into some prime choices out of the screener.

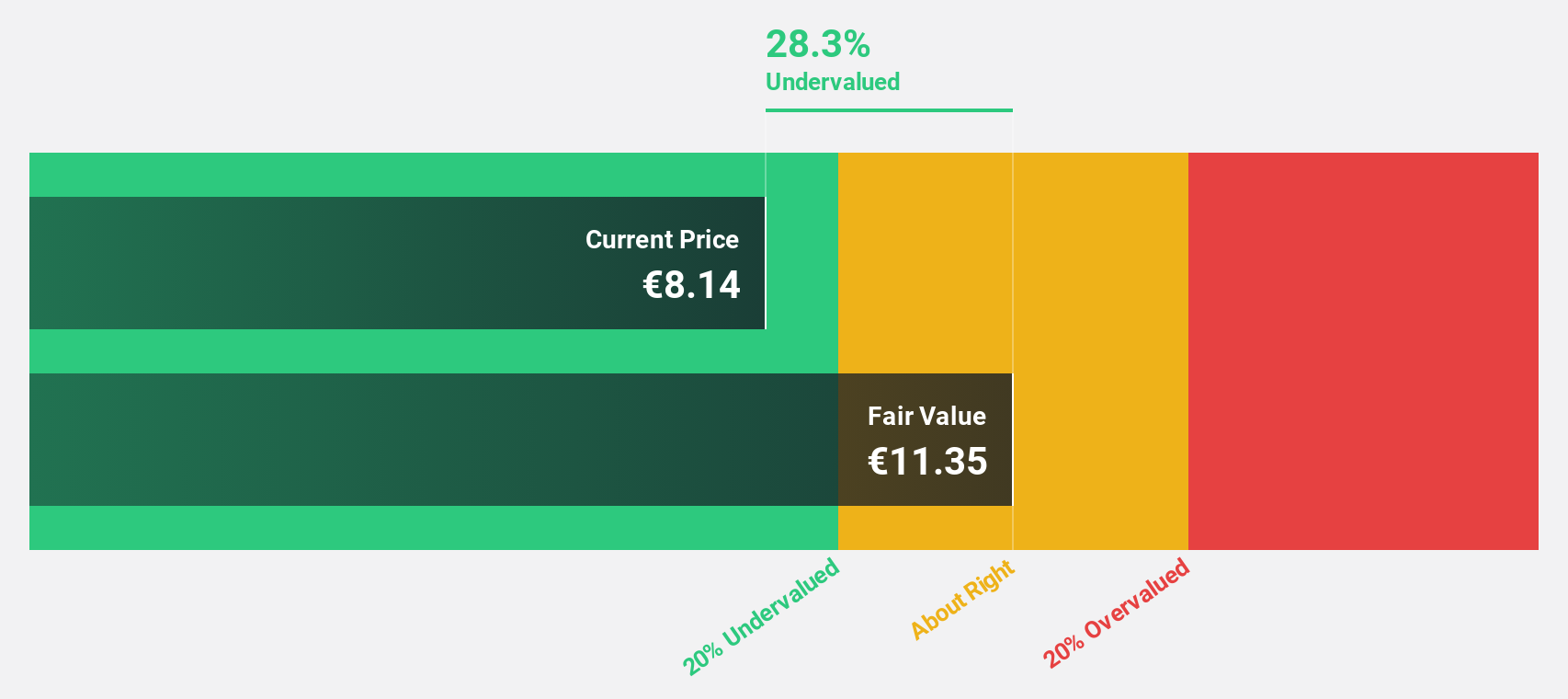

Zignago Vetro (BIT:ZV)

Overview: Zignago Vetro S.p.A., along with its subsidiaries, produces, markets, and sells hollow glass containers in Italy, the rest of Europe, and internationally, with a market cap of €668.17 million.

Operations: The company's revenue segments include Vetro Revet Srl (€13.30 million), Zignago Vetro SpA (€325.67 million), Zignago Glass USA Inc. (€4.50 million), Italian Glass Moulds Srl (€4.09 million), Zignago Vetro Brosse SAS (€52.41 million), and Zignago Vetro Polska S.A. (€80.10 million).

Estimated Discount To Fair Value: 34.9%

Zignago Vetro is trading at €7.57, significantly undervalued by 34.9% compared to its estimated fair value of €11.63, based on discounted cash flow analysis. Despite high debt levels and a reduced profit margin from last year, the company's earnings are expected to grow substantially at 30.9% annually, outpacing both revenue growth and the Italian market average. However, its dividend yield of 5.94% is not well covered by earnings, posing potential sustainability concerns.

- Our growth report here indicates Zignago Vetro may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Zignago Vetro.

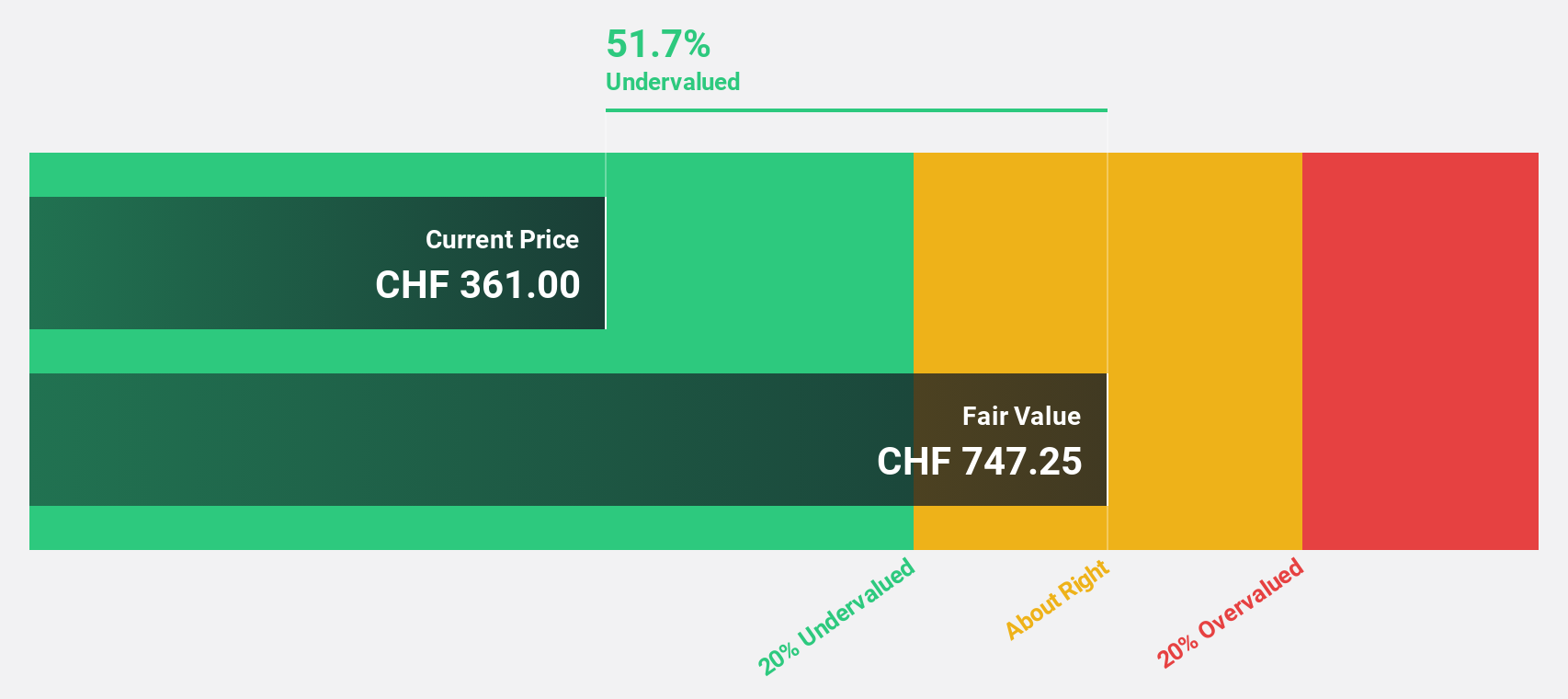

Bystronic (SWX:BYS)

Overview: Bystronic AG, with a market cap of CHF540.09 million, provides sheet metal processing solutions globally through its subsidiaries, focusing on cutting, bending, and automation.

Operations: Revenue Segments (in millions of CHF):

Estimated Discount To Fair Value: 11.7%

Bystronic is trading at CHF 261.5, undervalued by 11.7% compared to its estimated fair value of CHF 296.23 based on discounted cash flow analysis. Despite reporting lower net sales of CHF 445.7 million for the first nine months of 2025, the company anticipates improved operating results year-on-year and forecasts a significant earnings growth rate of nearly doubling annually over the next three years, surpassing market averages despite recent tariff challenges and volatile share prices.

- In light of our recent growth report, it seems possible that Bystronic's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Bystronic stock in this financial health report.

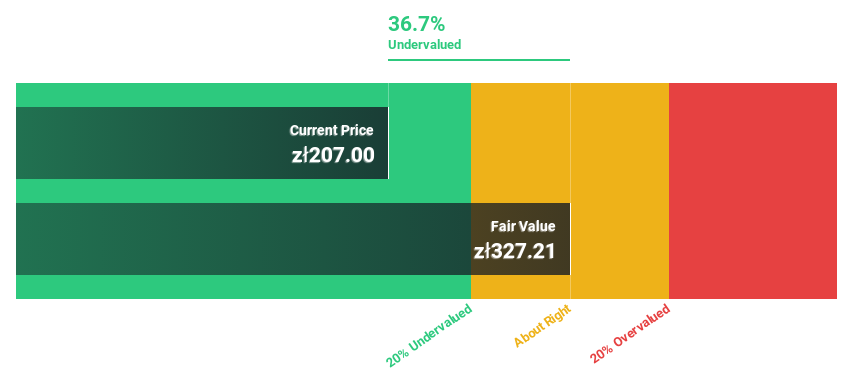

Synektik Spólka Akcyjna (WSE:SNT)

Overview: Synektik Spólka Akcyjna operates in Poland, offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market cap of PLN2.26 billion.

Operations: The company generates revenue primarily from Diagnostic and IT Equipment, amounting to PLN57.92 billion, and the Production of Radio Pharmaceuticals, which totals PLN4.67 billion.

Estimated Discount To Fair Value: 12.5%

Synektik Spólka Akcyjna's recent earnings report shows a rise in net income to PLN 23.71 million for the third quarter, with revenue increasing to PLN 154.24 million. The stock trades at PLN 265.4, about 12.5% below its fair value estimate of PLN 303.32, based on discounted cash flow analysis, indicating potential undervaluation despite a dividend not fully covered by free cash flows and high non-cash earnings levels. Revenue and earnings are forecasted to grow faster than the Polish market average.

- Our earnings growth report unveils the potential for significant increases in Synektik Spólka Akcyjna's future results.

- Click here to discover the nuances of Synektik Spólka Akcyjna with our detailed financial health report.

Key Takeaways

- Discover the full array of 186 Undervalued European Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SNT

Synektik Spólka Akcyjna

Provides products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives