Stock Analysis

- Switzerland

- /

- Building

- /

- SWX:ARBN

Three Growth Companies On SIX Swiss Exchange With Insider Ownership And Earnings Growth Of At Least 14%

Reviewed by Simply Wall St

In recent trading sessions, the Swiss stock market has shown modest movements, with the SMI index registering a slight uptick amidst mixed economic signals, including a near-stable consumer confidence index. Given this backdrop of cautious investor sentiment and economic uncertainty, companies with strong insider ownership and consistent earnings growth stand out as potentially resilient investment opportunities in Switzerland.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.9% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 14.6% | 14.7% |

| LEM Holding (SWX:LEHN) | 34.5% | 9.9% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.9% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 84.7% |

| Arbonia (SWX:ARBN) | 28.8% | 80% |

Here's a peek at a few of the choices from the screener.

Arbonia (SWX:ARBN)

Simply Wall St Growth Rating: ★★★★☆☆

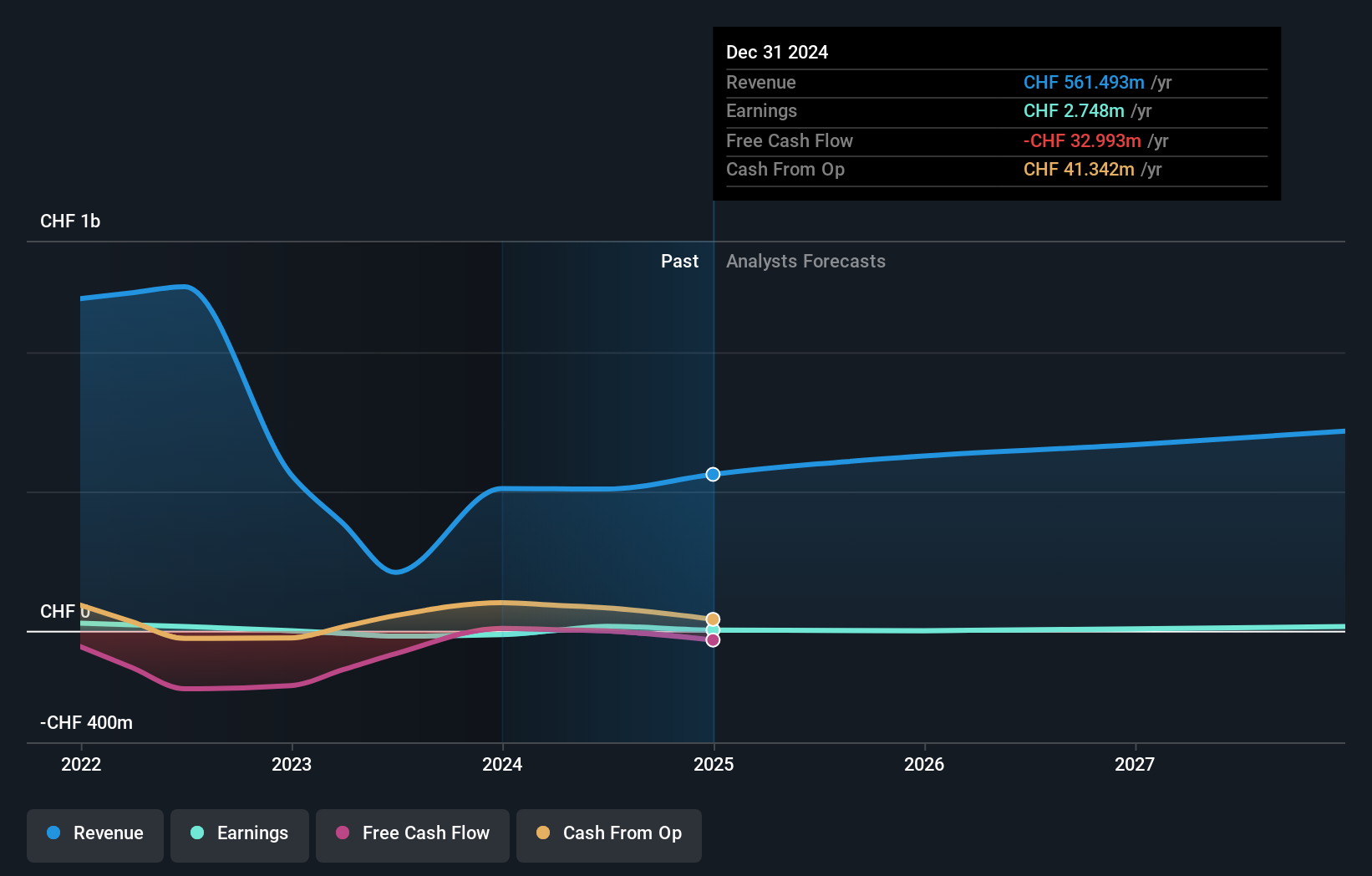

Overview: Arbonia AG is a company that supplies building components across Switzerland, Germany, and other international markets, with a market capitalization of approximately CHF 896.02 million.

Operations: The company generates revenue primarily from its Doors segment, which includes sanitary equipment, contributing CHF 501.56 million.

Insider Ownership: 28.8%

Earnings Growth Forecast: 80% p.a.

Arbonia, a Swiss building materials group, is navigating a strategic shift by planning to sell its climate division to concentrate on its doors business. This move follows unsolicited interest and aims at enhancing shareholder returns through significant proceeds distribution and debt reduction. Despite Arbonia's revenue growth forecast of 13.9% per year outpacing the Swiss market's 4.3%, its expected profitability in three years and below-market return on equity forecasts suggest mixed growth prospects.

- Get an in-depth perspective on Arbonia's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Arbonia shares in the market.

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

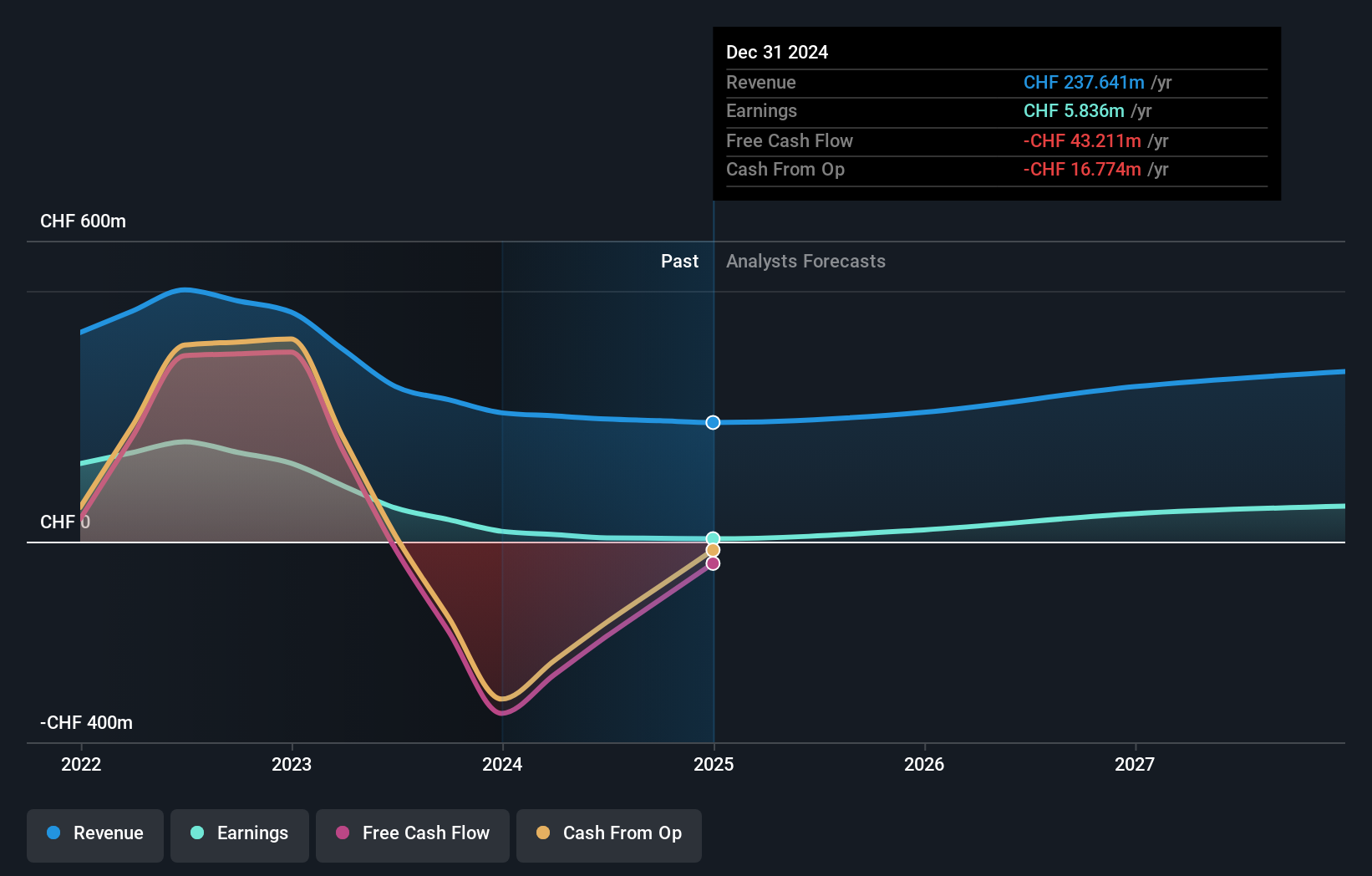

Overview: Leonteq AG is a financial services provider specializing in structured investment products and long-term savings and retirement solutions across Switzerland, Europe, Asia, and the Middle East, with a market capitalization of CHF 441.59 million.

Operations: The company generates CHF 256.88 million from its brokerage services.

Insider Ownership: 12.7%

Earnings Growth Forecast: 26.4% p.a.

Leonteq, a Swiss financial services firm, is experiencing a notable leadership transition with Hans Widler stepping in as CFO. Despite slower revenue growth projections at 10.1% annually compared to higher market averages, Leonteq's earnings are expected to rise significantly by 26.4% per year over the next three years. However, challenges persist with profit margins dropping from last year's 34.2% to 8%, and debt coverage by operating cash flow remains weak. The company trades at a substantial discount of 76.3% below estimated fair value, indicating potential undervaluation amidst these financial dynamics.

- Click here to discover the nuances of Leonteq with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Leonteq is priced higher than what may be justified by its financials.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.17 billion.

Operations: The firm's revenue is derived from the development, marketing, and sale of integrated banking software systems to financial institutions globally.

Insider Ownership: 14.6%

Earnings Growth Forecast: 14.7% p.a.

Temenos, a Swiss software company, is trading at CHF 31.4% below its estimated fair value, suggesting potential undervaluation. Despite a high level of debt and a volatile share price recently, Temenos offers reliable dividends (2.06%) and forecasts show earnings growth outpacing the Swiss market (14.7% vs 8% annually). Recent strategic moves include appointing Jean-Pierre Brulard as CEO and expanding Citi Securities Services' use of its Multifonds platform globally, enhancing its operational efficiency across multiple geographies.

- Click here and access our complete growth analysis report to understand the dynamics of Temenos.

- The analysis detailed in our Temenos valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 17 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Arbonia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ARBN

Arbonia

Engages in the supply of building components in Switzerland, Germany, and internationally.

Reasonable growth potential with adequate balance sheet.