- Switzerland

- /

- Aerospace & Defense

- /

- SWX:AERO

Why Montana Aerospace (SWX:AERO) Is Down 19.8% After Slashing 2025 Guidance Despite Operational Progress

Reviewed by Sasha Jovanovic

- Montana Aerospace reported third quarter and nine-month 2025 earnings, posting sales of €250.11 million and €718.79 million respectively, with a net loss for the period despite strong operational growth and the company's transition to a pure-play aerospace business following divestments.

- While the company showed increased revenue and a reduced net loss year-on-year, its significant downward revision of 2025 financial guidance stood out against positive business transformation and backlog strength.

- We will explore how the guidance revision, despite the company's streamlined focus and operational improvement, shapes Montana Aerospace’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Montana Aerospace's Investment Narrative?

For anyone considering Montana Aerospace, the investment story really centers on believing in the company’s ability to capture growth as a focused, pure-play aerospace supplier after its major divestments. The latest quarterly news, a mix of strong revenue growth and a sharply lower (though still material) net loss but paired with a significant downward guidance revision, adds a new layer to the short-term picture. Heading into this update, most saw the key catalysts as execution on long-term contracts, the continued commercial ramp, and improving profitability, held back mainly by questions of value and return on equity. Now, with earnings guidance cut despite operational business wins and the share price reacting with a steep week-long decline, the need to monitor near-term order trends and margin pressures is even more pressing. The risk calculus has shifted, making execution against revised expectations much more critical.

Yet, with the recent shift in guidance, Montana Aerospace faces questions that investors should not overlook.

Exploring Other Perspectives

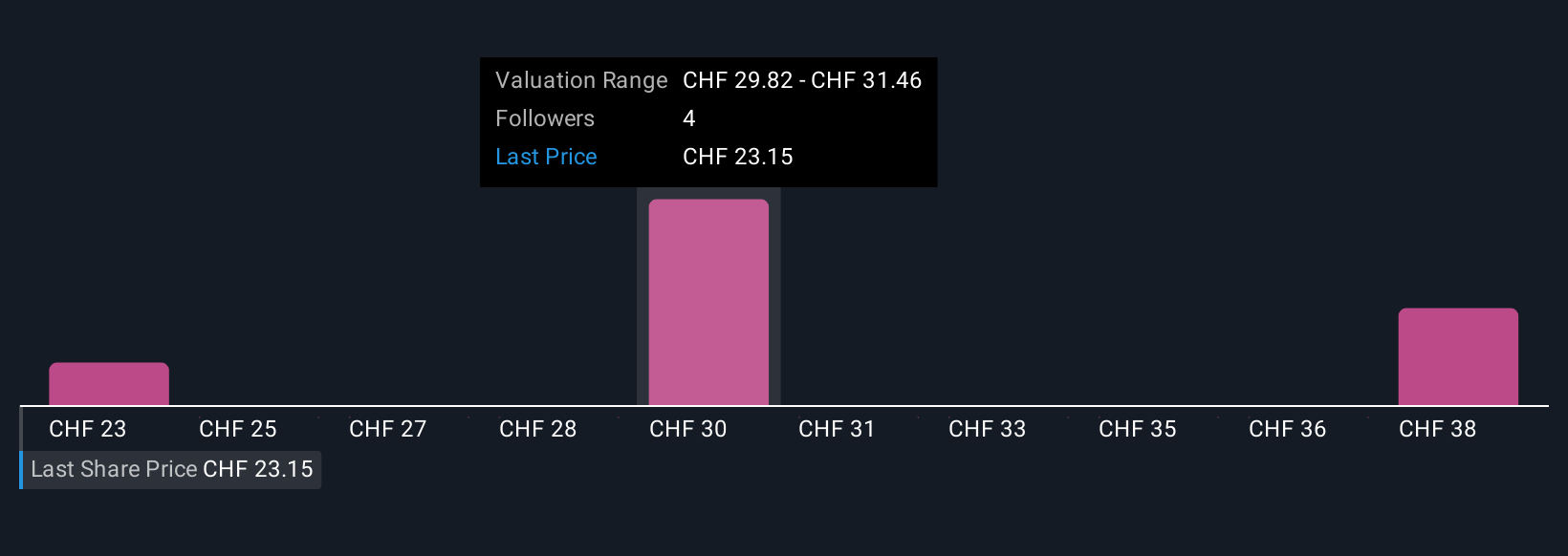

Explore 3 other fair value estimates on Montana Aerospace - why the stock might be worth as much as 65% more than the current price!

Build Your Own Montana Aerospace Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Montana Aerospace research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Montana Aerospace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Montana Aerospace's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AERO

Montana Aerospace

Montana Aerospace AG design, develop, and manufacture system components and complex assemblies worldwide.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives