Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ABB (VTX:ABBN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide ABB with the means to add long-term value to shareholders.

Check out our latest analysis for ABB

How Fast Is ABB Growing Its Earnings Per Share?

In the last three years ABB's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, ABB's EPS shot from US$1.02 to US$2.17, over the last year. Year on year growth of 114% is certainly a sight to behold.

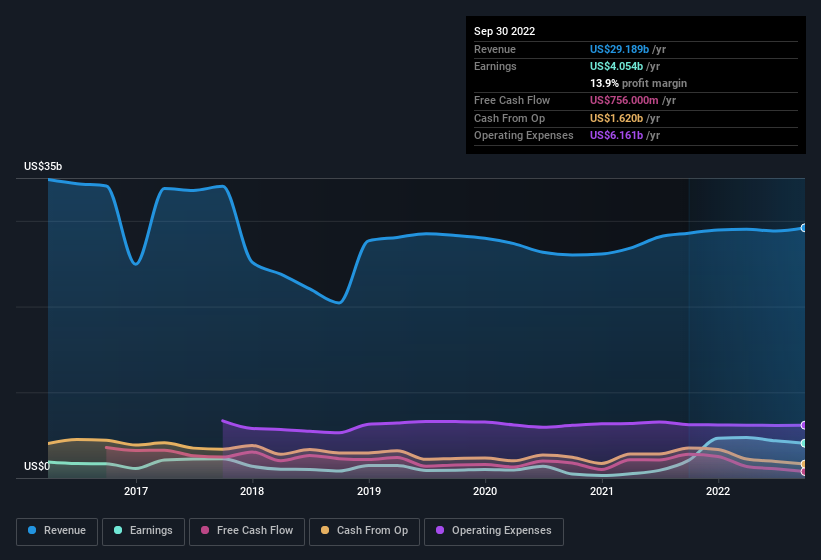

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for ABB remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 2.2% to US$29b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of ABB's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are ABB Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent US$8.2m buying ABB shares, over the last year, without reporting any share sales whatsoever. Knowing this, ABB will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Chief Executive Officer, Bjorn Klas Rosengren, who made the biggest single acquisition, paying CHF2.7m for shares at about CHF32.14 each.

The good news, alongside the insider buying, for ABB bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$45m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.09% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does ABB Deserve A Spot On Your Watchlist?

ABB's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest ABB belongs near the top of your watchlist. Even so, be aware that ABB is showing 2 warning signs in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, ABB isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:ABBN

ABB

Provides electrification, motion, and automation solutions and products for customers in utilities, industry and transport, and infrastructure in Europe, the Americas, Asia, the Middle East, and Africa.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives