- Switzerland

- /

- Electrical

- /

- SWX:ABBN

ABB (SWX:ABBN): Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for ABB.

ABB’s 17.7% year-to-date share price return stands out, and while this past week saw a mild dip, momentum has hardly faded. Shareholders are still sitting on an impressive 17.5% total return over the past year and more than a 115% gain over three years. Signs of healthy growth remain in focus, even as the latest rally catches its breath.

If you’re interested in what other market leaders are doing, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With ABB now trading just above analyst targets and after a strong three-year surge, the key question is whether shares have room to run or if the company’s impressive growth is already fully reflected in the price.

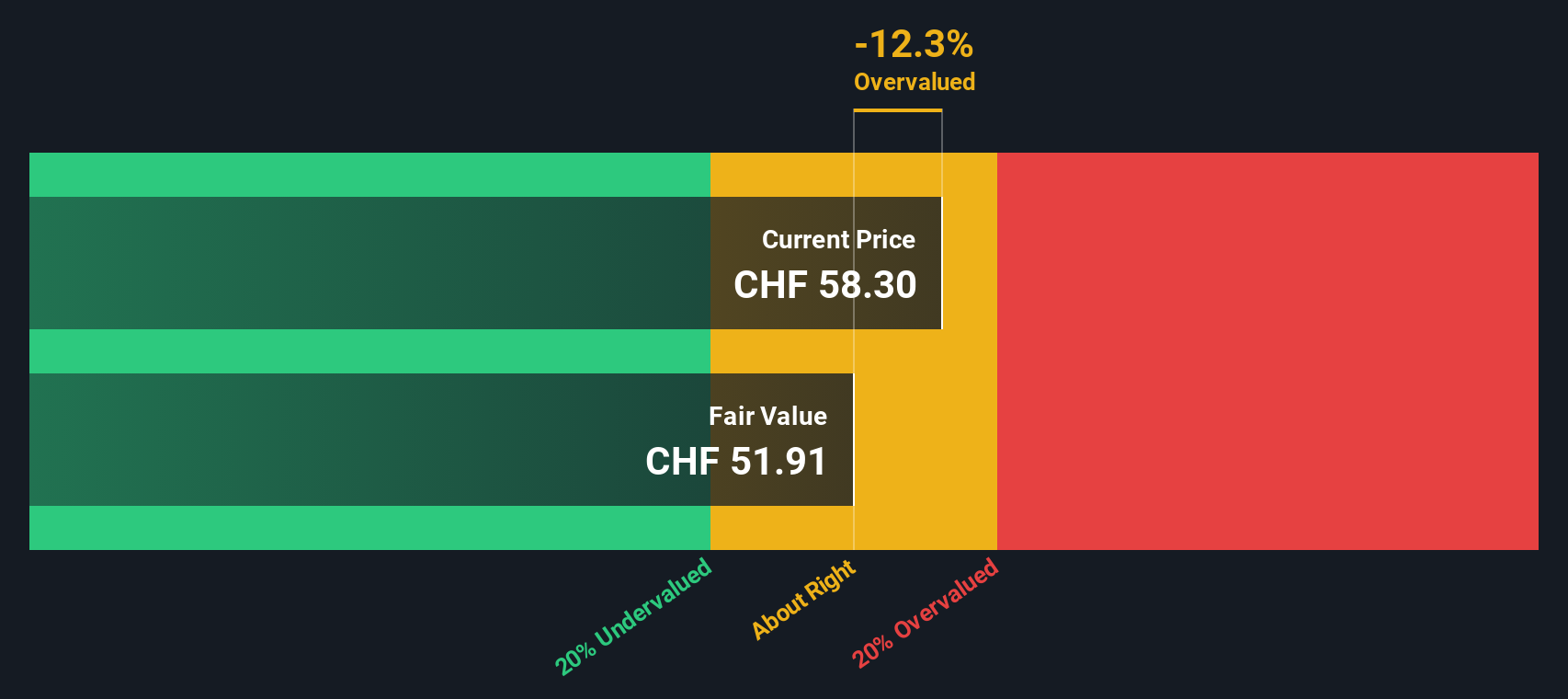

Most Popular Narrative: 4.4% Overvalued

The latest narrative puts ABB’s fair value slightly below where shares currently trade, indicating the market may be optimistic for continued outperformance. With this valuation gap, attention shifts to operational strengths and future execution as key drivers.

ABB's robust order intake, especially in electrification, utility, and data center demand, reflects structural increases in global electricity consumption and grid upgrades as industries and urban infrastructure transition away from fossil fuels. This underpins visible multi-year revenue growth and an expanding order backlog.

Want to see the financial forces shaping this price tag? Analysts are betting on recurring service growth, digital reinvention, and a future earnings profile most companies can only dream of. The full narrative reveals the bold assumptions behind this consensus. Don’t miss what could be powering the latest surge.

Result: Fair Value of $55.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key end-markets or intensifying competition could quickly challenge these optimistic projections and place pressure on ABB’s future growth story.

Find out about the key risks to this ABB narrative.

Another View: SWS DCF Fair Value Check

While analysts see ABB as slightly overvalued based on future earnings, our SWS DCF model tells a similar story. The DCF calculation suggests ABB is trading above its estimated fair value. This highlights the market’s optimism and leaves investors to consider whether today’s price reflects a premium for future growth.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ABB Narrative

If you have a different perspective or want to dig deeper into the numbers, you can craft your own narrative using the same data and insights in just a few minutes. Do it your way.

A great starting point for your ABB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. Use the Simply Wall Street Screener to unlock unique stocks that fit your investment goals right now.

- Target greater stability with smart income by tapping into these 20 dividend stocks with yields > 3% offering yields above 3% and boost your passive earnings.

- Ride the next tech wave by checking out these 26 AI penny stocks, which is packed with companies driving AI breakthroughs for tomorrow’s markets.

- Supercharge your search for deep value and uncover these 849 undervalued stocks based on cash flows based on robust cash flow analysis and fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ABBN

ABB

Provides electrification, motion, and automation solutions and products for customers in utilities, industry and transport, and infrastructure in Europe, the Americas, Asia, the Middle East, and Africa.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives