- Switzerland

- /

- Banks

- /

- SWX:TKBP

With EPS Growth And More, Thurgauer Kantonalbank (VTX:TKBP) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Thurgauer Kantonalbank (VTX:TKBP), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Thurgauer Kantonalbank

Thurgauer Kantonalbank's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. In previous twelve months, Thurgauer Kantonalbank's EPS has risen from CHF7.66 to CHF8.00. That's a fair increase of 4.4%.

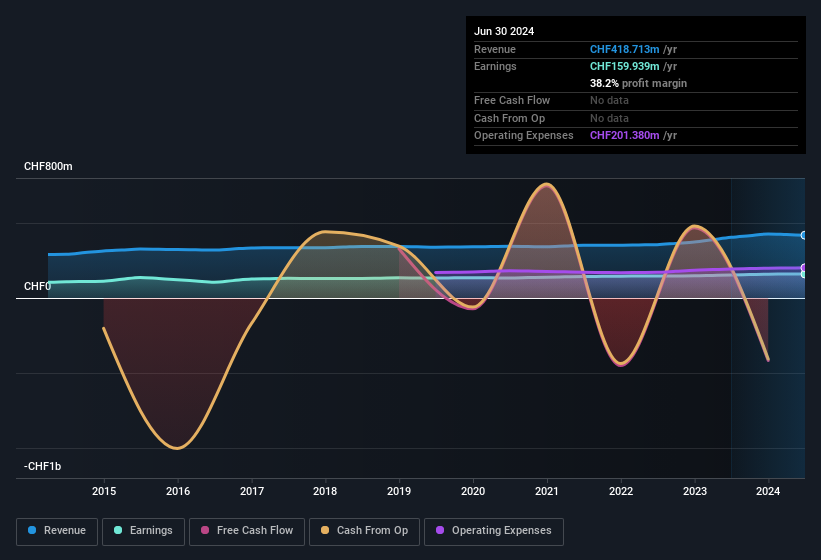

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Thurgauer Kantonalbank's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Thurgauer Kantonalbank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.5% to CHF419m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Thurgauer Kantonalbank's balance sheet strength, before getting too excited.

Are Thurgauer Kantonalbank Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between CHF1.8b and CHF5.8b, like Thurgauer Kantonalbank, the median CEO pay is around CHF1.3m.

Thurgauer Kantonalbank offered total compensation worth CHF996k to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Thurgauer Kantonalbank Deserve A Spot On Your Watchlist?

One important encouraging feature of Thurgauer Kantonalbank is that it is growing profits. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So all in all Thurgauer Kantonalbank is worthy at least considering for your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Thurgauer Kantonalbank. You might benefit from giving it a glance today.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CH with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Thurgauer Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:TKBP

Thurgauer Kantonalbank

Provides various banking products and services to private individuals, small and medium-sized enterprises, companies, and public sector entities in Switzerland.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives