- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

3 Dividend Stocks On The SIX Swiss Exchange Yielding Up To 4.8%

Reviewed by Simply Wall St

The Switzerland market closed higher on Friday, tracking positive cues from other European markets amid hopes the Federal Reserve will cut interest rates next week and possibly announce more reductions before the end of the year. In this favorable environment, dividend stocks can offer a reliable income stream and potential for capital appreciation.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.09% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.72% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.62% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.82% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.84% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.52% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.51% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 4.01% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.69% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.38% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise provides a range of financial services in Vaud Canton, Switzerland, the European Union, North America, and internationally with a market cap of CHF7.66 billion.

Operations: Banque Cantonale Vaudoise operates through several revenue segments, including retail banking, corporate banking, wealth management, and trading activities.

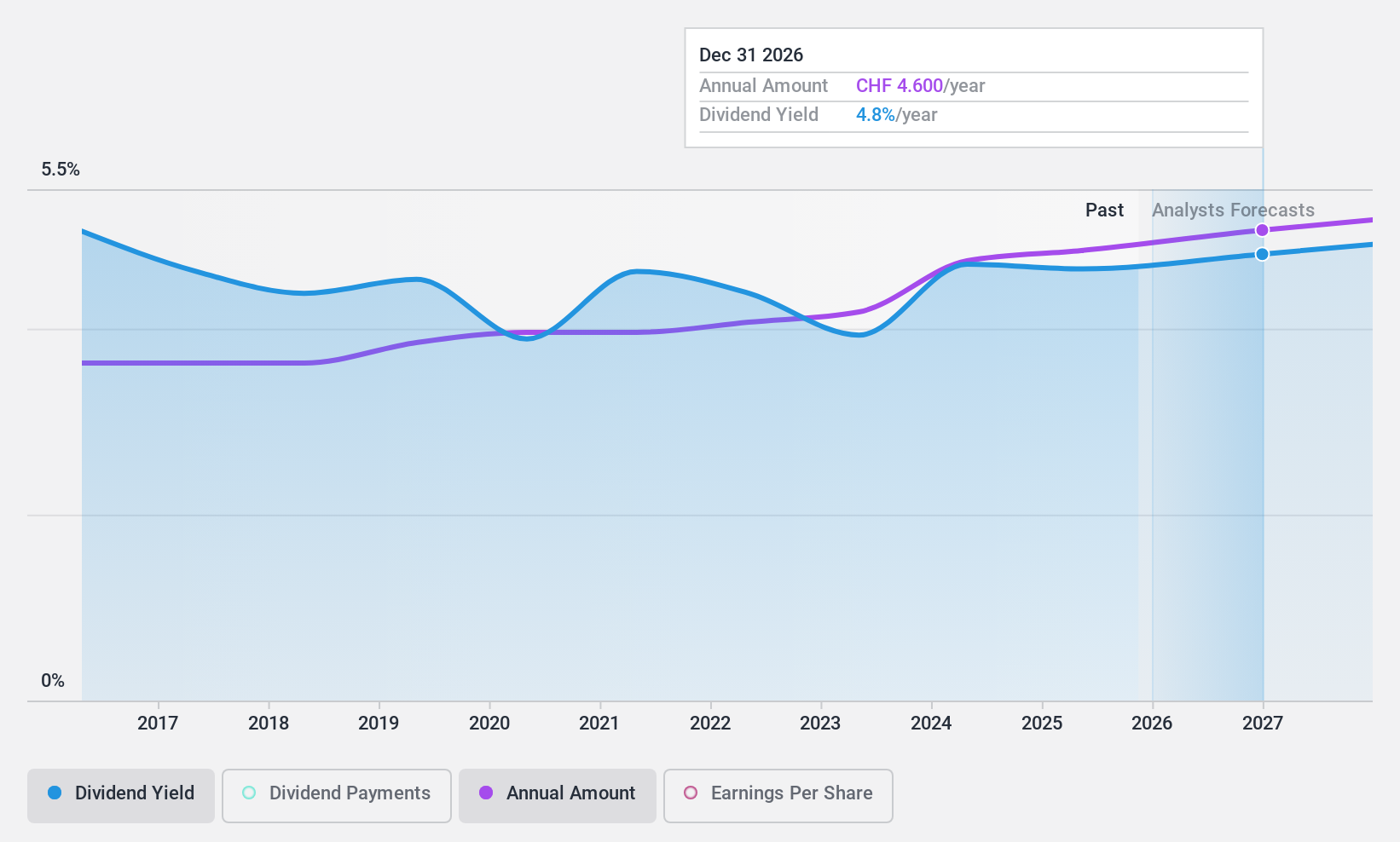

Dividend Yield: 4.8%

Banque Cantonale Vaudoise reported net interest income of CHF 290.8 million and net income of CHF 221.1 million for the half year ended June 30, 2024. Despite a slight dip in net income, BCVN's dividend payments have been reliable and growing over the past decade with a stable payout ratio currently at 78.7%. The bank's price-to-earnings ratio (17x) is attractive compared to the Swiss market average (21x), making it a solid option for dividend investors seeking stability and growth potential in their portfolios.

- Unlock comprehensive insights into our analysis of Banque Cantonale Vaudoise stock in this dividend report.

- In light of our recent valuation report, it seems possible that Banque Cantonale Vaudoise is trading beyond its estimated value.

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services in Liechtenstein, Switzerland, Germany, Austria, and internationally with a market cap of CHF2.21 billion.

Operations: Liechtensteinische Landesbank Aktiengesellschaft generates revenue through its Corporate Center (CHF2.40 million), Retail & Corporate Banking (CHF313.30 million), and International Wealth Management (CHF241.83 million) segments.

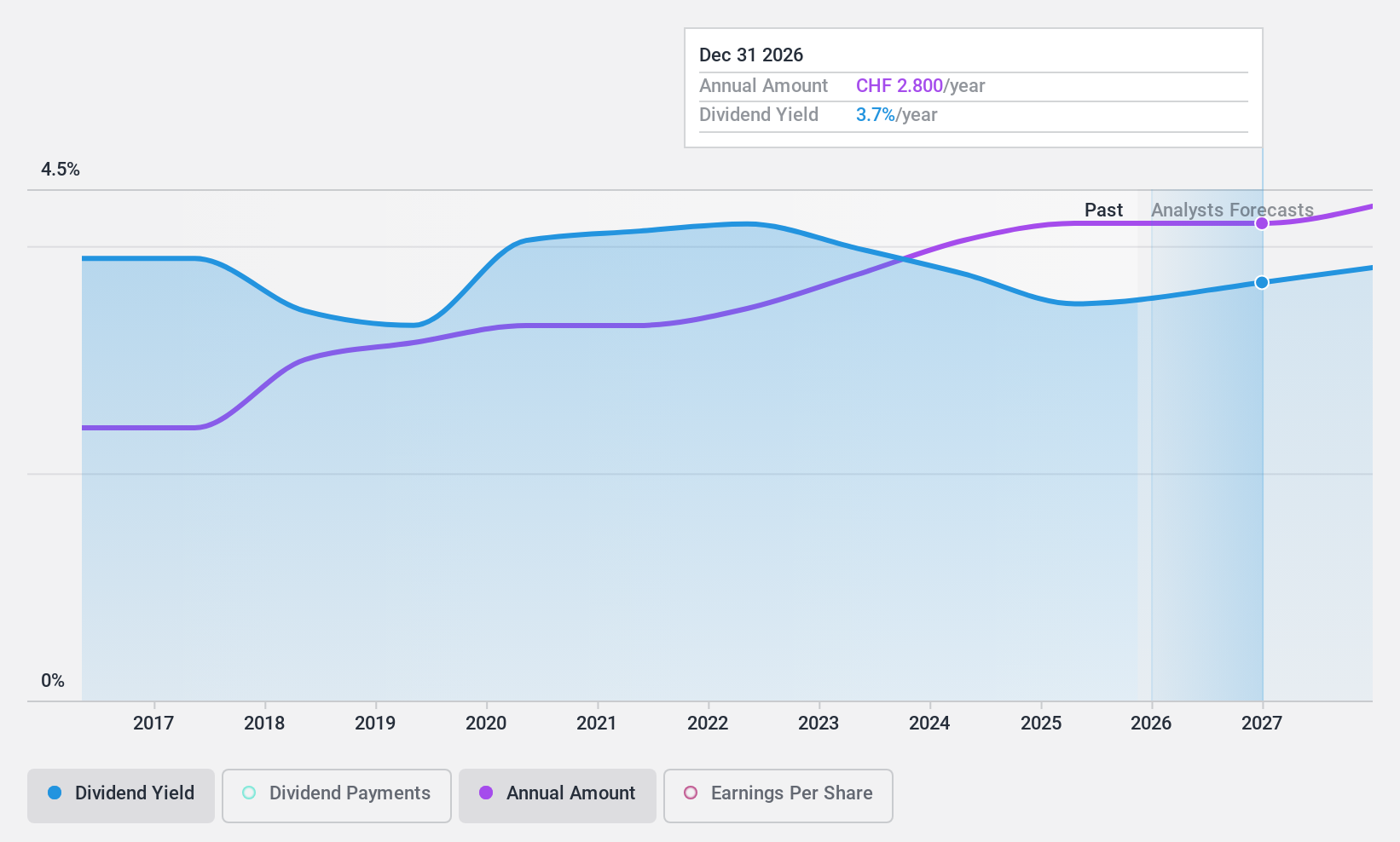

Dividend Yield: 3.7%

Liechtensteinische Landesbank's dividend yield (3.73%) is lower than the top 25% of Swiss dividend payers. The bank maintains a low payout ratio (49.7%), ensuring dividends are well covered by earnings now and in three years, despite a volatile dividend history over the past decade. Recent half-year results show net interest income at CHF 67.73 million and net income at CHF 90.16 million, indicating stable financial performance but highlighting some inconsistencies in dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Liechtensteinische Landesbank.

- In light of our recent valuation report, it seems possible that Liechtensteinische Landesbank is trading behind its estimated value.

mobilezone holding ag (SWX:MOZN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mobilezone Holding AG, with a market cap of CHF575.48 million, offers mobile and fixed-line telephony, television, and internet services for various network operators in Germany and Switzerland through its subsidiaries.

Operations: Mobilezone Holding AG generates revenues of CHF727.71 million from Germany and CHF291.80 million from Switzerland through its subsidiaries.

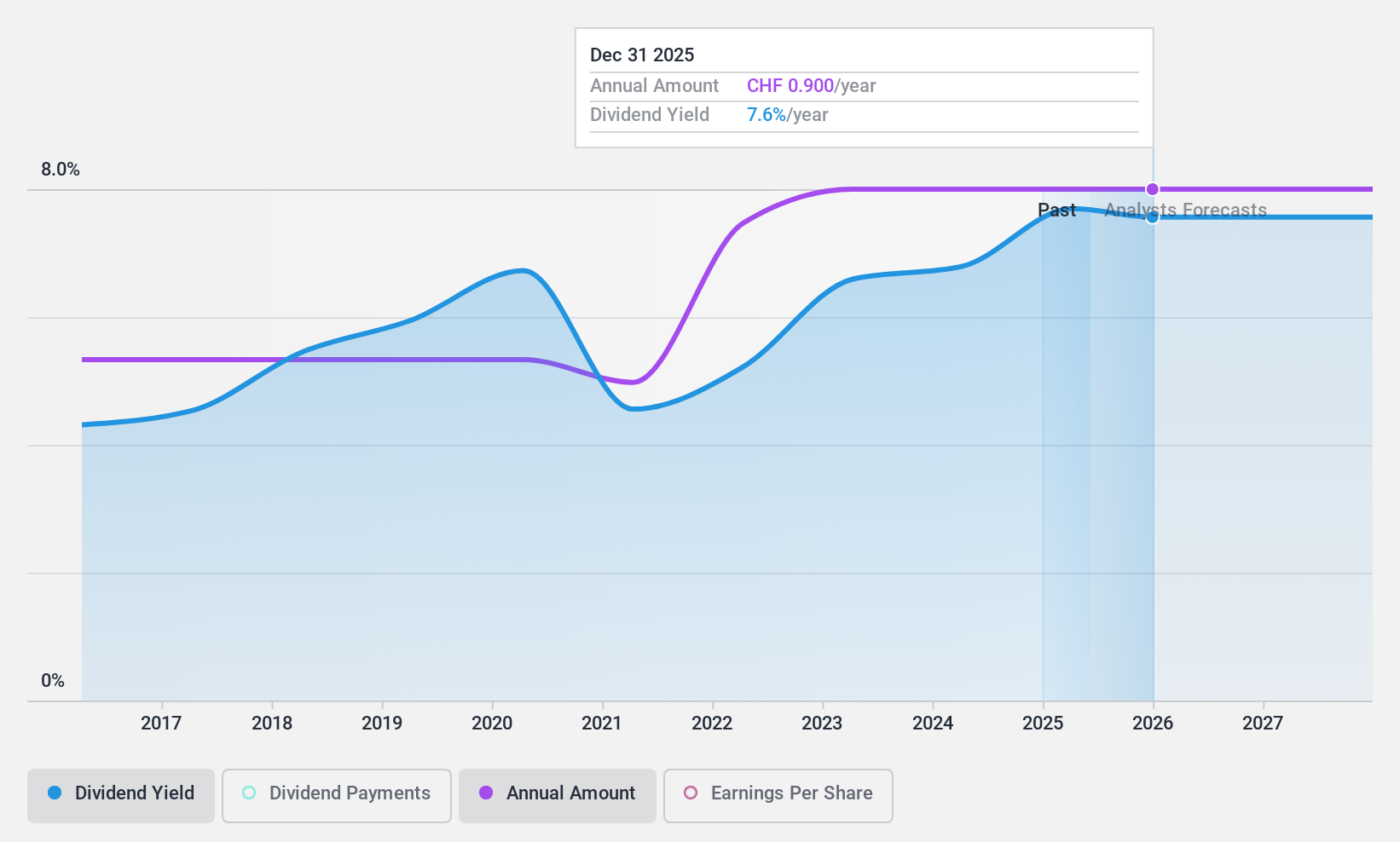

Dividend Yield: 3.7%

mobilezone holding ag's dividend yield (3.72%) is below the top 25% of Swiss dividend payers. Despite stable dividends per share over the past decade, payments have been unreliable and have declined. The company's recent earnings report shows net income at CHF 20.26 million for H1 2024, with sales rising slightly to CHF 479.55 million. Dividends are covered by both earnings (payout ratio: 79.1%) and cash flows (cash payout ratio: 80.9%), though debt coverage remains a concern.

- Get an in-depth perspective on mobilezone holding ag's performance by reading our dividend report here.

- The valuation report we've compiled suggests that mobilezone holding ag's current price could be quite moderate.

Make It Happen

- Take a closer look at our Top SIX Swiss Exchange Dividend Stocks list of 25 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and internet services for various network operators in Germany and Switzerland.

Adequate balance sheet average dividend payer.