- Switzerland

- /

- Building

- /

- SWX:MTG

Basellandschaftliche Kantonalbank Leads Three Top Swiss Dividend Stocks

Reviewed by Simply Wall St

The Switzerland market recently displayed resilience, ending modestly higher on Monday as investor sentiment improved throughout the trading session. The benchmark SMI index notched a gain, reflecting a broader interest in Swiss equities amid fluctuating market conditions. In such an environment, understanding the fundamentals of dividend-paying stocks can be particularly beneficial for investors looking for stable returns and financial security.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Vontobel Holding (SWX:VONN) | 5.47% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.18% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.44% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.31% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.17% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.94% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.08% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.06% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.75% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

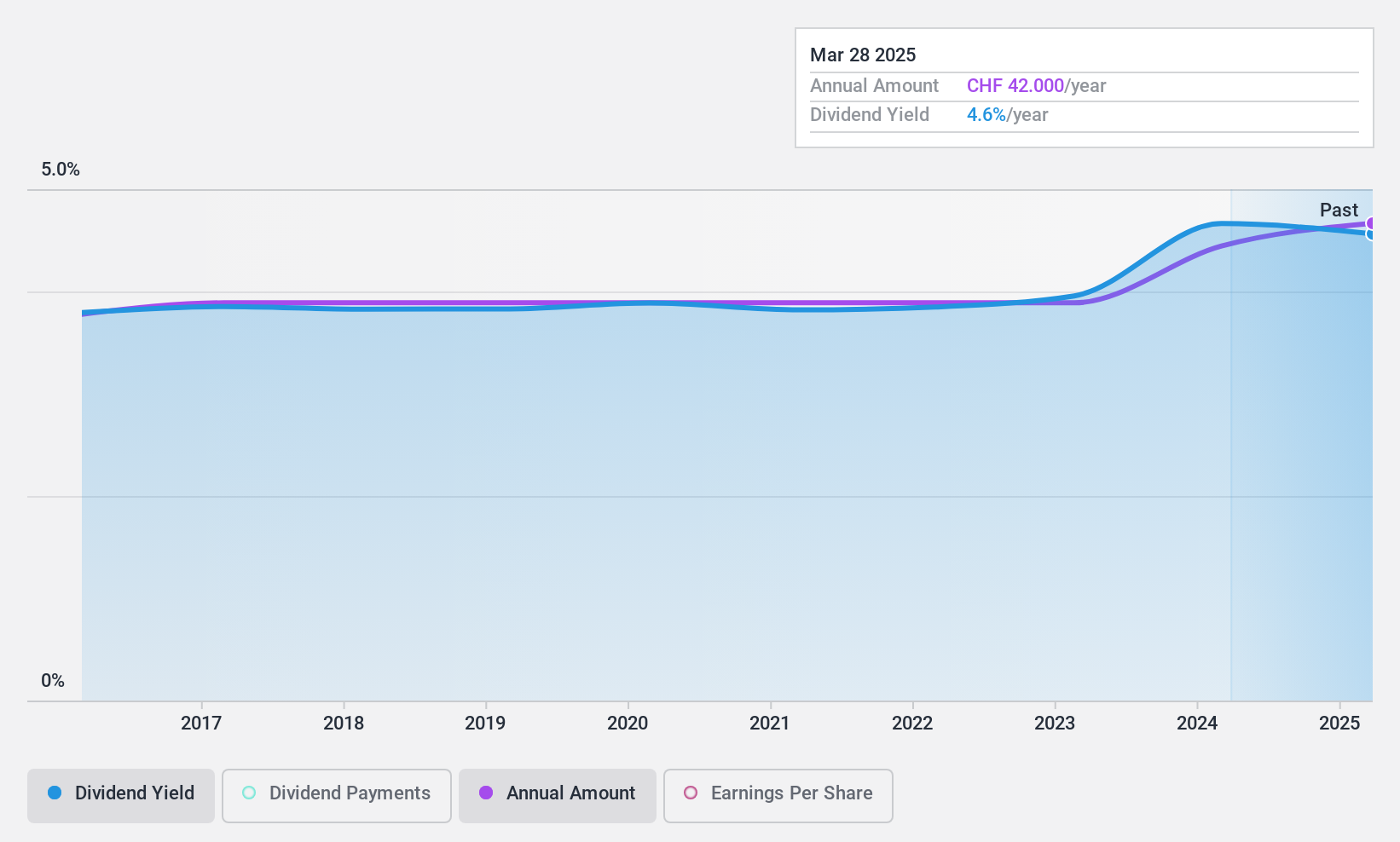

Basellandschaftliche Kantonalbank (SWX:BLKB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private and corporate clients primarily in Switzerland, with a market capitalization of CHF 1.82 billion.

Operations: Basellandschaftliche Kantonalbank generates CHF 458.55 million in revenue from its banking operations.

Dividend Yield: 4.8%

Basellandschaftliche Kantonalbank offers a compelling 4.75% dividend yield, ranking in the top 25% of Swiss dividend payers. The bank has demonstrated a decade of stable and growing dividends, supported by a reasonable payout ratio of 56.7%, indicating that payments are well-covered by earnings. Despite its low allowance for bad loans at 51%, suggesting potential risk management issues, it trades at an appealing 31.2% below estimated fair value, enhancing its attractiveness to income-focused investors seeking stability and value.

- Get an in-depth perspective on Basellandschaftliche Kantonalbank's performance by reading our dividend report here.

- The analysis detailed in our Basellandschaftliche Kantonalbank valuation report hints at an inflated share price compared to its estimated value.

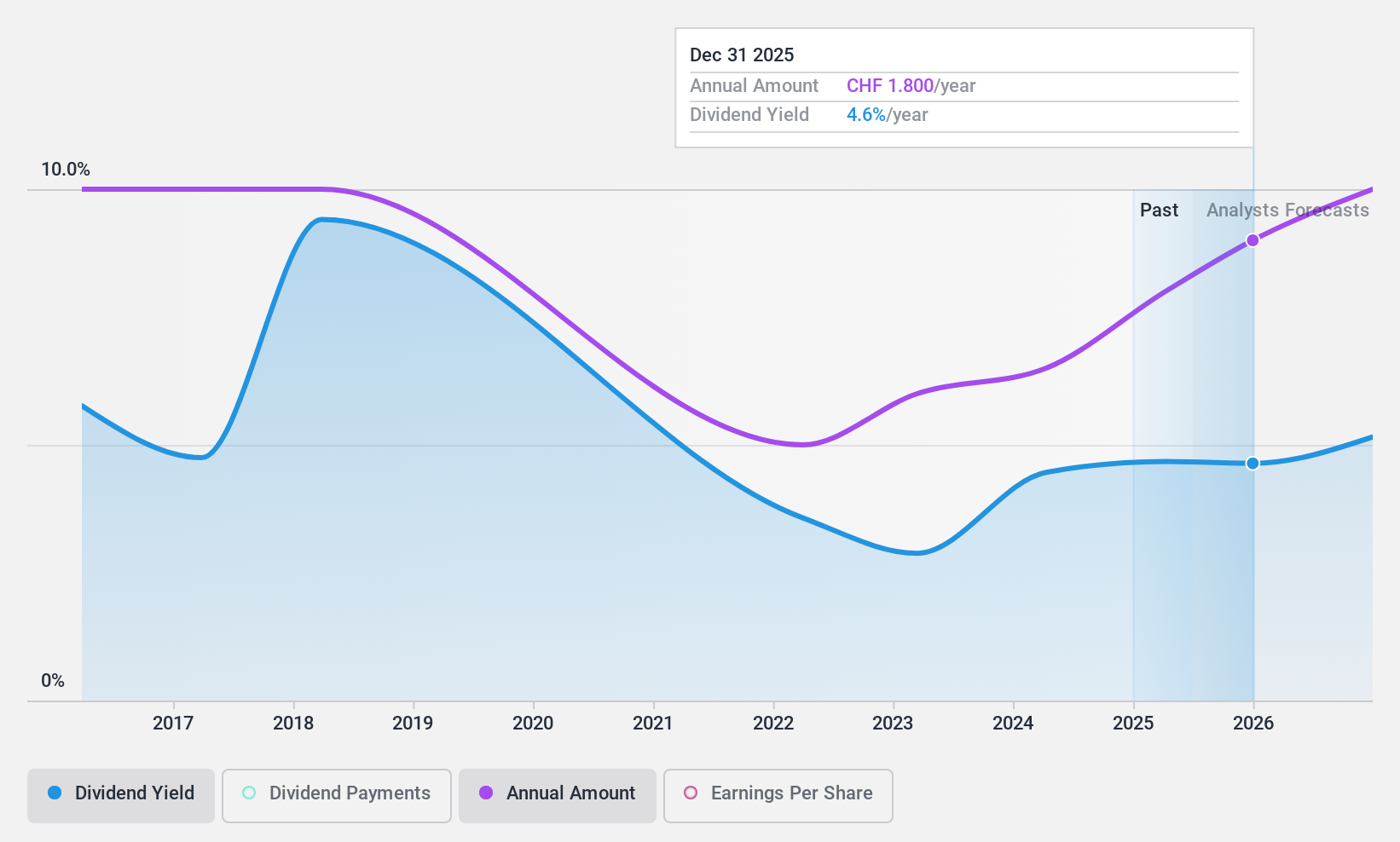

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG is a Swiss-based company specializing in trading and services for heat generation and air conditioning systems, with a market capitalization of CHF 370.25 million.

Operations: Meier Tobler Group AG generates revenue primarily through two segments: Distribution, which brings in CHF 441.25 million, and Services, contributing CHF 104.67 million.

Dividend Yield: 4%

Meier Tobler Group, while trading at a significant 64.4% below its estimated fair value, presents a mixed scenario for dividend investors. The company has shown a capacity to increase dividends over the past decade, supported by earnings and cash flows with payout ratios at 54.8% and 50.7%, respectively. However, its dividend track record has been marked by volatility and unreliability in the same period, with substantial annual fluctuations exceeding 20%. Additionally, its current dividend yield of 3.96% is slightly below the top quartile of Swiss dividend payers at 4.15%.

- Unlock comprehensive insights into our analysis of Meier Tobler Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Meier Tobler Group is trading behind its estimated value.

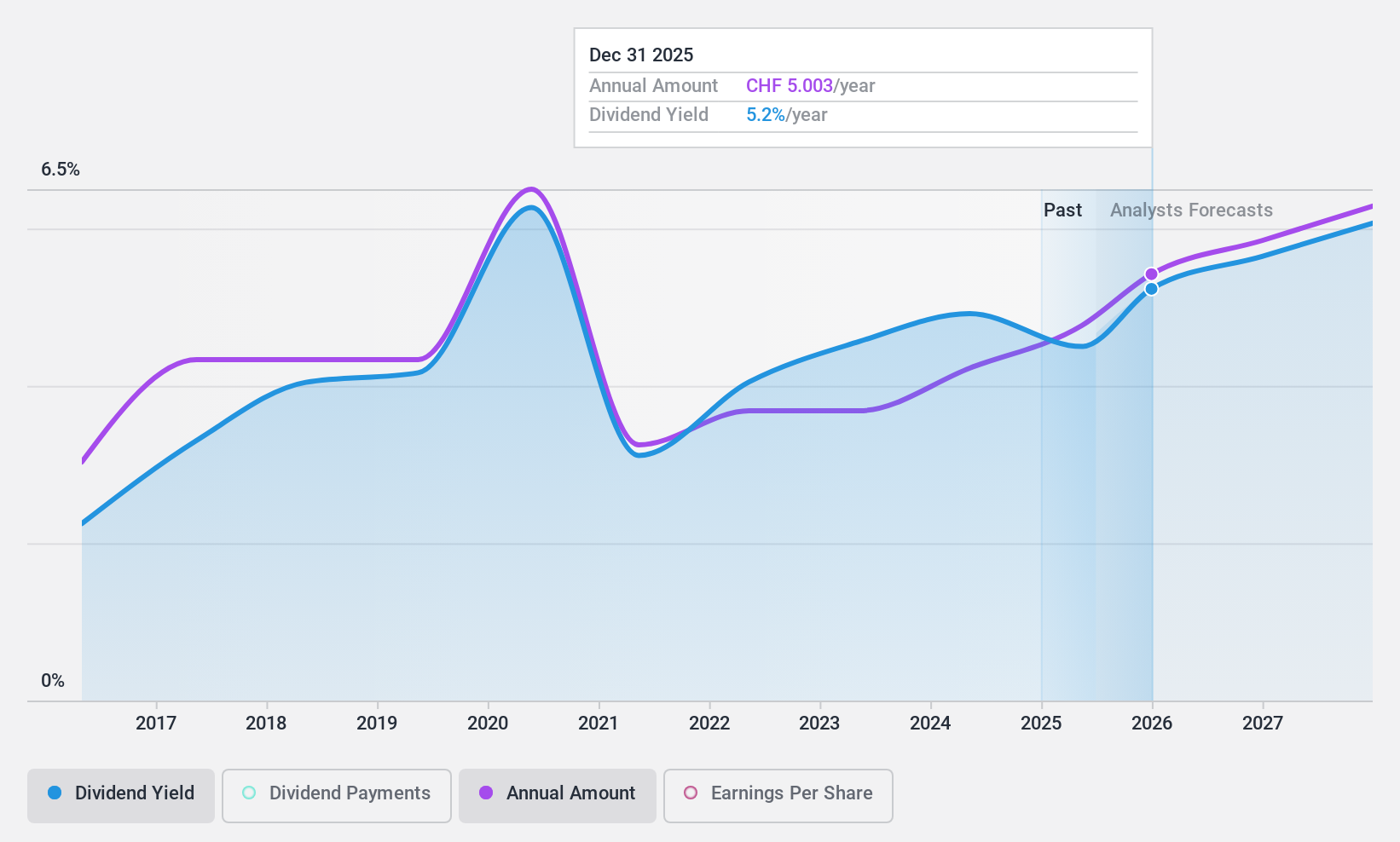

Orell Füssli (SWX:OFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security solutions and book retailing, serving both Swiss and international markets, with a market capitalization of CHF 152.49 million.

Operations: Orell Füssli AG generates revenue primarily through its book trade, security printing, and industrial systems segments, which collectively brought in CHF 216.22 million.

Dividend Yield: 5%

Orell Füssli offers a dividend yield of 5.01%, placing it in the upper quartile of Swiss dividend stocks, where the average is 4.15%. Despite this, its dividend history over the past eight years shows inconsistency with volatile payments. The dividends are well-supported financially, with a payout ratio of 63.5% from earnings and a cash payout ratio of 61.6%, suggesting sustainability from current income and cash flows. However, its relatively short history of dividend payments underlines some risk for long-term stability.

- Navigate through the intricacies of Orell Füssli with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Orell Füssli's current price could be quite moderate.

Make It Happen

- Explore the 26 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MTG

Meier Tobler Group

Operates as a trading and services company in heat generation and air conditioning systems.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives