- Canada

- /

- Renewable Energy

- /

- TSXV:SOLR

If You Had Bought Solar Alliance Energy (CVE:SOLR) Stock Three Years Ago, You'd Be Sitting On A 63% Loss, Today

It's nice to see the Solar Alliance Energy Inc. (CVE:SOLR) share price up 20% in a week. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 63% in the last three years. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for Solar Alliance Energy

Solar Alliance Energy recorded just CA$1,297,330 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Solar Alliance Energy will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Solar Alliance Energy has already given some investors a taste of the bitter losses that high risk investing can cause.

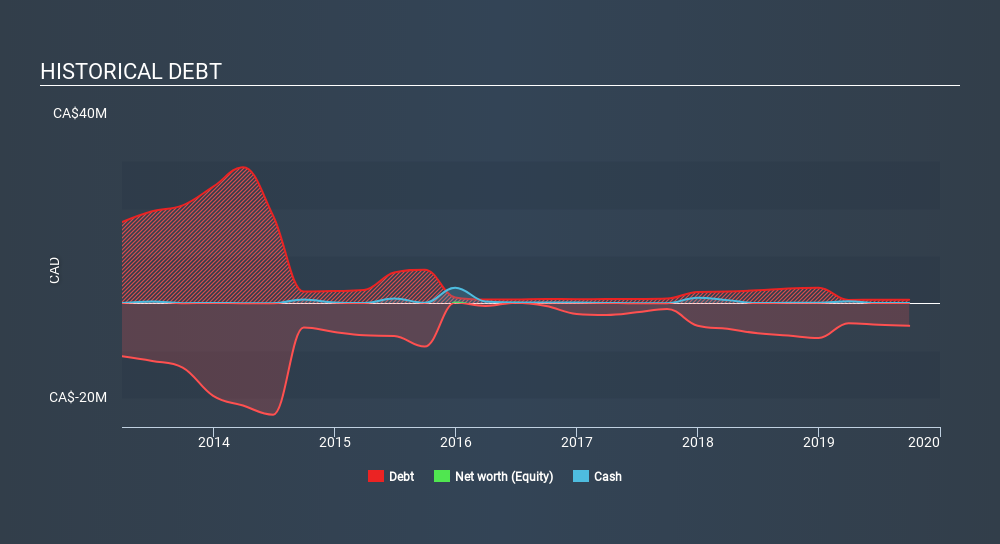

Our data indicates that Solar Alliance Energy had CA$6.0m more in total liabilities than it had cash, when it last reported in September 2019. That makes it extremely high risk, in our view. But since the share price has dived -28% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Solar Alliance Energy's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

We regret to report that Solar Alliance Energy shareholders are down 60% for the year. Unfortunately, that's worse than the broader market decline of 32%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 16% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Solar Alliance Energy (of which 5 are significant!) you should know about.

Solar Alliance Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:SOLR

Moderate and slightly overvalued.

Market Insights

Community Narratives