- Canada

- /

- Renewable Energy

- /

- TSX:TA

Will Two Straight Quarterly Losses Shift TransAlta's (TSX:TA) Profit Outlook and Growth Ambitions?

Reviewed by Simply Wall St

- TransAlta Corporation recently reported second quarter 2025 earnings, showing sales of C$433 million and a net loss of C$99 million, compared to sales of C$582 million and net income of C$69 million a year earlier.

- This marked the second consecutive quarter of losses for TransAlta, reflecting ongoing challenges with profitability and revenue momentum despite continued dividend payouts.

- With quarterly losses prevailing for another period, we'll examine how this impacts confidence in TransAlta's projected profitability and growth initiatives.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

TransAlta Investment Narrative Recap

To be a TransAlta shareholder, you need to have confidence in its ability to recover earnings power through operational improvements and integration of new assets, even as revenue and profit challenges persist. The recent quarterly loss underscores significant near-term pressure, and while it doesn't alter the outlook for key milestones like the full integration of Heartland assets, it does highlight that the biggest risk, sustained weak electricity pricing and rising costs in Alberta, remains a hurdle for short-term results.

Among the latest announcements, the continued affirmation of dividends stands out, especially as TransAlta posts consecutive losses. This signals an intent to manage capital returns to shareholders even in tough quarters, and ties into the short-term catalyst of achieving more stable and contracted cash flows from new asset additions, which may help support those payouts if operational headwinds can be managed accordingly.

Yet, in contrast, investors should be aware of the ongoing risk that low Alberta power prices and rising costs might...

Read the full narrative on TransAlta (it's free!)

TransAlta's narrative projects CA$2.3 billion revenue and CA$136.9 million earnings by 2028. This requires a 4.2% annual revenue decline and a CA$135.9 million earnings increase from CA$1.0 million currently.

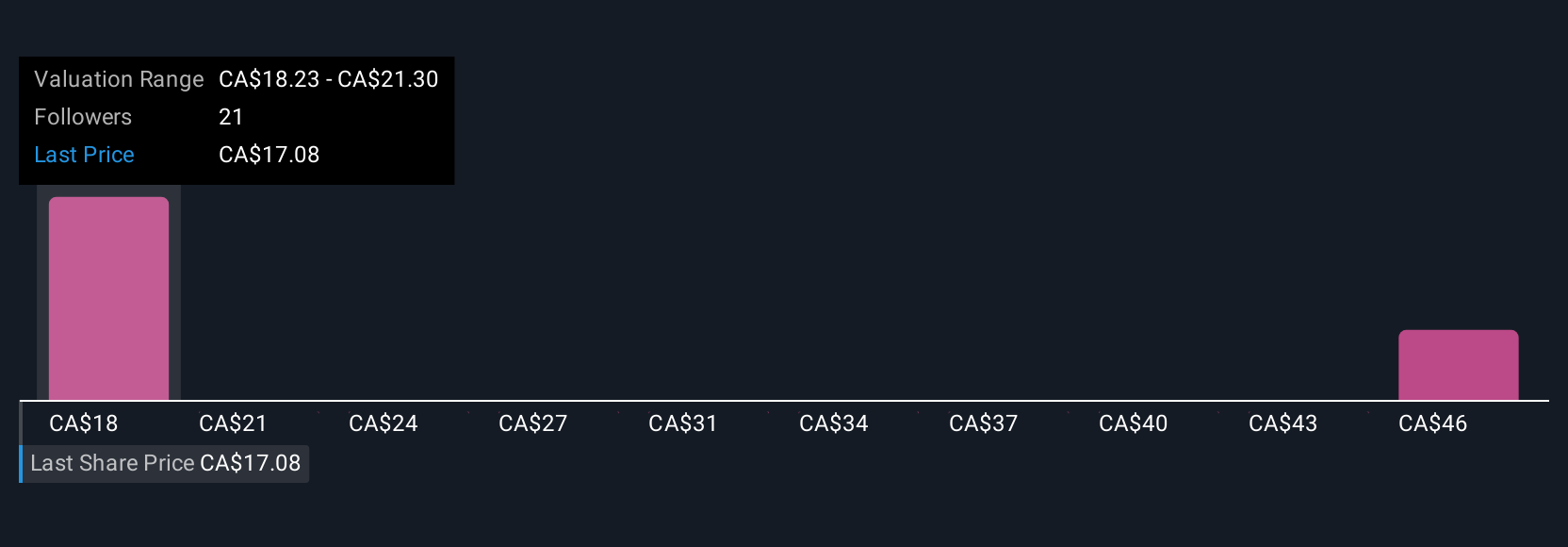

Uncover how TransAlta's forecasts yield a CA$18.23 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for TransAlta ranging from C$18.23 to C$48.19, based on two individual perspectives. These divergent views highlight debate around future earnings recovery, especially given current margin pressures and Alberta market risks.

Explore 2 other fair value estimates on TransAlta - why the stock might be worth over 2x more than the current price!

Build Your Own TransAlta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransAlta research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free TransAlta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransAlta's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransAlta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TA

TransAlta

Engages in the development, production, and sale of electric energy.

Good value low.

Similar Companies

Market Insights

Community Narratives