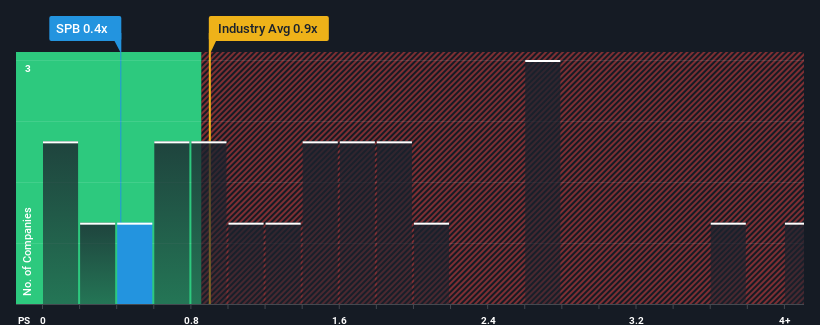

When close to half the companies operating in the Gas Utilities industry in Canada have price-to-sales ratios (or "P/S") above 1.4x, you may consider Superior Plus Corp. (TSE:SPB) as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Superior Plus

What Does Superior Plus' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Superior Plus has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Superior Plus will help you uncover what's on the horizon.How Is Superior Plus' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Superior Plus' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.7%. Still, the latest three year period has seen an excellent 48% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 48% growth forecast for the broader industry.

With this in consideration, its clear as to why Superior Plus' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Superior Plus' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Superior Plus' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Superior Plus that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SPB

Superior Plus

Distributes propane, compressed natural gas, and renewable energy and related products and services in the United States and Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives