- Canada

- /

- Renewable Energy

- /

- TSX:NPI

While shareholders of Northland Power (TSE:NPI) are in the red over the last three years, underlying earnings have actually grown

Northland Power Inc. (TSE:NPI) shareholders should be happy to see the share price up 14% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 48% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

On a more encouraging note the company has added CA$348m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Our free stock report includes 2 warning signs investors should be aware of before investing in Northland Power. Read for free now.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Northland Power became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. Northland Power has maintained its top line over three years, so we doubt that has shareholders worried. A closer look at revenue and profit trends might yield insights.

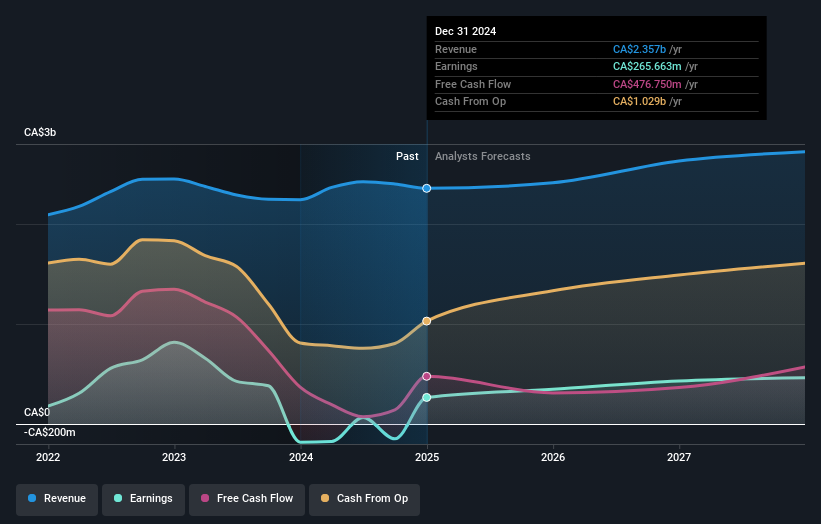

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Northland Power

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Northland Power the TSR over the last 3 years was -41%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Northland Power shareholders are down 4.1% for the year (even including dividends), but the market itself is up 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 4% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Northland Power you should be aware of, and 1 of them is a bit concerning.

Northland Power is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Northland Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NPI

Northland Power

Operates as a power producer in Canada, the Netherlands, Germany, Colombia, Spain, the United States, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives