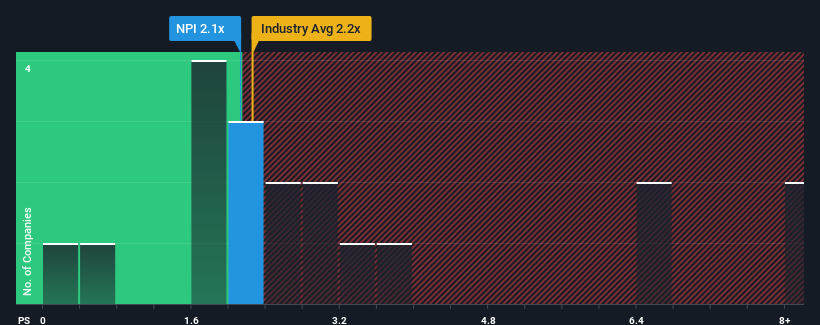

It's not a stretch to say that Northland Power Inc.'s (TSE:NPI) price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" for companies in the Renewable Energy industry in Canada, where the median P/S ratio is around 2.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Northland Power

What Does Northland Power's P/S Mean For Shareholders?

Northland Power could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Northland Power will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Northland Power's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.8% last year. The latest three year period has also seen a 23% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 3.5% per annum over the next three years. With the industry predicted to deliver 9.0% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Northland Power's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Northland Power's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You need to take note of risks, for example - Northland Power has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Northland Power, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Northland Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NPI

Northland Power

Operates as a power producer in Canada, the Netherlands, Germany, Colombia, Spain, the United States, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives