- Canada

- /

- Electric Utilities

- /

- TSX:H

Hydro One (TSX:H): Valuation Insights After Upgraded Earnings Guidance and Strong Q3 Results

Reviewed by Simply Wall St

Hydro One (TSX:H) just made headlines with its new earnings guidance, projecting annual earnings per share growth of 6% to 8% through 2027. This update was released together with a strong performance in its latest quarterly results.

See our latest analysis for Hydro One.

Hydro One’s upbeat forecasts and solid Q3 results have given its shares fresh momentum, helping drive a one-day share price return of 1.39% and pushing its year-to-date share price return to 20.77%. Encouraged by growing revenues, reliable dividends, and infrastructure investments, investors have also seen a total shareholder return of 24.56% over the past year. All of these factors point to sustained confidence in the company’s long-term outlook.

If Hydro One’s growth and dividend track record caught your attention, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But after such strong gains and higher earnings guidance, are investors still overlooking value in Hydro One? Or has the recent rally already priced in the company’s future prospects, leaving limited upside for new buyers?

Most Popular Narrative: 6% Overvalued

Despite Hydro One’s fair value estimate of CA$50.21, shares recently closed higher at CA$53.37. The favored narrative suggests the stock is priced above what future earnings and regulated returns might justify, which is an important distinction for value-focused investors.

“Surging electricity demand in Ontario, projected to grow 70% by 2050, along with government policy accelerating transmission and distribution infrastructure expansion, position Hydro One for sustained, rate base-driven revenue and earnings growth as electrification of transportation and industry advances. The provincial Integrated Energy Plan explicitly prioritizes new transmission and grid modernization projects for Hydro One, enhancing multi-year capital investment visibility and supporting higher regulated asset base, which should boost future allowed revenues and long-term EPS growth.”

Want to know why the market is assigning Hydro One a premium price? It all comes down to hot forecasts. This narrative hinges on major assumptions about future profitability, capital spending, and regulatory support. How bullish are the earnings and growth projections? Uncover the core numbers and scenario that drives this valuation when you read the full story.

Result: Fair Value of $50.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital needs and regulatory uncertainty could dampen future earnings and put pressure on Hydro One’s steady growth narrative.

Find out about the key risks to this Hydro One narrative.

Another View: DCF Model Sees Different Value

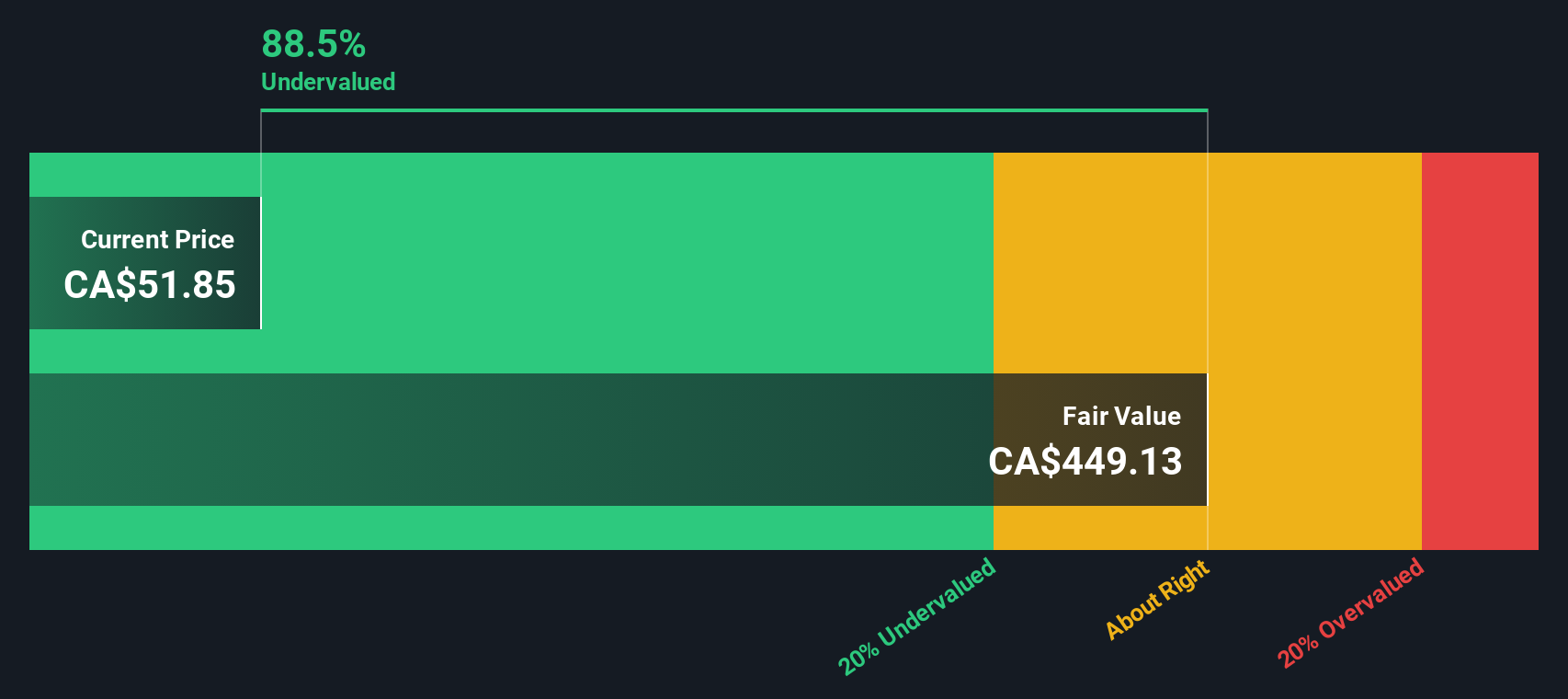

Taking a step back from multiples and looking instead at the SWS DCF model, we see a very different outcome. According to our DCF, Hydro One appears dramatically undervalued, which suggests the market may be overlooking potential upside. Does this point to a missed opportunity, or is DCF being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hydro One for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hydro One Narrative

If you have a different take on Hydro One’s outlook or want to break down the numbers your own way, the platform lets you craft your perspective in just a few minutes with Do it your way.

A great starting point for your Hydro One research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your potential to just one company? Level up your research and capture tomorrow’s biggest investment stories with these smart stock themes traders are already talking about:

- Unlock consistent income streams by tapping into these 15 dividend stocks with yields > 3% with attractive yields and robust payout histories.

- Ride the momentum of technological progress by starting with these 27 AI penny stocks, which are driving breakthroughs in automation, data, and the future of industry.

- Catch hidden market gems before they take off by targeting these 3585 penny stocks with strong financials that showcase powerful fundamentals and real growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydro One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:H

Hydro One

Through its subsidiaries, operates as an electricity transmission and distribution company in Ontario.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives