- Canada

- /

- Electric Utilities

- /

- TSX:FTS

Fortis (TSX:FTS) Margins Edge Higher, Reinforcing Value Narrative Despite Dividend Sustainability Concerns

Reviewed by Simply Wall St

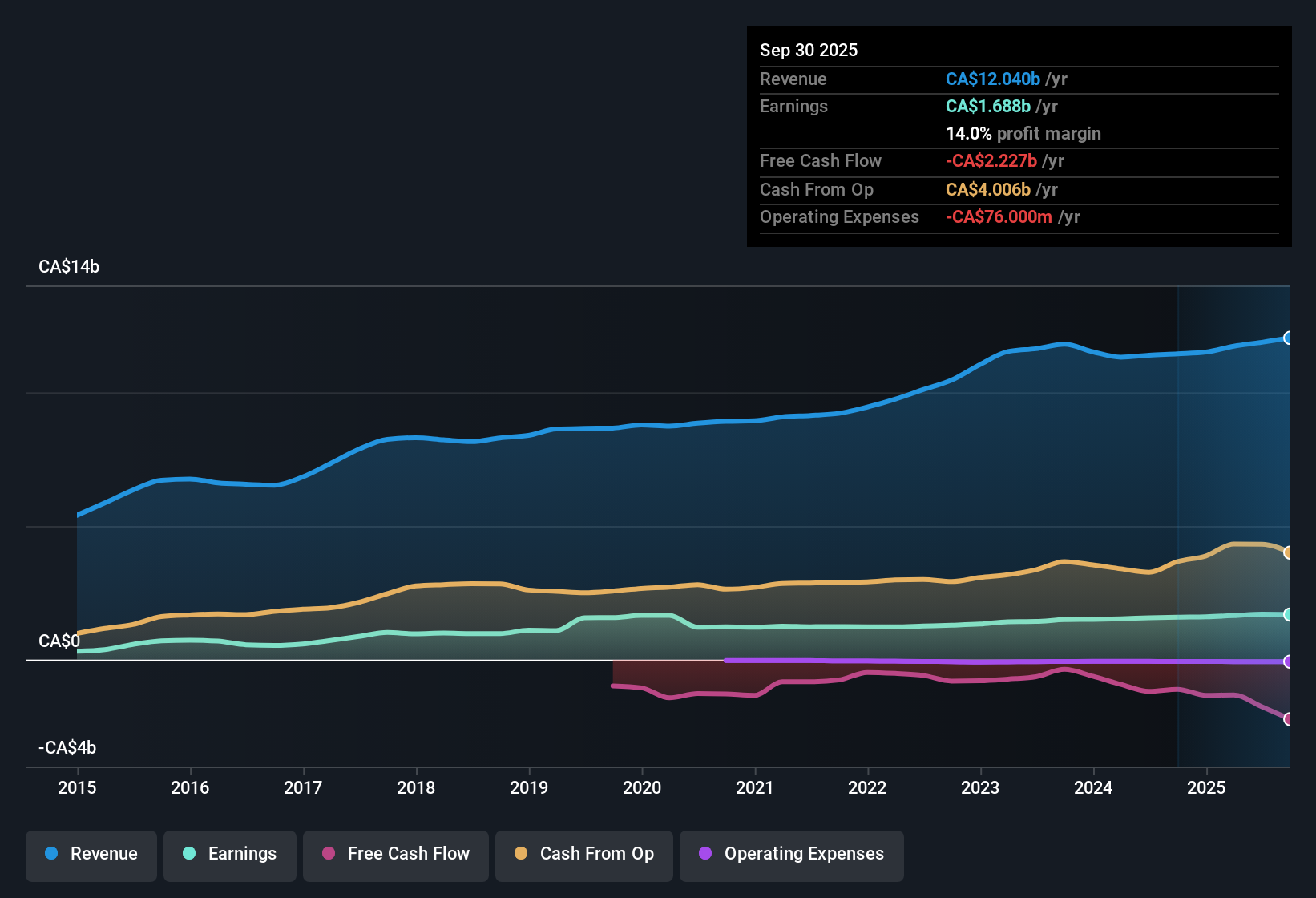

Fortis (TSX:FTS) reported net profit margins of 14.1%, a slight uptick from last year’s 13.9%. The company grew earnings at an annualized rate of 7.8% over the past five years. Its shares are trading at CA$71.24, below an estimated fair value of CA$270.48. The forward-looking earnings growth forecast is 6.9% per year, lagging the broader Canadian market’s 12.1% pace. Margins remain healthy, but with flagged risks around dividend sustainability and financial position, investors will be focused on ongoing profit and revenue trends as value metrics remain attractive.

See our full analysis for Fortis.The next section will put these earnings numbers side by side with the major narratives surrounding Fortis to see which stories hold up and which might be due for a rethink.

See what the community is saying about Fortis

Margins Remain Above 14% Despite Slower Growth

- Profit margin ticked up to 14.1%, extending last year’s 13.9% and staying well above the 10 to 12% range often seen in the sector.

- According to the analysts' consensus view, rising margins offer a buffer against slower earnings and revenue growth over the coming years.

- Consensus narrative notes that policy-driven decarbonization and supportive regulations, such as higher allowed ROEs and formulaic rate plans, are expected to further improve net margins and enable faster cost recovery in the near future.

- They also highlight that, while margins are rebounding, persistently high regulatory scrutiny and possible ROE reductions, especially in Alberta, could still limit upside if oversight becomes more stringent or investment cycles are delayed.

- To see how these margin trends stack up against analyst forecasts and where the balanced view sees the real inflection point, read the full Consensus Narrative. 📊 Read the full Fortis Consensus Narrative.

DCF Fair Value Signals Big Discount

- Shares trade at CA$71.24, a steep 74% discount to the DCF fair value of CA$270.48, even though sell-side analysts set their price target at CA$69.47, in line with the current market price.

- In the analysts' consensus view, Fortis’s deep discount to fair value reflects how the market is weighing steady, inflation-protected returns against flagged risks such as financial leverage and policy shifts.

- Consensus narrative anchors the valuation gap to confidence in Fortis’s regulated asset base and earnings visibility, emphasizing that continued capital spending on energy infrastructure supports long-term profit stability, even with muted revenue growth forecasts of 4.1% per year.

- At the same time, analysts warn that ongoing regulatory pushback, rising capital costs, and uncertainty over tax credits in the U.S. could keep the stock locked at discounted levels unless Fortis proves the resilience of its future cash flows.

Capital Investment Pace Raises Debt Risk

- Fortis is targeting $2.9 billion in capital spending for the first half of 2025, driving up leverage and heightening exposure to changing interest rates.

- The consensus narrative notes that while bulls point to these investments as expanding Fortis’s regulated returns and supporting dividend growth, critics highlight that ballooning capex may pressure net earnings and credit ratings, especially if rising debt service costs are not offset by improved margins.

- Analysts clarify that Fortis’s projected 6.9% annualized earnings growth depends on successfully ramping up these projects, but delays, regulatory lag, or shifts in policy could challenge that outlook.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fortis on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? Shape your unique perspective and craft your narrative in just a few minutes. Do it your way

A great starting point for your Fortis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Fortis maintains strong margins and a hefty asset base, debt-fueled capital spending puts pressure on its financial health and future earnings stability.

If you want companies with sturdier financial footing instead, use our solid balance sheet and fundamentals stocks screener (1979 results) to identify businesses with low debt and resilient balance sheets ready for any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FTS

Fortis

Operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives