- Canada

- /

- Electric Utilities

- /

- TSX:EMA

This Is The Reason Why We Think Emera Incorporated's (TSE:EMA) CEO Might Be Underpaid

The solid performance at Emera Incorporated (TSE:EMA) has been impressive and shareholders will probably be pleased to know that CEO Scott Balfour has delivered. This would be kept in mind at the upcoming AGM on 20 May 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

See our latest analysis for Emera

Comparing Emera Incorporated's CEO Compensation With the industry

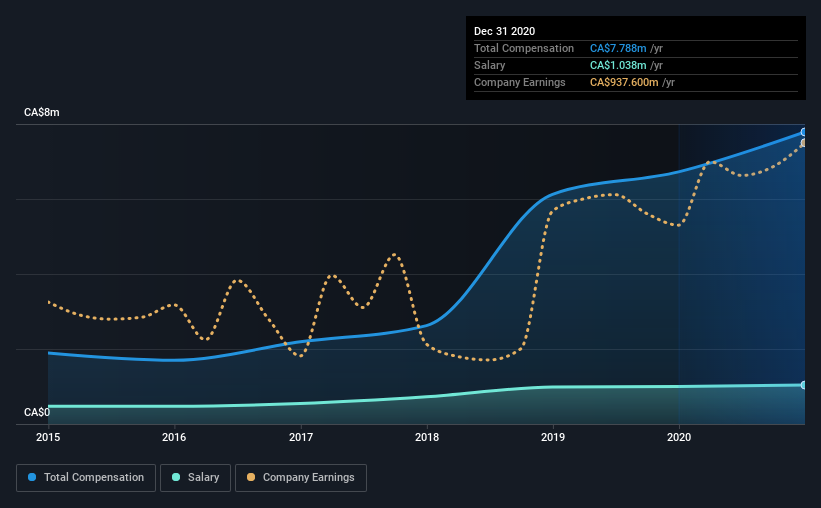

At the time of writing, our data shows that Emera Incorporated has a market capitalization of CA$14b, and reported total annual CEO compensation of CA$7.8m for the year to December 2020. We note that's an increase of 16% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$1.0m.

On comparing similar companies in the industry with market capitalizations above CA$9.7b, we found that the median total CEO compensation was CA$13m. In other words, Emera pays its CEO lower than the industry median. Furthermore, Scott Balfour directly owns CA$3.4m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$1.0m | CA$1.0m | 13% |

| Other | CA$6.7m | CA$5.7m | 87% |

| Total Compensation | CA$7.8m | CA$6.7m | 100% |

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. Although there is a difference in how total compensation is set, Emera more or less reflects the market in terms of setting the salary. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Emera Incorporated's Growth

Over the past three years, Emera Incorporated has seen its earnings per share (EPS) grow by 54% per year. It saw its revenue drop 9.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Emera Incorporated Been A Good Investment?

Boasting a total shareholder return of 58% over three years, Emera Incorporated has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for Emera you should be aware of, and 1 of them is significant.

Important note: Emera is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Emera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EMA

Emera

An energy and services company, invests in generation, transmission, and distribution of electricity in the United States, Canada, Barbados, and the Bahamas.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion