- Canada

- /

- Electric Utilities

- /

- TSX:EMA

A Look at Emera (TSX:EMA) Valuation Following Strong Q3 Revenue and Profit Growth

Reviewed by Simply Wall St

Emera (TSX:EMA) has just released its third quarter earnings, reporting a significant increase in both revenue and net income compared to last year. These results may prompt investors to reconsider their outlook on the stock.

See our latest analysis for Emera.

Emera’s robust third quarter numbers have built on an already strong run for the stock, with the share price up nearly 27% year to date and a total shareholder return of 41% over the past twelve months. That kind of momentum, especially after such a significant jump in both revenue and profit, suggests investors are growing more confident about the company’s outlook and its ability to deliver consistent returns over time.

If you’re interested in seeing what other companies have delivered impressive results lately, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares near their analyst target and mounting gains already delivered, the question becomes whether Emera is still undervalued or if the market is already factoring in all the future growth potential for investors.

Most Popular Narrative: Fairly Valued

Emera’s current share price of CA$67.89 is almost indistinguishable from its narrative fair value of CA$67.54. This suggests little gap between consensus expectations and today’s market price. Investors looking for a disconnect between market opinion and fundamentals may find this match striking.

*Emera stands to benefit from accelerating electricity demand driven by electrification in Florida and Atlantic Canada. There is significant near-term and longer-term potential from ongoing discussions to support hundreds of megawatts of prospective new data center load that is not yet included in their current capital or earnings forecasts. This scenario could drive revenue and future earnings above current expectations.*

Want to know the growth blueprint behind this valuation? The linchpin of the narrative is unusually optimistic revenue and margin increases projected years ahead. If you’re curious about the big financial bets underpinning this price, follow the trail that analysts are using to justify their target.

Result: Fair Value of $67.54 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or regulatory delays could undermine Emera’s outlook. These factors could potentially constrain revenue growth and challenge the bullish consensus.

Find out about the key risks to this Emera narrative.

Another View: What About the SWS DCF Model?

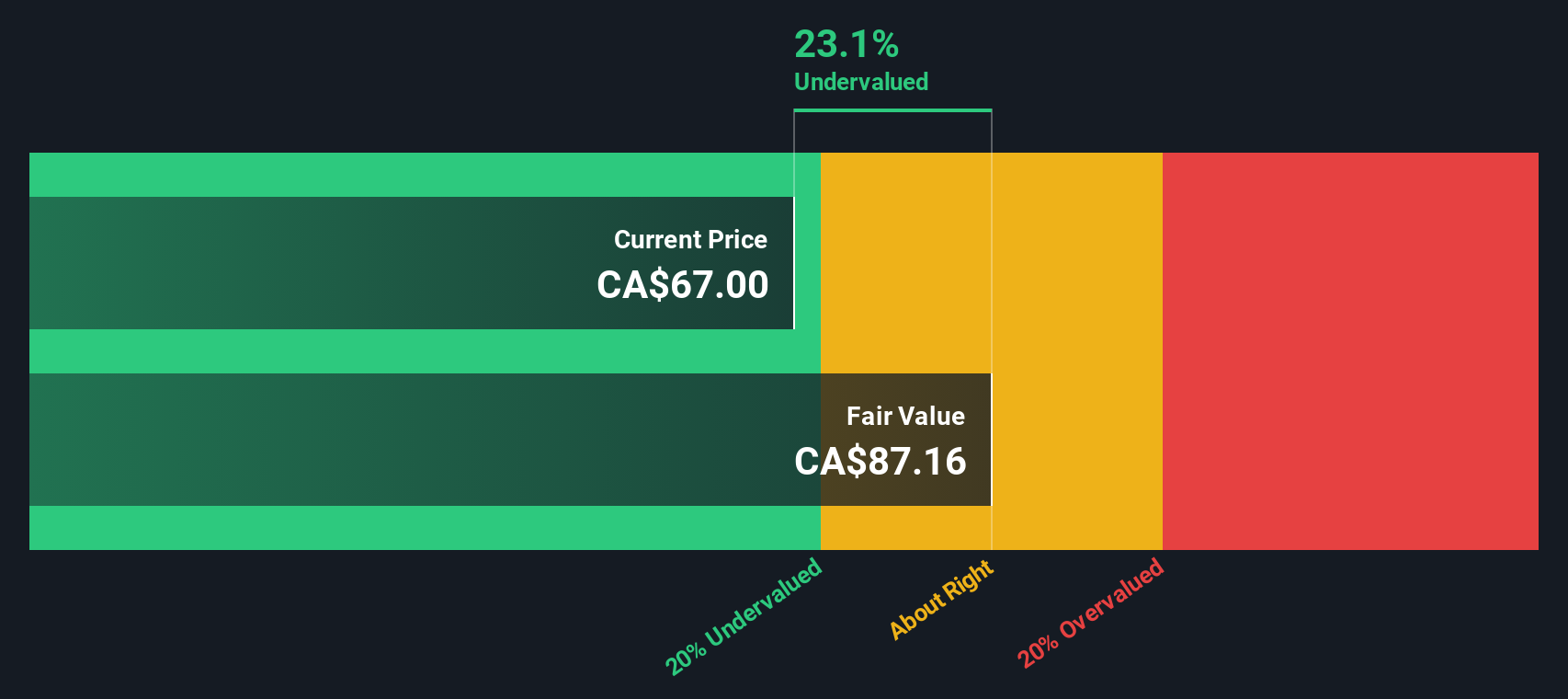

While the current fair value estimate suggests Emera is priced about right according to market expectations, our SWS DCF model paints a different picture. This approach, which weighs future cash flows, indicates Emera could be trading at a 22.7% discount to its fair value. Could this method be uncovering hidden value, or is the market cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Emera Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Emera research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let strong opportunities slip by. The right tools can spotlight hidden winners before the crowd catches on, fueling confident moves with your next investment.

- Capture unrivaled potential by backing companies with robust earnings and steady income by tapping into these 15 dividend stocks with yields > 3%.

- Join the search for market-beating growth and stability with the hottest trends in healthcare and tech. See what’s possible through these 31 healthcare AI stocks.

- Unlock powerful gains by finding top picks overlooked by others in these 885 undervalued stocks based on cash flows that are built on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EMA

Emera

An energy and services company, invests in generation, transmission, and distribution of electricity in the United States, Canada, Barbados, and the Bahamas.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives