- Canada

- /

- Other Utilities

- /

- TSX:CU

Canadian Utilities (TSE:CU) Will Pay A Larger Dividend Than Last Year At CA$0.4577

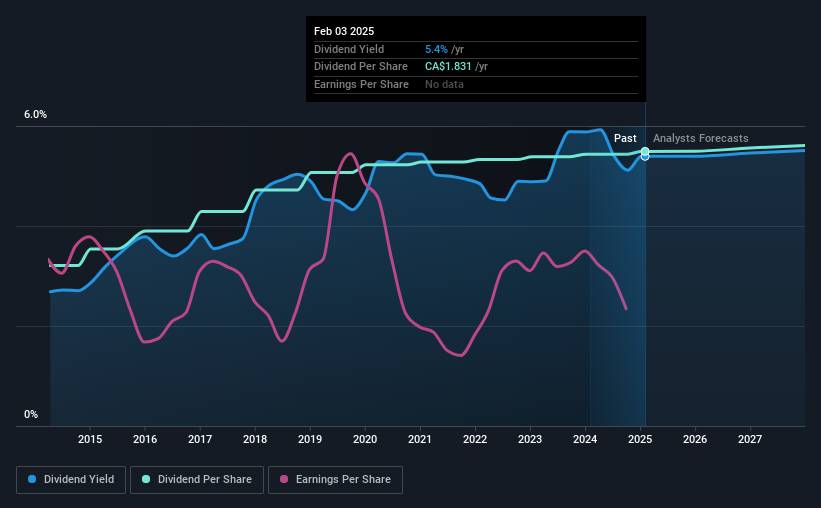

The board of Canadian Utilities Limited (TSE:CU) has announced that it will be paying its dividend of CA$0.4577 on the 1st of March, an increased payment from last year's comparable dividend. This makes the dividend yield about the same as the industry average at 5.4%.

Check out our latest analysis for Canadian Utilities

Canadian Utilities' Future Dividends May Potentially Be At Risk

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Before making this announcement, the company's dividend was much higher than its earnings. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Looking forward, EPS could fall by 15.5% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 145%, which is definitely a bit high to be sustainable going forward.

Canadian Utilities Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2015, the annual payment back then was CA$1.07, compared to the most recent full-year payment of CA$1.83. This implies that the company grew its distributions at a yearly rate of about 5.5% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 16% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Although they have been consistent in the past, we think the payments are a little high to be sustained. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 3 warning signs for Canadian Utilities that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026