- Canada

- /

- Renewable Energy

- /

- TSX:CPX

Capital Power (TSX:CPX) One-Off Gain Boosts Earnings, Challenging Bullish Margin Narratives

Reviewed by Simply Wall St

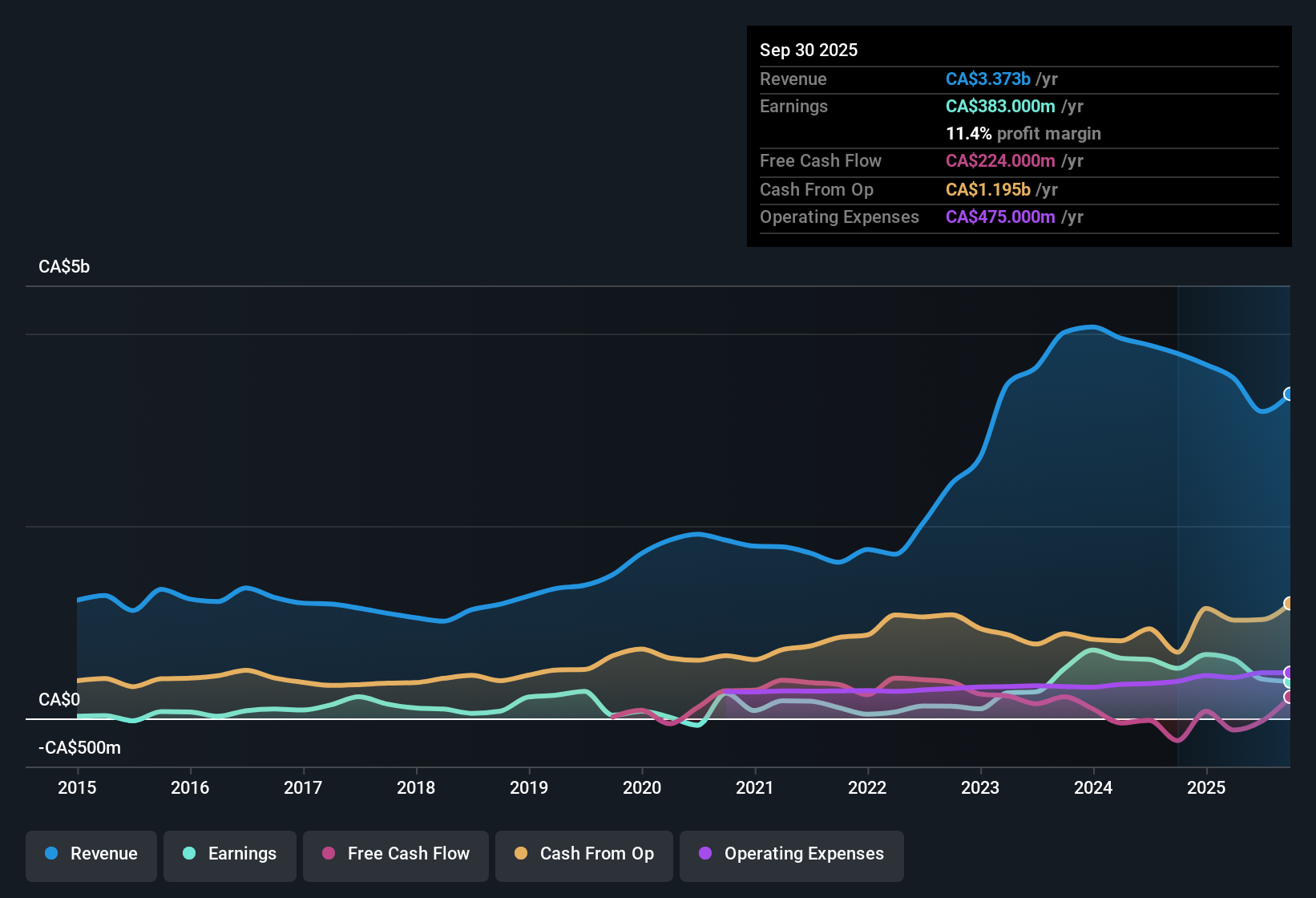

Capital Power (TSX:CPX) has posted eye-catching headline numbers, with earnings rising at an average annual rate of 33.9% over the past five years, despite a slip into negative earnings growth in the most recent period. Net profit margin dropped to 11.7% from last year’s 13.7%, and the bottom line was boosted by a one-off CA$290.0 million gain. Looking ahead, revenue is forecast to grow at 4.1% per year, trailing the Canadian market’s 5%, while earnings are expected to accelerate by 21.3% per year, pacing well ahead of the sector. Investors are weighing this strong growth outlook against a premium 27x P/E ratio as well as notable risks around financial quality, share dilution, and dividend sustainability.

See our full analysis for Capital Power.Next up, we’ll see how the headline figures fit alongside the current narratives. This includes where consensus holds and where the numbers challenge expectations.

See what the community is saying about Capital Power

Profit Margins Slide as One-Off Gains Boost Bottom Line

- Net profit margin fell to 11.7% from 13.7% last year. This year's result was propped up by a one-time gain of CA$290.0 million, indicating that reported profitability may not reflect underlying trends.

- According to the analysts' consensus view, recurring earnings growth could be constrained going forward if non-operating gains fade and profit margins continue to shrink.

- Consensus notes margins could decline further to 12.8% within three years, which points to pressure from rising costs and competitive dynamics.

- Forecasts show annual profit could fall from CA$614.0 million today to CA$521.7 million by July 2028 if operational challenges persist.

Share Dilution and Lower Quality Earnings Raise Red Flags

- The number of shares outstanding is expected to rise by 7.0% per year over the next three years, reducing the benefit of any per-share earnings growth.

- Consensus narrative highlights that increasing share count and reliance on one-off income gains weaken earnings quality and can limit upside for shareholders.

- Rising dilution makes it harder for true underlying EPS to keep up with headline growth rates, which poses a headwind for long-term value creation.

- The trend of one-time boosts requires scrutiny, as bulls counting on sustainable earnings may be overstating operational momentum.

Premium Valuation Despite Price Below DCF Fair Value

- At a 27x P/E, Capital Power trades above both its peer average (21x) and the global renewables industry (17.2x). Its CA$70.21 share price sits at a steep discount to DCF fair value of CA$210.32.

- Consensus narrative flags that a premium multiple is only justified if robust growth and margin assumptions play out, while analyst price target of CA$75.96 offers only modest upside.

- The narrow 6.7% gap between current price and target suggests analysts see fair pricing. Expectations are high, and any disappointment on growth or margins could weigh on the shares.

- Investors may want to examine whether guided earnings growth and margin forecasts are truly achievable in light of competitive and market risks.

If you want to see how the broader consensus narrative stacks up against these latest financial figures, check out the full story in the analyst consensus breakdown. 📊 Read the full Capital Power Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Capital Power on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these figures tell a different story to you? Take just a few minutes to capture your insights and shape a personal take: Do it your way

A great starting point for your Capital Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Capital Power’s rising share count, reliance on one-time gains, and contracting margins raise doubts about its true earnings quality and sustainable valuation.

If you’re looking for companies where the price better reflects their sustainable cash flows, focus on stronger opportunities with these 834 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives