- Canada

- /

- Renewable Energy

- /

- TSX:BLX

Boralex (TSX:BLX): Assessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Boralex (TSX:BLX) shares have caught the eye recently, up roughly 2% over the past week and 5% in the past month. Investors are taking a closer look at the company as it experiences this modest rebound.

See our latest analysis for Boralex.

This uptick in Boralex's share price comes against a challenging backdrop, with the stock still reflecting a 12.8% total shareholder return loss over the past year. While recent gains hint at renewed confidence or shifting growth expectations, overall momentum remains muted compared to long-term performance.

If Boralex’s recent rebound has you thinking more broadly, this could be the right moment to expand your watchlist and discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst targets and recent growth in revenue and net income, investors are left to wonder if Boralex is undervalued now or if the market is fully factoring in future opportunities.

Most Popular Narrative: 25% Undervalued

Boralex’s narrative fair value sits well above its last close, projecting meaningful upside for investors if growth unfolds as outlined. This sets the stage for a closer look at the underlying thesis that sets these expectations apart from prevailing market sentiment.

Large increases in North American clean electricity demand, driven by government policy shifts such as Quebec's Bill 69 and Ontario's new procurement windows, are expected to create significant opportunities for Boralex to capture new PPAs and expand its asset base. This is likely to drive revenue and earnings growth through greater market share.

Can Boralex's position in the renewables race actually power this level of growth? The narrative hinges on a bold leap in profitability and a projected market multiple more often reserved for high-growth disruptors. What are the numbers behind this confidence? Find out which aggressive forecasts anchor this eye-catching fair value.

Result: Fair Value of $38.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, exposure to falling contract prices in France and unpredictable weather patterns could disrupt Boralex’s growth and affect future earnings confidence.

Find out about the key risks to this Boralex narrative.

Another View: Market Ratios Tell a Different Story

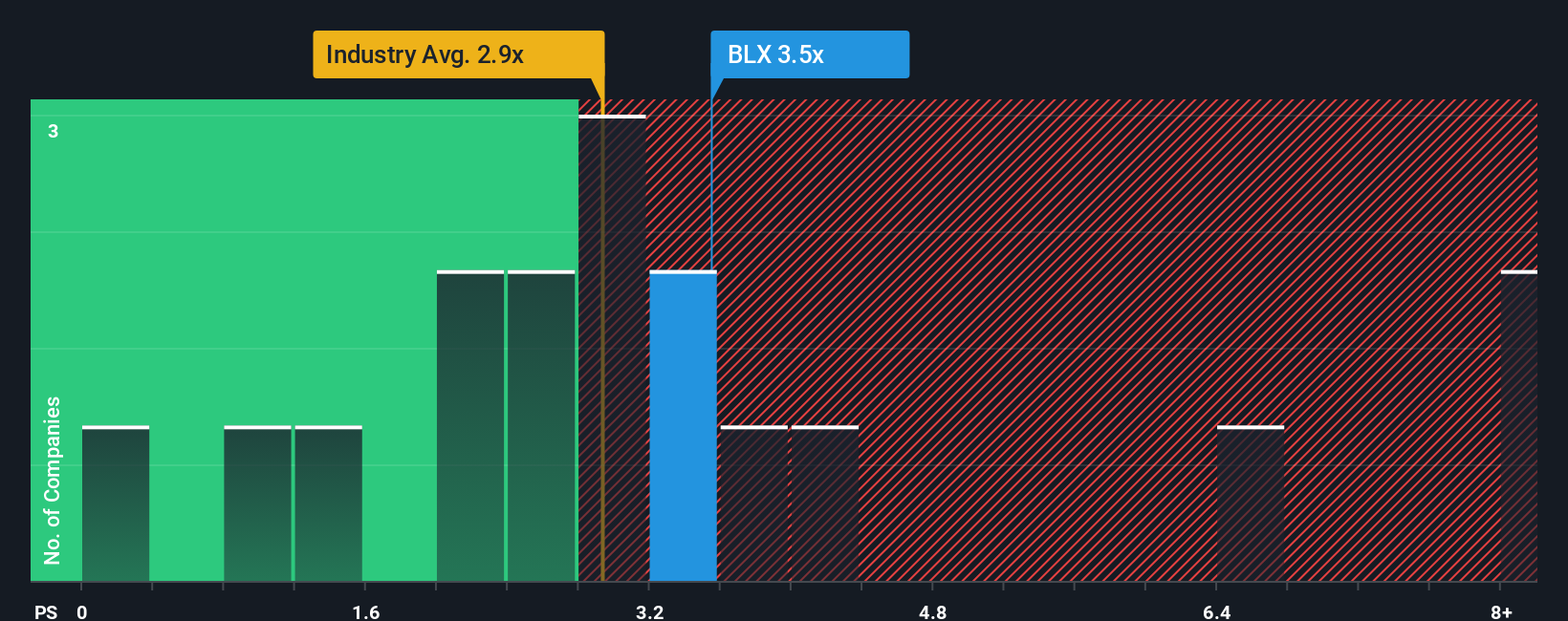

Looking at Boralex through the lens of its price-to-sales ratio casts doubt on the deep value suggested by other methods. The company trades at 3.5 times sales, which is higher than both the North American industry average of 2.8 and its peers at 3.0. However, the fair ratio is even higher at 3.9, suggesting there could still be room to move up if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boralex Narrative

If you see things differently or want to dig into the figures on your terms, it only takes a few minutes to craft your own take. Do it your way

A great starting point for your Boralex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to get ahead. Some of the best opportunities are just a few clicks away in Simply Wall Street's specialized stock screeners. Take your next step here:

- Unlock real income potential and tap into these 21 dividend stocks with yields > 3% with impressive yields over 3% for steady, reliable returns.

- Catch the early movers shaking up artificial intelligence, and profit from breakthroughs with these 26 AI penny stocks that stand at the forefront of innovation.

- Target tomorrow’s undervalued champions. Seize your advantage now with these 866 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boralex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BLX

Boralex

Engages in the developing, building, and operating power generating and storage facilities in Canada, France, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives