- Canada

- /

- Renewable Energy

- /

- TSX:BEP.UN

Brookfield Renewable (TSX:BEP.UN): Is Recent Momentum Justified by Current Valuation?

Reviewed by Simply Wall St

See our latest analysis for Brookfield Renewable Partners.

Brookfield Renewable Partners’ recent rally has pushed its share price up nearly 12% over the past month, adding to a sharp 28% gain year to date. The company’s total shareholder return stands at 29% for the past year, reflecting renewed optimism around renewables and growing confidence in its business model. Momentum is clearly building, with recent gains outpacing longer-term performance and suggesting that investor sentiment toward the sector has shifted in a positive direction.

If you’re watching renewables make headlines and want to broaden your search, now is a good time to discover fast growing stocks with high insider ownership

But with shares rallying and recent results drawing attention, investors are left to wonder whether Brookfield Renewable Partners is still trading at a bargain. Has the market already factored in the company’s future growth prospects, leaving little room for upside?

Most Popular Narrative: 7.9% Overvalued

Brookfield Renewable Partners closed at CA$42.75, while the most widely followed narrative assigns a fair value roughly 8% lower. This gap is stirring debate about whether momentum can keep pushing the share price higher or if expectations are becoming too optimistic.

Ongoing decline in battery and renewable energy technology costs, combined with increasing grid modernization and the need for 24/7 clean power, positions Brookfield's diversified portfolio (including recent Neoen acquisition and major battery pipeline) to capture higher-margin growth and expand overall earnings and net margins.

Want to know what powers this premium valuation? The narrative is built around blockbuster growth assumptions and bullish sector tailwinds. The real headline is a financial forecast with some bold upgrades few saw coming. See which numbers justify this price and if the reasoning stacks up.

Result: Fair Value of $39.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a shift in U.S. policy or weaker hydroelectric output could quickly challenge Brookfield’s growth assumptions and limit investor optimism.

Find out about the key risks to this Brookfield Renewable Partners narrative.

Another View: SWS DCF Model Questions the Market Price

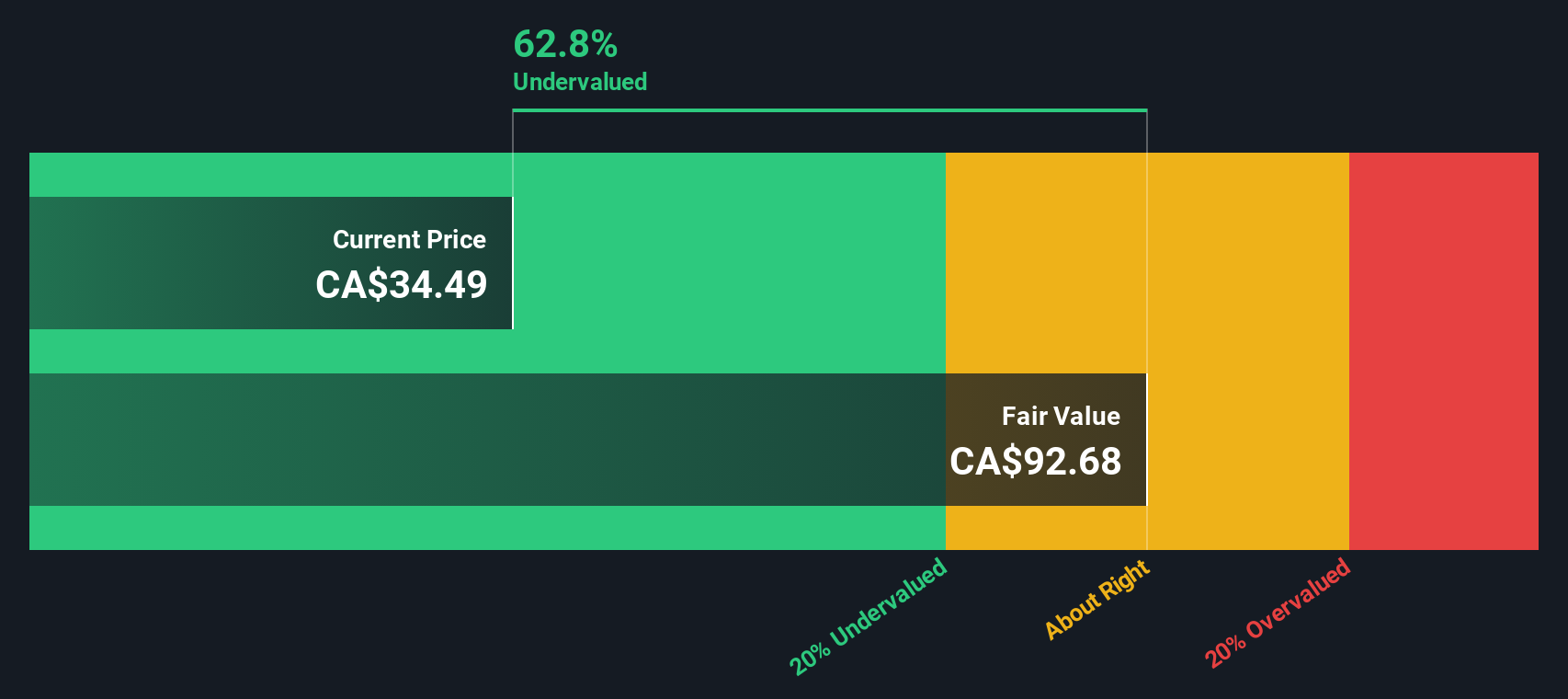

While analysts see Brookfield Renewable Partners as overvalued based on typical market multiples, our SWS DCF model tells a very different story. According to this discounted cash flow approach, the company trades at a steep 64% discount to its estimated fair value of CA$119.84. Could investors be overlooking long-term potential? Does the DCF fail to account for near-term risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Renewable Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Renewable Partners Narrative

If you have a different take or want to dig into the numbers yourself, you can quickly put together your own perspective and see how it compares. Do it your way.

A great starting point for your Brookfield Renewable Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next great investing opportunity right now. Waiting could mean missing out on the stocks set to make tomorrow's headlines. Use these handpicked screens to get a real edge:

- Tap into future-defining breakthroughs in computing by checking out these 27 quantum computing stocks with enormous growth potential on the horizon.

- Start earning more from your portfolio by targeting income opportunities with these 20 dividend stocks with yields > 3% offering standout yields above 3%.

- Catch early-stage tech disruptors set for rapid growth by exploring these 26 AI penny stocks that are shaping the AI landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEP.UN

Brookfield Renewable Partners

Owns a portfolio of renewable power generating facilities in North America, Colombia, and Brazil.

Fair value with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion