Stock Analysis

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like AltaGas (TSE:ALA), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for AltaGas

How Fast Is AltaGas Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that AltaGas has managed to grow EPS by 18% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

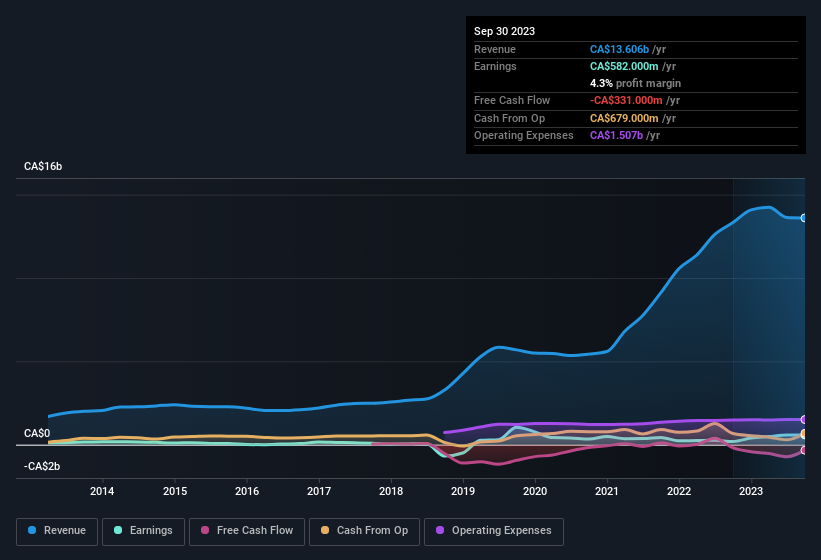

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note AltaGas achieved similar EBIT margins to last year, revenue grew by a solid 2.1% to CA$14b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of AltaGas' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are AltaGas Insiders Aligned With All Shareholders?

Since AltaGas has a market capitalisation of CA$8.4b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they hold CA$65m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 0.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does AltaGas Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into AltaGas' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in AltaGas' continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Before you take the next step you should know about the 4 warning signs for AltaGas (1 is significant!) that we have uncovered.

Although AltaGas certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Canadian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether AltaGas is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ALA

AltaGas

AltaGas Ltd. operates as an energy infrastructure company in North America.

Undervalued with proven track record.