- Canada

- /

- Gas Utilities

- /

- TSX:ALA

How Investors Are Reacting To AltaGas (TSX:ALA) Turning Profitable and Securing Major Export Agreements

Reviewed by Simply Wall St

- AltaGas Ltd. recently reported a turnaround in its second-quarter results, moving from a net loss a year ago to a net profit of CA$175 million on sales of CA$2.84 billion, alongside announcing new long-term export agreements with Pembina Pipeline and BASF for its Ridley Island facilities.

- These developments signal not only improved operational performance but also reflect growing demand and customer diversification in its global energy export business.

- We'll now consider how these strengthened export partnerships might influence the company's outlook within its established investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

AltaGas Investment Narrative Recap

For AltaGas shareholders, conviction often hinges on the ability of export growth and recurring infrastructure revenues to offset project challenges and regulatory constraints. The latest round of long-term export agreements and improved earnings in Q2 2025 suggest progress on customer diversification and steadying financial performance; however, the most critical short-term catalyst, timely, cost-controlled completion of the Ridley Island Energy Export Facility, remains, while delays or overruns on this and other capital projects stay a material risk. This news reinforces the outlook but does not dramatically upend these near-term priorities or threats.

The new long-term agreement with Pembina Pipeline for expanded propane export capacity is particularly relevant, as it directly supports a key catalyst: filling and optimizing AltaGas’s Ridley Island assets to drive higher export volumes. This partnership with a major Canadian pipeline operator indicates ongoing demand and visibility for the company's export infrastructure, offering some validation of AltaGas’s investment thesis around infrastructure-led growth in the energy export market.

By contrast, investors should be aware of the risk that if large projects like REEF experience significant delays or budget overruns…

Read the full narrative on AltaGas (it's free!)

AltaGas is projected to achieve CA$15.0 billion in revenue and CA$848.3 million in earnings by 2028. This outlook is based on an anticipated 5.6% annual revenue growth rate and a CA$286.3 million earnings increase from the current earnings of CA$562.0 million.

Uncover how AltaGas' forecasts yield a CA$42.64 fair value, a 3% upside to its current price.

Exploring Other Perspectives

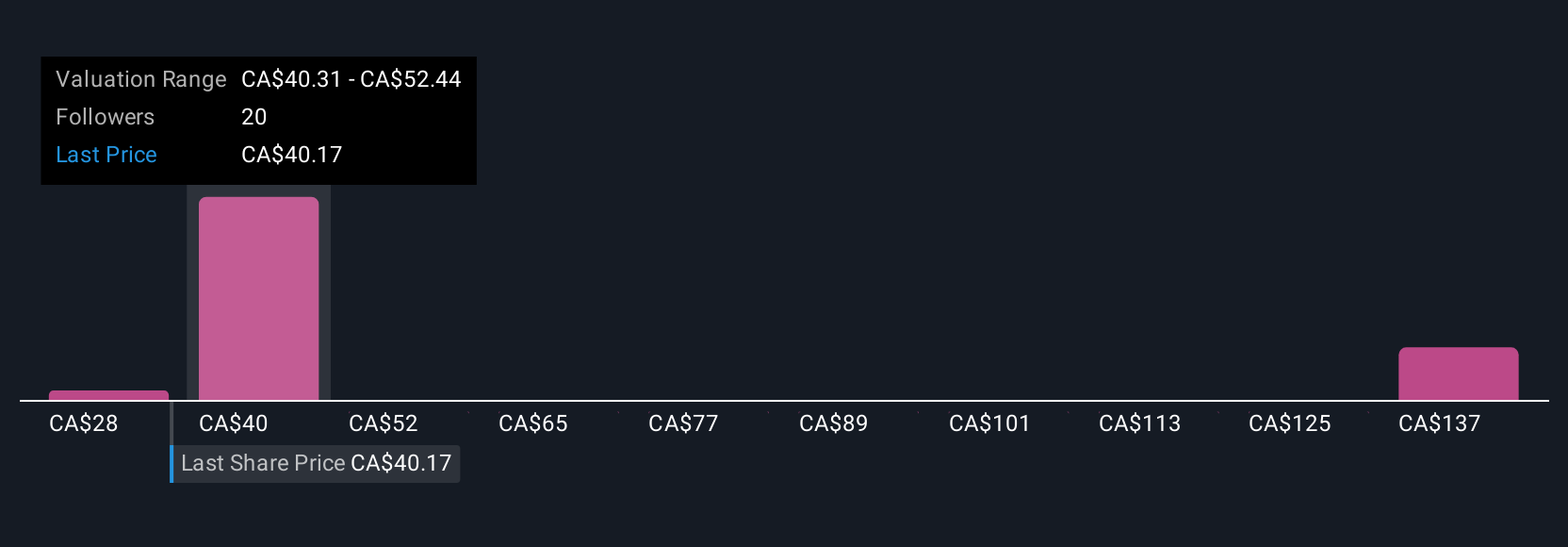

Fair value estimates from four members of the Simply Wall St Community span from CA$28.17 to CA$150.48 per share. Considering ongoing capital project risks, opinions about AltaGas's outlook and value can differ widely, explore these distinct viewpoints for a fuller understanding.

Explore 4 other fair value estimates on AltaGas - why the stock might be worth 32% less than the current price!

Build Your Own AltaGas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AltaGas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AltaGas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AltaGas' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALA

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives