- Canada

- /

- Gas Utilities

- /

- TSX:ALA

AltaGas (TSX:ALA) Net Profit Margin Rises to 5.9%, Testing Bull Narrative

Reviewed by Simply Wall St

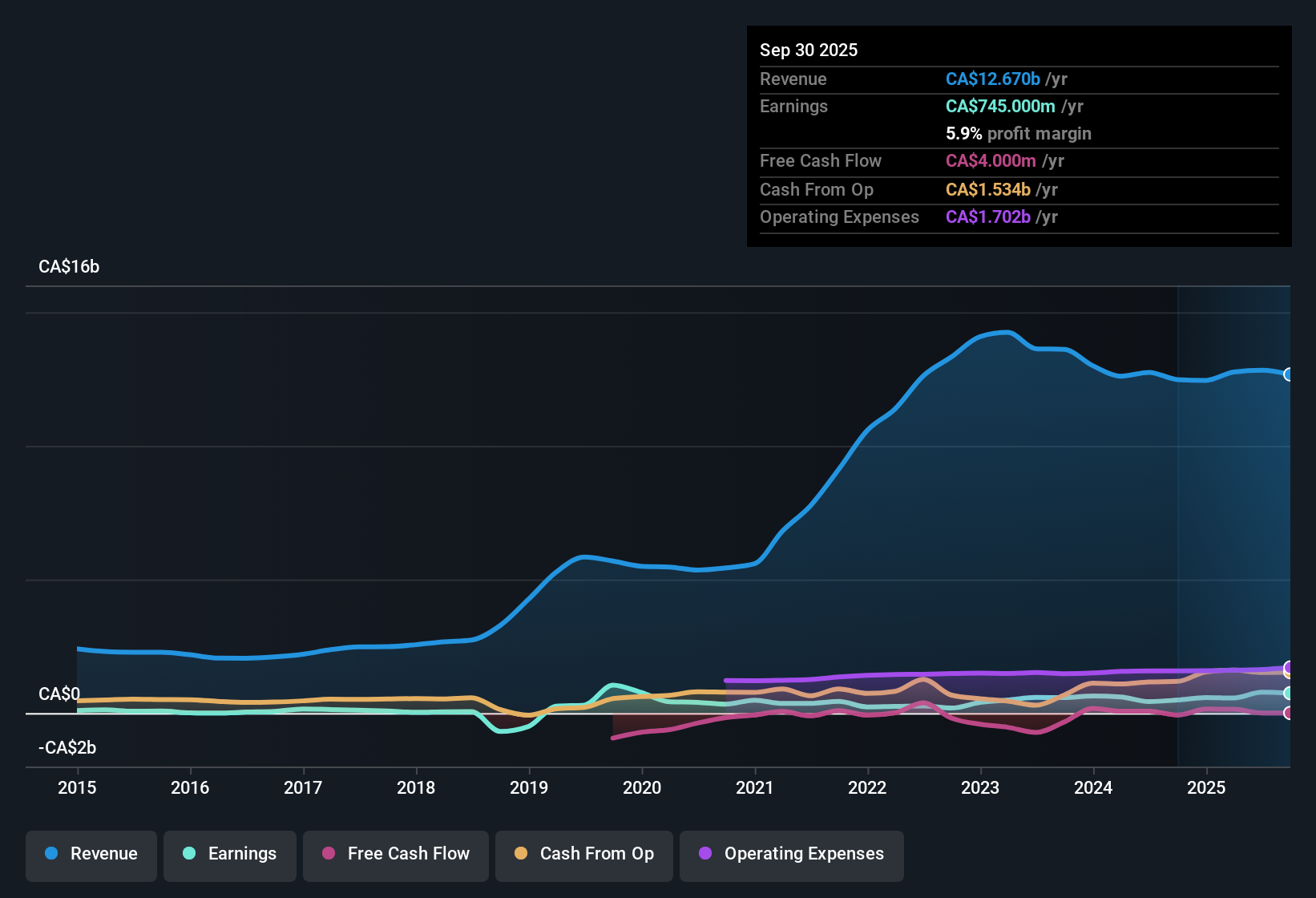

AltaGas (TSX:ALA) reported a net profit margin of 5.9%, up from 3.9% a year ago, with earnings growth over the past year reaching 52.7%, compared to its five-year average growth rate of 16.4%. The company’s share price is CA$41.17, trading below the discounted cash flow fair value estimate of CA$158.12. Its price-to-earnings ratio is 16.6x, which is above industry averages but well below peer benchmarks. With recent margin momentum and forecasted revenue growth of 5.8% per year, slightly higher than the Canadian market average of 5%, AltaGas presents mixed signals. Operational improvements are evident, but earnings are projected to modestly decline by -0.4% annually over the next three years.

See our full analysis for AltaGas.Next, we’ll compare these numbers to the stories investors are telling to see where the latest results align with or challenge the community narrative around AltaGas.

See what the community is saying about AltaGas

Profit Margin Expansion vs. Shrinking Guidance

- AltaGas's current net profit margin sits at 5.9%, which is an increase from last year's 3.9%, but analysts now forecast this margin to shrink to 5.1% over the next three years.

- According to the analysts' consensus narrative, recent operational efficiencies and modernization efforts are credited for margin gains.

- However, consensus also points to upcoming margin pressure from higher infrastructure investment and policy risks related to decarbonization policy and regulatory changes.

- Despite strong recent performance, this margin outlook creates tension, as bulls highlight expanding free cash flow now, while skeptics warn that these gains may not last as costs and operational headwinds accumulate.

- Consensus narrative suggests that while margin expansion has been driven by efficiencies and growth projects, future decarbonization efforts and capex demands threaten to compress profits, creating a push-pull dynamic between short-term profitability and long-term risks.

- See how the consensus narrative unpacks these opposing forces for AltaGas in our full analysis. 📊 Read the full AltaGas Consensus Narrative.

Revenue Growth Outpaces Domestic Peers

- AltaGas projects annual revenue growth of 5.8%, just ahead of the Canadian market's expected 5% rate, as new infrastructure and export opportunities come online.

- From the consensus narrative: the company’s diversified revenue streams and export capacity investments (such as recent expansions in LPG exports and utility modernization)

- are portrayed as fueling stable, inflation-protected revenue and long-term earnings growth even as domestic utility demand faces electrification headwinds,

- although reliance on Western Canada gas supply and Asian markets introduces greater exposure to commodity price swings and global trade dynamics that could unsettle these optimistic forecasts.

Valuation Discounts and Analyst Price Targets

- AltaGas is trading at CA$41.17, which remains well below its DCF fair value of CA$158.12 and the analyst consensus price target of CA$45.64, suggesting that investors are not fully pricing in projected earnings and cash flow potential.

- Analysts' consensus narrative notes that while the price-to-earnings ratio (16.6x) is above the industry average (13.7x) but below peer benchmarks (26.2x),

- forward multiples are expected to rise as earnings flatten, meaning the current valuation discount could narrow if AltaGas meets or exceeds bullish growth expectations,

- however, the relatively tight gap (only about 10% upside to the consensus target) reflects analysts' balanced view: they see AltaGas as fairly priced unless margin or growth surprises materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AltaGas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on these results? Share your perspective and shape your own narrative in just a few minutes. Do it your way

A great starting point for your AltaGas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

AltaGas faces looming pressure on margins and only modest earnings growth, with forecasts hinting at flat or declining profits, even as operational improvements are made.

If you want more consistent results and fewer surprises, look at stable growth stocks screener (2103 results) to find companies with steadier revenue and earnings expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALA

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion