- Canada

- /

- Gas Utilities

- /

- TSX:ALA

A Look at AltaGas (TSX:ALA) Valuation After Recent $900 Million Debt and Equity Financing

Reviewed by Simply Wall St

AltaGas (TSX:ALA) just wrapped up a $500 million fixed-income offering and a $400 million follow-on equity raise. These moves are set to impact its capital structure and flexibility in the months ahead.

See our latest analysis for AltaGas.

With fresh capital from its recent debt and equity offerings, AltaGas has caught investors’ attention. The share price has climbed nearly 30% so far this year, while the company’s 33% total shareholder return over the past year reflects growing optimism about its prospects and an improved risk-reward balance.

If the momentum in AltaGas has you thinking more broadly, it could be the perfect time to discover fast growing stocks with high insider ownership.

With the stock up nearly 30% and new capital strengthening AltaGas' financial footing, investors might wonder if the latest rally is justified by fundamentals or if the market has already priced in all the future growth.

Most Popular Narrative: 5.1% Undervalued

With AltaGas shares trading at CA$43.47 and the most widely followed narrative pointing to a fair value of CA$45.82, the market appears to be lagging behind analysts' forward-looking view. This creates a foundation for some ambitious growth and profitability assumptions that support the latest price target.

Significant investments in utility modernization and infrastructure expansion (for example, $2 billion since 2018, ongoing ARP and rate base growth, new customer connections, and projects like the Keweenaw Connector) position AltaGas to benefit from population growth, urbanization, and rising electrification demand. This could drive stable, inflation-protected revenue and long-term earnings growth.

Want to discover what drives this optimistic outlook? The key lies in bold revenue and earnings forecasts alongside a higher future profit multiple than many rivals. See what surprising projections support this fair value narrative and find out if AltaGas could defy expectations.

Result: Fair Value of $45.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy risks from decarbonization efforts and fluctuations in commodity prices could reshape AltaGas's growth outlook and challenge current valuation assumptions.

Find out about the key risks to this AltaGas narrative.

Another View: What Do Multiples Say?

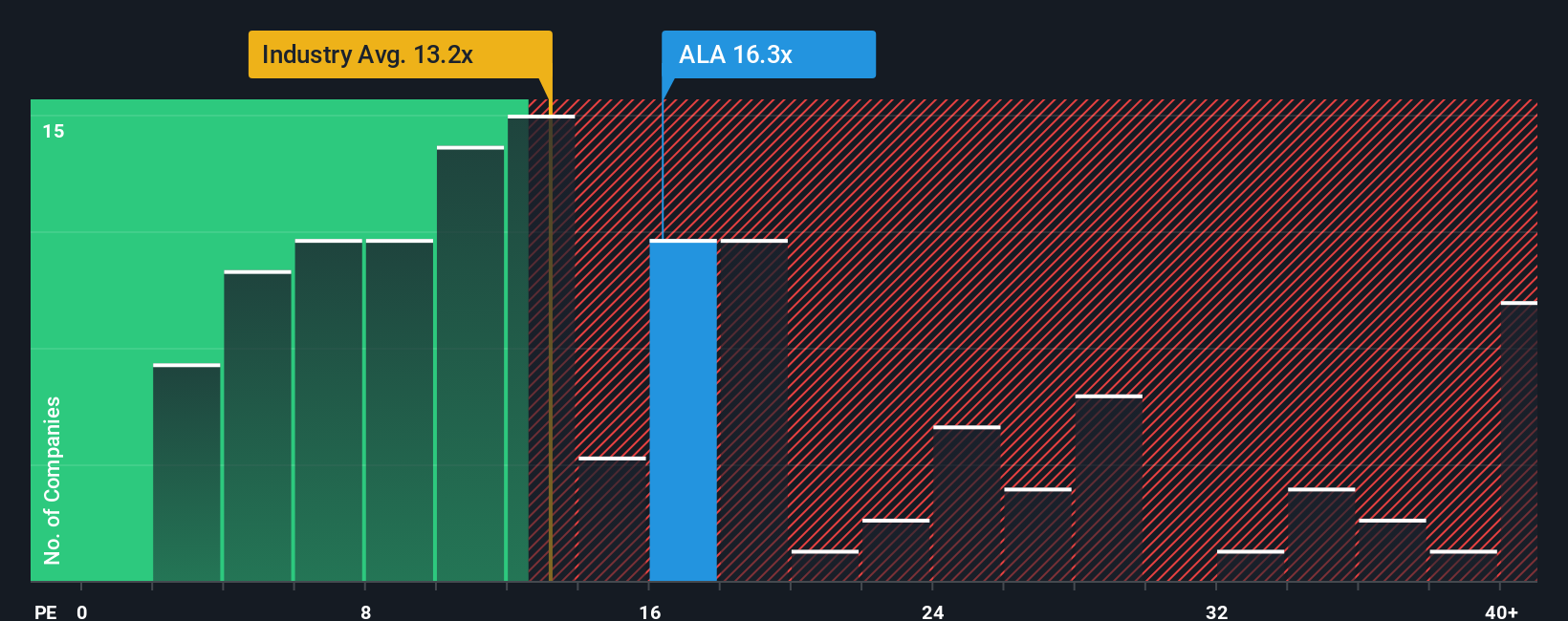

Looking at AltaGas through the lens of its price-to-earnings ratio tells a different story. Shares trade at 18.2 times earnings, above both the industry average of 14.1 and a fair ratio of 16.3. This premium signals that investors may be paying for growth that is not guaranteed. Could this mean there is more risk than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AltaGas Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own analysis and perspective in just a few minutes. Do it your way

A great starting point for your AltaGas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Opportunities?

Put yourself ahead of the crowd with new investment angles that could dramatically impact your portfolio. Hand-picked stock ideas are waiting, so do not let them slip by.

- Seize the chance to earn reliable income by checking out these 16 dividend stocks with yields > 3%, which features high yields and rock-solid fundamentals.

- Catch the wave of disruptive tech by researching AI-driven businesses featured in these 25 AI penny stocks before they become household names.

- Unlock rare value plays with these 886 undervalued stocks based on cash flows, which highlights stocks trading well below their intrinsic worth and could offer upside others miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALA

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives