- Canada

- /

- Other Utilities

- /

- TSX:ACO.X

Income Investors Should Know That ATCO Ltd. (TSE:ACO.X) Goes Ex-Dividend Soon

It looks like ATCO Ltd. (TSE:ACO.X) is about to go ex-dividend in the next 3 days. Ex-dividend means that investors that purchase the stock on or after the 4th of September will not receive this dividend, which will be paid on the 30th of September.

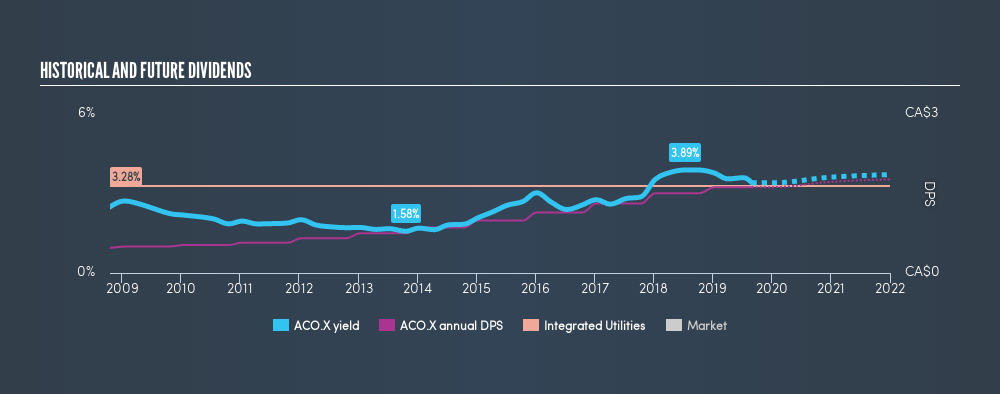

ATCO's next dividend payment will be CA$0.40 per share, and in the last 12 months, the company paid a total of CA$1.62 per share. Based on the last year's worth of payments, ATCO has a trailing yield of 3.4% on the current stock price of CA$47.58. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for ATCO

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately ATCO's payout ratio is modest, at just 34% of profit. A useful secondary check can be to evaluate whether ATCO generated enough free cash flow to afford its dividend. ATCO paid out more free cash flow than it generated - 115%, to be precise - last year, which we think is concerningly high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

ATCO paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to ATCO's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at ATCO, with earnings per share up 4.5% on average over the last five years. Earnings have been growing somewhat, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. ATCO has delivered an average of 13% per year annual increase in its dividend, based on the past ten years of dividend payments. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has ATCO got what it takes to maintain its dividend payments? ATCO has seen its earnings per share grow steadily and paid out less than half its profit over the last year. Unfortunately, its dividend was not well covered by free cash flow. In summary, while it has some positive characteristics, we're not inclined to race out and buy ATCO today.

Ever wonder what the future holds for ATCO? See what the six analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:ACO.X

ATCO

Engages in the energy, logistics and transportation, shelter, and real estate services in Canada, Australia, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion