Optimistic Investors Push Volatus Aerospace Inc. (CVE:FLT) Shares Up 111% But Growth Is Lacking

Volatus Aerospace Inc. (CVE:FLT) shares have continued their recent momentum with a 111% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

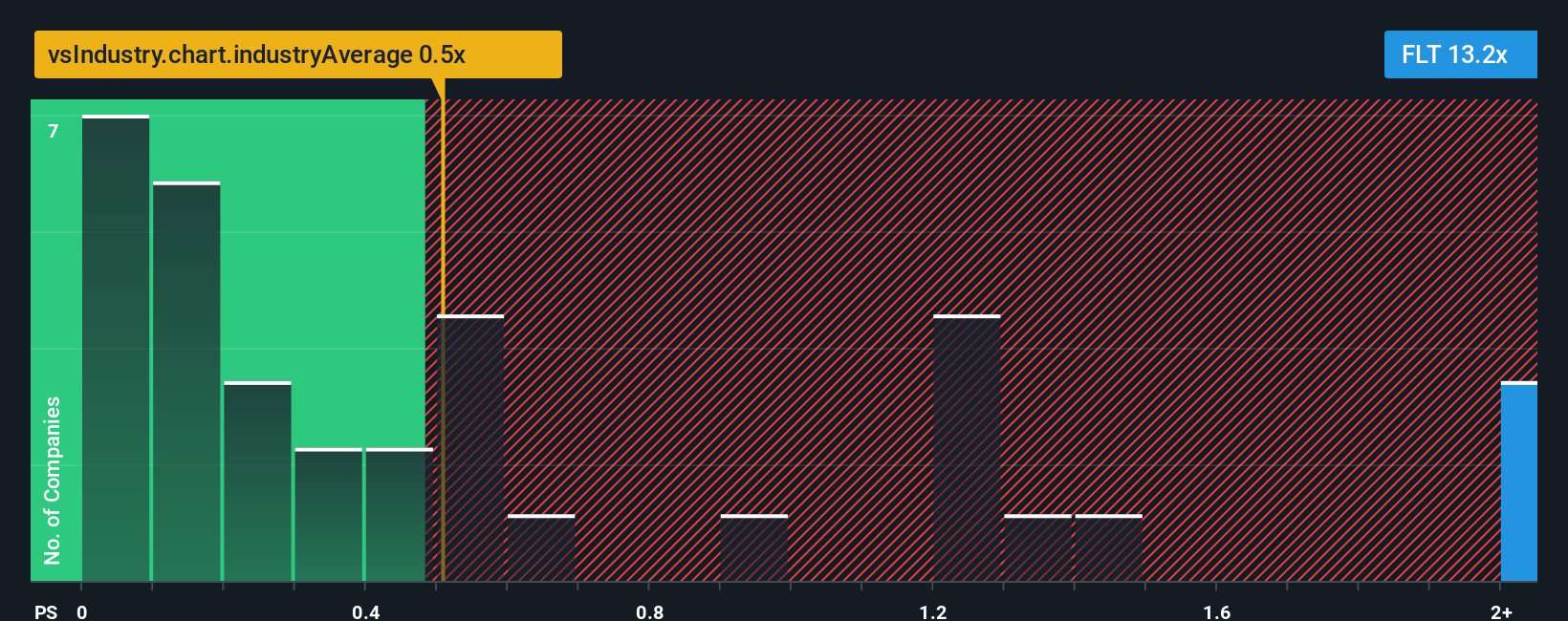

Following the firm bounce in price, when almost half of the companies in Canada's Airlines industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Volatus Aerospace as a stock not worth researching with its 13.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Volatus Aerospace

What Does Volatus Aerospace's P/S Mean For Shareholders?

Volatus Aerospace has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Volatus Aerospace will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Volatus Aerospace's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. Still, the latest three year period has seen an excellent 82% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 50% each year as estimated by the lone analyst watching the company. With the industry predicted to deliver 630% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Volatus Aerospace is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in Volatus Aerospace have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Volatus Aerospace, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Volatus Aerospace that you need to be mindful of.

If these risks are making you reconsider your opinion on Volatus Aerospace, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:FLT

Volatus Aerospace

Provides integrated drone solutions in Canada, the United States, the United Kingdom, and Norway.

Limited growth very low.

Market Insights

Community Narratives