Dividend paying stocks like TFI International Inc. (TSE:TFII) tend to be popular with investors, and for good reason - some research shows that a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

A slim 2.2% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, TFI International could have potential. It also bought back stock during the year, equivalent to approximately 3.6% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insight when buying a company for its dividend, and we'll go through these below.

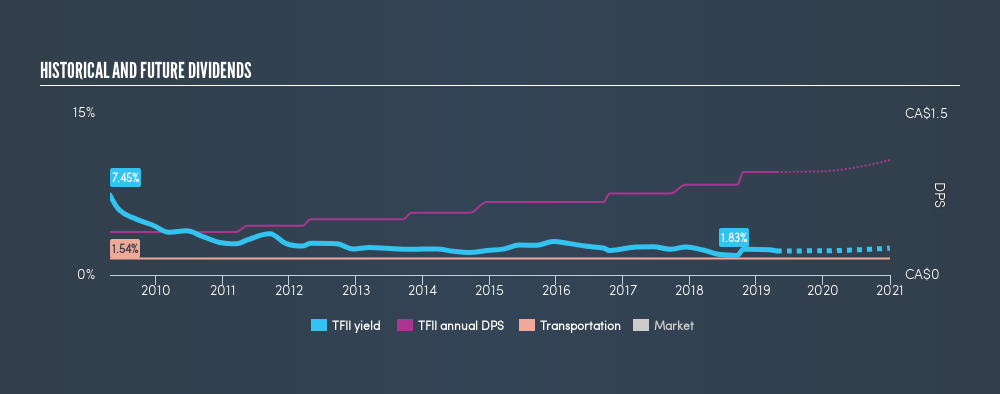

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to be form a view on if a company's dividend is sustainable, relative to its net profit after tax. TFI International paid out 26% of its profit as dividends, over the trailing twelve month period. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. TFI International's cash payout ratio in the last year was 33%, which suggests dividends were well covered by cash generated by the business.

Is TFI International's Balance Sheet Risky?

As TFI International has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks.A quick way to check a company's financial situation uses these two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments on debt. Essentially we check that a) a company does not have too much debt, and b) that it can afford to pay the interest. With net debt of 2.36 times its EBITDA, TFI International's debt burden is within a normal range for most listed companies.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Net interest cover of 8.02 times its interest expense appears reasonable for TFI International, although we're conscious that even high interest cover doesn't make a company bulletproof.

Consider getting our latest analysis on TFI International's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of TFI International's dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past ten-year period, the first annual payment was CA$0.40 in 2009, compared to CA$0.96 last year. Dividends per share have grown at approximately 9.1% per year over this time.

Dividend Growth Potential

While dividend payments have been relatively stable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. It's good to see TFI International has been growing its earnings per share at 38% a year over the past 5 years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's great to see that TFI International is paying out a low percentage of its earnings and cash flow. Next, growing earnings per share and steady dividend payments is a great combination. Overall, we think there are a lot of positives to TFI International from a dividend perspective.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 13 analysts we track are forecasting for TFI International for free with public analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:TFII

TFI International

Provides transportation and logistics services in the United States, Mexico, and Canada.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success