Exploring 3 Undervalued Small Caps In Canada With Insider Buying

Reviewed by Simply Wall St

As we enter the fourth quarter, both the S&P 500 and Canadian TSX have experienced strong growth, though recent volatility has been fueled by uncertainties surrounding the U.S. labor market, geopolitical tensions in the Middle East, and upcoming political events. Despite these challenges, solid economic fundamentals in Canada present opportunities for discerning investors to explore small-cap stocks that might be trading below their intrinsic value.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.6x | 0.9x | 13.76% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 22.45% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 48.94% | ★★★★★☆ |

| Foraco International | 5.6x | 0.5x | -27.82% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.27% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.3x | 3.3x | 48.38% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.81% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -77.06% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -58.09% | ★★★☆☆☆ |

| Spartan Delta | 4.5x | 2.3x | -45.33% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

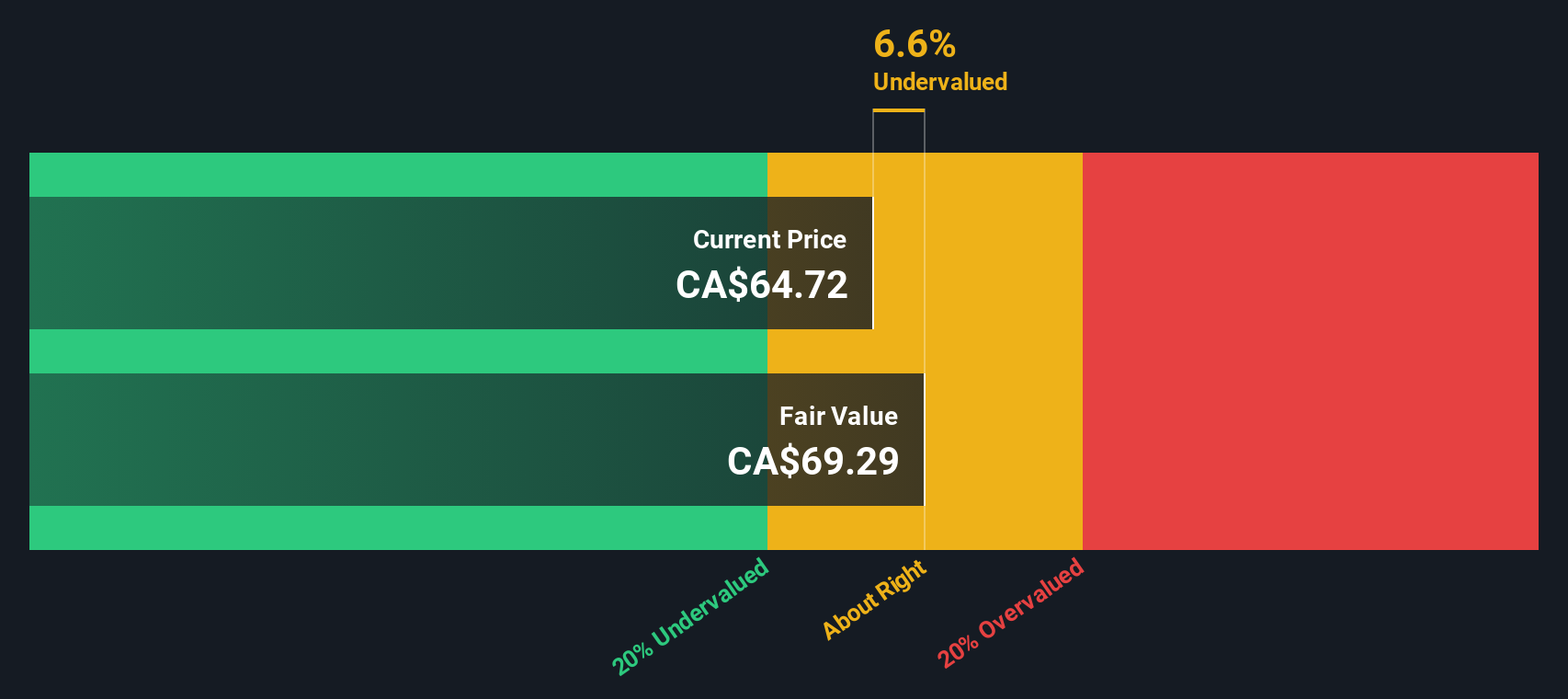

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income operates in the manufacturing and aerospace & aviation sectors, with a focus on providing diversified services across these industries, and has a market capitalization of CA$2.43 billion.

Operations: Exchange Income generates revenue primarily from its Aerospace & Aviation and Manufacturing segments, with the former contributing CA$1.60 billion and the latter CA$1.01 billion. The company's gross profit margin has shown a trend of fluctuation, reaching 34.72% as of October 2024. Operating expenses have consistently impacted profitability, with recent figures at CA$614.63 million in June 2024 and non-operating expenses at CA$174.73 million during the same period.

PE: 21.9x

Exchange Income, a smaller Canadian company, has shown insider confidence with share purchases over the past year. Despite higher risk funding from external borrowing and interest payments not being well covered by earnings, its earnings are forecasted to grow 25.94% annually. The company reported sales of C$426 million in Q2 2024, up from C$372 million a year ago. Its Atik Mason Pilot Pathway supports Indigenous students' aviation careers, reflecting a commitment to community engagement and future growth potential.

Pason Systems (TSX:PSI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pason Systems is a company that provides specialized data management systems for drilling operations, with a market cap of CA$1.06 billion.

Operations: The company generates revenue primarily from North America Drilling, International Drilling, and Solar and Energy Storage segments. Over recent periods, the gross profit margin has shown variability but reached 65.84% in June 2023 before declining to 59.51% by October 2024. Key costs include COGS and operating expenses, with R&D consistently being a notable expenditure within operating costs.

PE: 9.9x

Pason Systems, a Canadian company in the oilfield services sector, recently reported CAD 95.86 million in second-quarter sales, up from CAD 84.69 million the previous year, but net income dropped to CAD 10.89 million from CAD 25.47 million due to large one-off items affecting earnings quality. They also repurchased 151,900 shares for CAD 2.7 million between April and June 2024, signaling potential insider confidence despite forecasts of declining earnings over the next three years at an average rate of 1.5%.

- Get an in-depth perspective on Pason Systems' performance by reading our valuation report here.

Understand Pason Systems' track record by examining our Past report.

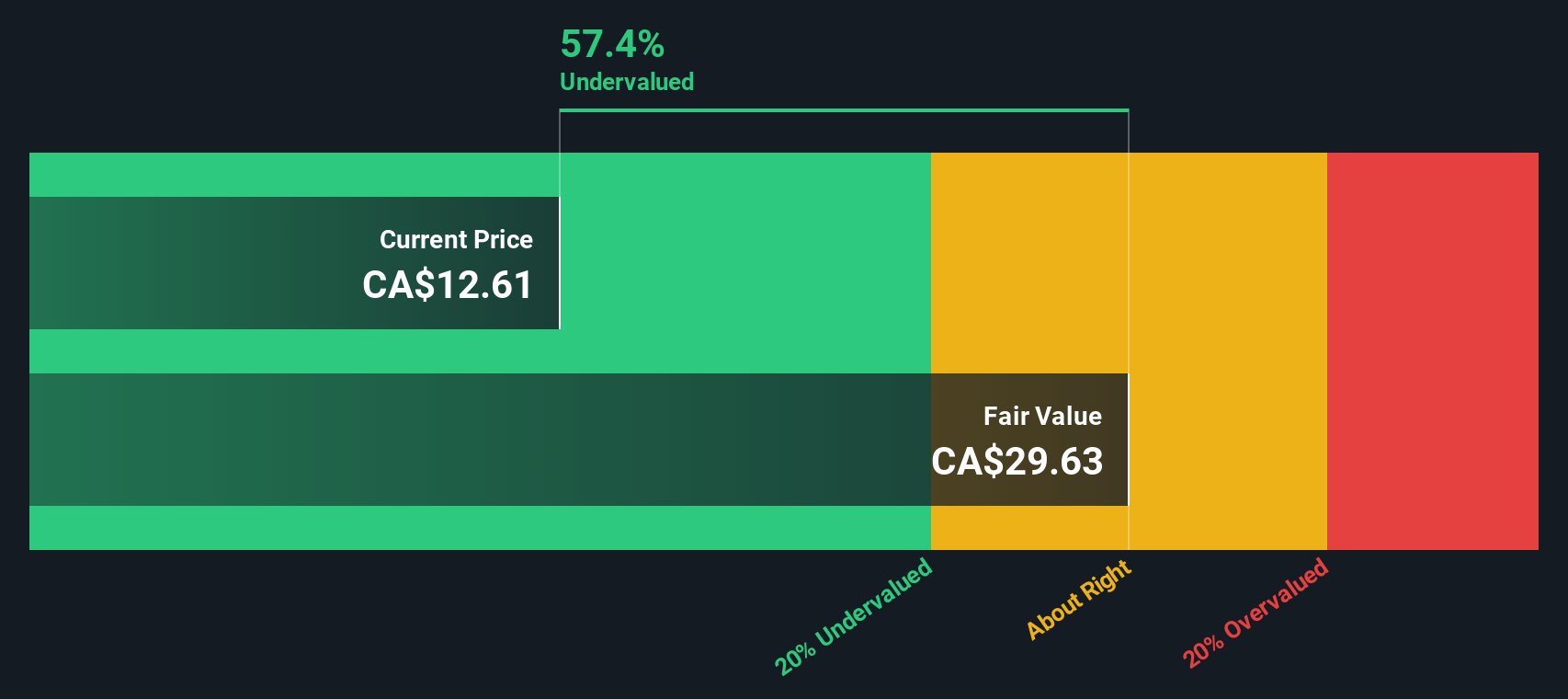

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is engaged in the exploration and production of oil and gas, with operations primarily focused on these sectors, and has a market capitalization of approximately CA$3.5 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, with recent reported revenue of CA$1.81 billion. The gross profit margin has shown variability, reaching as high as 82.55% but recently recorded at 65.72%. Operating expenses have been a significant component of costs, impacting net income margins which have fluctuated widely over time, including periods of negative margins.

PE: -2.7x

Vermilion Energy, a Canadian energy company, is navigating challenging times with recent earnings showing a net loss of C$82.43 million for Q2 2024. Despite this, they are making strategic moves to enhance future prospects. In September 2024, Vermilion announced successful testing of their first deep gas well in Germany and commenced drilling additional wells to capitalize on promising results. The company has repurchased shares worth C$112 million since July 2023, reflecting insider confidence in its long-term potential amidst volatile market conditions.

- Delve into the full analysis valuation report here for a deeper understanding of Vermilion Energy.

Gain insights into Vermilion Energy's past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our Undervalued TSX Small Caps With Insider Buying screener has unearthed 17 more companies for you to explore.Click here to unveil our expertly curated list of 20 Undervalued TSX Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives