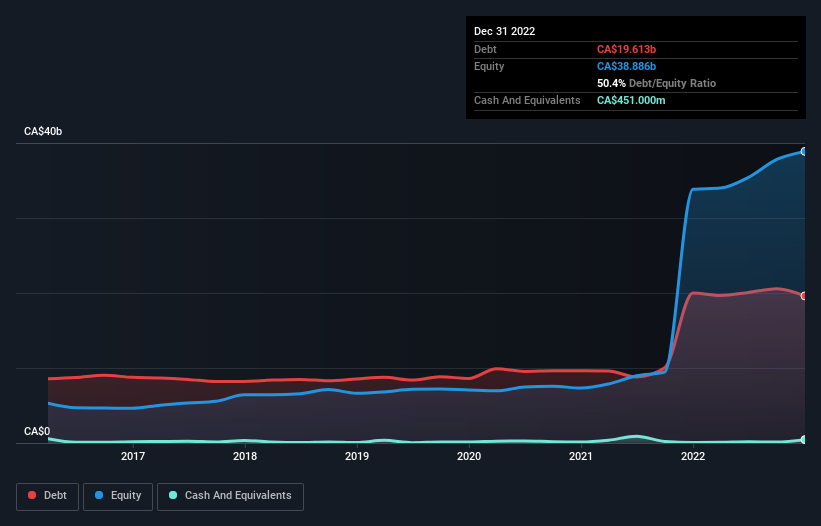

Please note this is a snapshot of the company's debt profle prior to the $31b merger between Canadian Pacific Railway and Kansas City Southern.

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Canadian Pacific Railway Limited ( TSE:CP ) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Canadian Pacific Railway

What Is Canadian Pacific Railway's Debt?

As you can see below, Canadian Pacific Railway had CA$19.6b of debt, at December 2022, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of CA$451.0m, its net debt is less, at about CA$19.2b.

A Look At Canadian Pacific Railway's Liabilities

We can see from the most recent balance sheet that Canadian Pacific Railway had liabilities of CA$3.21b falling due within a year, and liabilities of CA$31.4b due beyond that. Offsetting these obligations, it had cash of CA$451.0m as well as receivables valued at CA$1.02b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$33.1b.

Canadian Pacific Railway has a very large market capitalization of CA$95.6b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Canadian Pacific Railway has a debt to EBITDA ratio of 4.1 and its EBIT covered its interest expense 5.8 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably Canadian Pacific Railway's EBIT was pretty flat over the last year. We would prefer to see some earnings growth, because that always helps diminish debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Canadian Pacific Railway can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts .

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Canadian Pacific Railway produced sturdy free cash flow equating to 52% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Canadian Pacific Railway's net debt to EBITDA was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. For example, its conversion of EBIT to free cash flow is relatively strong. Looking at all the angles mentioned above, it does seem to us that Canadian Pacific Railway is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Canadian Pacific Railway that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Mediocre balance sheet and slightly overvalued.