- Canada

- /

- Transportation

- /

- TSX:CP

How New Labor Agreements and Strong Results at Canadian Pacific Kansas City (TSX:CP) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Canadian Pacific Kansas City has finalized 13 new tentative five-year collective agreements with U.S. unions, covering employees such as carmen, hostlers, laborers, clerks, maintenance workers, and supervisors, alongside reporting increased third quarter revenue to C$3.66 billion and net income to C$920 million compared to the prior year.

- The collaborative agreements include wage increases and suggest a focus on workforce stability and operational reliability, coinciding with continued share buybacks and an affirmed quarterly dividend.

- We’ll explore how these comprehensive labor agreements reflect the company’s approach to workforce management and its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Canadian Pacific Kansas City's Investment Narrative?

To see Canadian Pacific Kansas City as a compelling investment, you need to be comfortable with its blend of operational consistency, capital deployment, and the sector’s current cycle. The recent round of collective agreements with U.S. unions was a meaningful development for labor stability, potentially smoothing short-term disruptions and helping preserve uninterrupted operations, an essential catalyst for any railroad. Recent earnings results and cash returns, like buybacks and dividends, reflect efforts to reward shareholders and reinforce the company’s investment narrative. Importantly, the labor deals may temporarily ease one of the bigger operational risks that had been top of mind, although broader concerns around low forecast revenue growth, high debt, and industry competition remain. Overall, while the agreements reduce near-term labor volatility, the biggest fundamental risks remain outside labor and are not changed by this news. Despite wage agreements offering stability, pressure from relatively high debt remains a risk to watch.

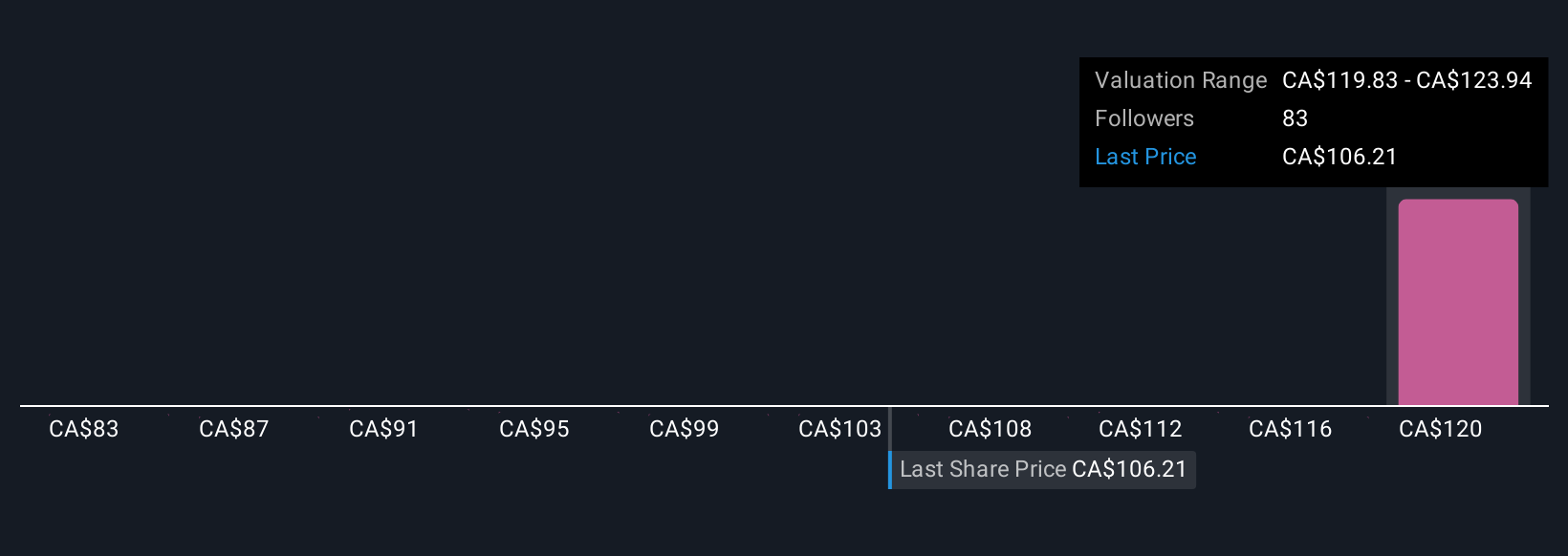

Canadian Pacific Kansas City's shares have been on the rise but are still potentially undervalued by 24%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on Canadian Pacific Kansas City - why the stock might be worth 6% less than the current price!

Build Your Own Canadian Pacific Kansas City Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Pacific Kansas City research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Pacific Kansas City research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Pacific Kansas City's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives